United Healthcare 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

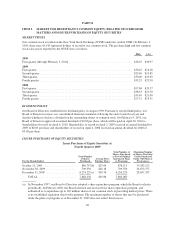

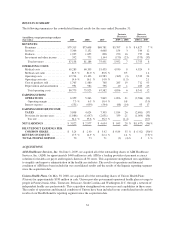

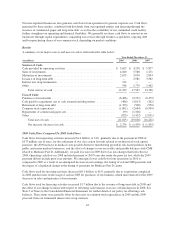

RESULTS SUMMARY

The following summarizes the consolidated financial results for the years ended December 31:

(in millions, except percentages and per

share data)

Increase

(Decrease)

Increase

(Decrease)

2009 2008 2007 2009 vs. 2008 2008 vs. 2007

REVENUES:

Premiums ..................... $79,315 $73,608 $68,781 $5,707 8 % $ 4,827 7 %

Services ...................... 5,306 5,152 4,608 154 3 544 12

Products ...................... 1,925 1,655 898 270 16 757 84

Investment and other income ..... 592 771 1,144 (179) (23) (373) (33)

Total revenues ............... 87,138 81,186 75,431 5,952 7 5,755 8

OPERATING COSTS:

Medical costs .................. 65,289 60,359 55,435 4,930 8 4,924 9

Medical care ratio .............. 82.3 % 82.0 % 80.6 % 0.3 1.4

Operating costs ................ 12,734 13,103 10,583 (369) (3) 2,520 24

Operating cost ratio ............. 14.6 % 16.1 % 14.0 % (1.5) 2.1

Cost of products sold ............ 1,765 1,480 768 285 19 712 93

Depreciation and amortization .... 991 981 796 10 1 185 23

Total operating costs .......... 80,779 75,923 67,582 4,856 6 8,341 12

EARNINGS FROM

OPERATIONS ............... 6,359 5,263 7,849 1,096 21 (2,586) (33)

Operating margin ............. 7.3 % 6.5 % 10.4 % 0.8 (3.9)

Interest expense ................ (551) (639) (544) (88) (14) 95 17

EARNINGS BEFORE INCOME

TAXES ...................... 5,808 4,624 7,305 1,184 26 (2,681) (37)

Provision for income taxes ....... (1,986) (1,647) (2,651) 339 21 (1,004) (38)

Tax rate .................... 34.2 % 35.6 % 36.3 % (1.4) (0.7)

NET EARNINGS ................ $ 3,822 $ 2,977 $ 4,654 $ 845 28 % $(1,677) (36)%

DILUTED NET EARNINGS PER

COMMON SHARE ............ $ 3.24 $ 2.40 $ 3.42 $ 0.84 35 % $ (1.02) (30)%

RETURN ON EQUITY .......... 17.3 % 14.9 % 22.4 % 2.4 % (7.5)%

TOTAL PEOPLE SERVED ....... 70 73 71 (3) (4)% 2 3 %

ACQUISITIONS

AIM Healthcare Services, Inc. On June 1, 2009, we acquired all of the outstanding shares of AIM Healthcare

Services, Inc. (AIM) for approximately $440 million in cash. AIM is a leading provider of payment accuracy

solutions for health care payer and hospital clients in all 50 states. This acquisition strengthened our capabilities

to simplify and improve administration in the health care industry. The results of operations and financial

condition of AIM have been included in our consolidated results and the results of the Ingenix reporting segment

since the acquisition date.

Unison Health Plans. On May 30, 2008, we acquired all of the outstanding shares of Unison Health Plans

(Unison) for approximately $930 million in cash. Unison provides government-sponsored health plan coverage to

people in Pennsylvania, Ohio, Tennessee, Delaware, South Carolina and Washington, D.C. through a network of

independent health care professionals. This acquisition strengthened our resources and capabilities in these areas.

The results of operations and financial condition of Unison have been included in our consolidated results and the

results of our Health Benefits reporting segment since the acquisition date.

34