United Healthcare 2009 Annual Report Download - page 34

Download and view the complete annual report

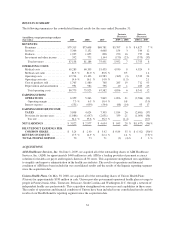

Please find page 34 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Medical costs include estimates of our obligations for medical care services rendered on behalf of insured

consumers for which we neither have received nor processed claims, and for liabilities for physician, hospital and

other medical cost disputes. In every reporting period, our operating results include the effects of more

completely developed medical costs payable estimates associated with previously reported periods.

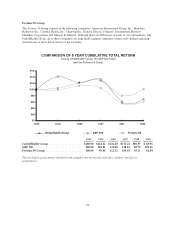

Our medical care ratio, calculated as medical costs as a percentage of premium revenues, reflects the

combination of pricing, benefit designs, consumer health care utilization and comprehensive care facilitation

efforts. We seek to sustain a stable medical care ratio for an equivalent mix of business, however, changes in

business mix, such as expanding participation in comparatively higher medical care ratio government-sponsored

public sector programs, will change the dynamics of our results.

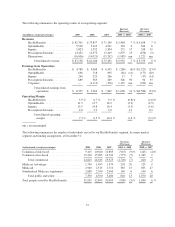

Operating Costs. Operating costs are primarily comprised of costs related to employee compensation and

benefits, agent and broker commissions, premium taxes and assessments, professional fees, advertising and

occupancy costs.

Cash Flows

We generate cash primarily from premiums, service revenues and investment income, as well as proceeds from

the sale or maturity of our investments. Our primary uses of cash are for payments of medical claims, purchases

of investments, common stock repurchases and payments on long-term debt. For more information on our cash

flows, see “Liquidity” below.

Business Trends

Our businesses participate in the U.S. health economy, which comprises approximately 17% of U.S. gross

domestic product and which has grown consistently for many years. We expect overall spending on health care in

the U.S. to continue to rise in the future, based on inflation, demographic trends in the U.S. population and

national interest in health and well-being. The rate of market growth may be affected by a variety of factors,

including macro-economic conditions and proposed health care reforms, which could also impact our results of

operations.

Adverse Economic Conditions. The current U.S. recessionary economic environment has impacted demand for

some of our products and services. For example, decreases in employment have reduced the number of workers

and dependants offered health care benefits by our employer customers, putting pressure on top line growth for

our UnitedHealthcare and OptumHealth businesses. This workplace attrition contributed more than half of the

7% decrease in UnitedHealthcare’s commercial membership during 2009, and this attrition trend is expected to

continue at a generally elevated level until national employment stabilizes. In contrast, our AmeriChoice business

is experiencing growth in its state Medicaid offerings as employment rates fall. If the recessionary economic

environment continues for a prolonged period, federal and state governments may decrease funding for various

health care government programs in which we participate and/or impose new or higher levels of taxes or

assessments. Our revenues are also impacted by U.S. monetary and fiscal policy. In response to recessionary

conditions, the U.S. Federal Reserve has maintained the target federal funds rate at a range of zero to 25 basis

points. Changes in federal monetary policy have reduced the level of investment income received on our

portfolio on a year-over-year basis.

In total, we believe that economic recessions will slow our revenue growth rate and could impact our operating

profitability. We also believe that government funding pressure, coupled with recessionary economic conditions,

will impact the financial positions of hospitals, physicians and other care providers and could therefore increase

medical cost trends experienced by our businesses. For additional discussions regarding how the adverse

economic conditions could affect our business, see Item 1A, “Risk Factors.”

32