Tesco 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

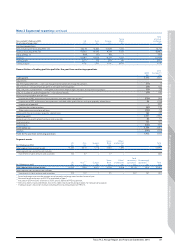

Note 11 Property, plant and equipment

Land and

buildings

£m

Other(a)

£m

Total

£m

Cost

At 23 February 2013 24,817 10,826 35,643

Foreign currency translation (1,131) (470) (1,601)

Additions(b) 1,492 955 2,447

Acquired through business combinations 9 6 15

Reclassification 1,875 27 1,902

Classified as held for sale (115) –(115)

Disposals (239) (133) (372)

Transfer to disposal group classified as held for sale (974) (360) (1,334)

At 22 February 2014 25,734 10,851 36,585

Accumulated depreciation and impairment losses

At 23 February 2013 3,961 6,812 10,773

Foreign currency translation (220) (267) (487)

Charge for the year 466 846 1, 312

Impairment losses 814 52 866

Reversal of impairment losses (152) (2) (154)

Reclassification 282 1283

Classified as held for sale 2 1 3

Disposals (139) (117) (256)

Transfer to disposal group classified as held for sale (29) (216) (245)

At 22 February 2014 4,985 7,110 12,095

Net carrying value(c)(d)

At 22 February 2014 20,749 3,741 24,490

At 23 February 2013 20,856 4,014 24,870

Construction in progress included above(e)

At 22 February 2014 612 80 692

At 23 February 2013 584 96 680

(a) Other assets consist of plant, equipment, fixtures and fittings and motor vehicles.

(b) Includes £79m (2013: £123m) in respect of interest capitalised, principally relating to land and building assets. The capitalisation rate used to determine the amount of finance

costs capitalised during the financial year was 5.1% (2013: 5.1%). Interest capitalised is deducted in determining taxable profit in the financial year in which it is incurred.

(c) Net carrying value includes:

(i) Capitalised interest of £1,208m (2013: £1,195m).

(ii) Assets held under finance leases which are analysed below:

2014 2013

Land and

buildings

£m

Other(a)

£m

Land and

buildings

£m

Other(a)

£m

Cost 151 558 157 559

Accumulated depreciation and impairment losses (50) (529) (45) (514)

Net carrying value 101 29 112 45

These assets are pledged as security for the finance lease liabilities.

(d) The net carrying value of land and buildings comprises:

2014

£m

2013

£m

Freehold 18,430 18,335

Long leasehold – 50 years or more 662 623

Short leasehold – less than 50 years 1,657 1,898

Net carrying value 20,749 20,856

(e) Construction in progress does not include land.

The Group continually assesses the level of services provided to tenants of its managed investment properties in accordance with IAS 40. During the year,

it was concluded that the level of services provided to tenants of some malls operated by the Group are no longer considered insignificant and as a result a

number of malls with a net book value of £1,623m have been reclassified from investment property to property, plant and equipment.

Other information

Governance Financial statementsStrategic report

Tesco PLC Annual Report and Financial Statements 2014 91