Tesco 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

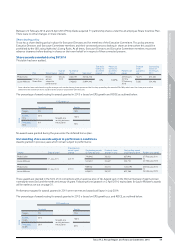

Selection of performance measures

Annual bonus

The annual bonus performance measures have been selected

to provide an appropriate balance between incentivising Executive

Directors to meet financial targets for the year and incentivising

them to achieve specific strategic objectives. This allows

the Company to more specifically incentivise the delivery

of key elements of our strategy. The particular bonus metrics

are selected by the Committee each year to ensure that Executive

Directors are appropriately focused on the key objectives for the

next 12 months.

Performance share plan

The ultimate goal of our strategy is to provide long-term sustainable

returns for all of our shareholders. Tesco believes that the best way

to deliver enhanced value is to grow earnings over the long term

while maintaining a sustainable level of capital efficiency – in other

words to keep growing the size of the business in an efficient way.

The measures used in the PSP reflect this.

Performance targets for both the annual bonus and Performance

Share Plan are set taking into account internal budget forecasts,

external expectations and the need to ensure that targets

remain motivational.

Remuneration arrangements throughout the Group

Remuneration arrangements are determined throughout the

Group based on the same principle; that reward should be

sufficient to attract and retain high calibre talent without paying

more than is necessary and that reward should support the delivery

of the business strategy.

Tesco is one of the largest public company employers in the world.

Our colleagues undertake a variety of roles reflecting the countries

we operate in and the range of skills we need to run our various

businesses (from stores to banking to telecoms). Reward packages

therefore differ taking into account location, seniority and level of

responsibility but they are all built around the common reward

objectives and principles outlined above. The following is based

on current practice which may change during the life of the policy.

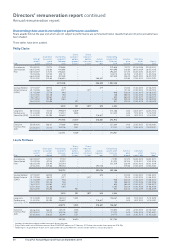

•Annual bonus – Annual bonuses throughout the Group are

linked to local business performance, Group success and,

where appropriate, individual contribution in a structure

that is consistent with the Executive Directors’ annual bonus

with a focus on financial and strategic measures.

• Share incentives – Currently our 5,000 strong management

team across the Group participates in share incentives to create

alignment with shareholder interests. The management team

also receives some of their bonus in Tesco shares deferred for

a period of two or three years.

•Pensions – Pensions across the Group vary widely according

to local market practice. In the UK all Tesco colleagues

currently have the opportunity to participate in a career average

defined benefit scheme up to tax approved limits. This benefit

is unique in comparison with our key retail peers.

•Colleagues as shareholders – It is an important part of the

Tesco Values that all colleagues, not just management, have

the opportunity to become Tesco shareholders. Over 200,000

of our colleagues participate in our all-employee schemes and

hold over 119 million shares in our Share Incentive Plan and

over 127 million options over shares in our Sharesave scheme.

When determining Executive Director remuneration arrangements

the Committee takes into account pay conditions throughout the

Group to ensure that the structure and quantum of Executive

Directors’ pay remains appropriate in this context.

Information supporting the policy table

Tesco also operates shareholding guidelines. See page 48

of the Annual Remuneration Report for further details.

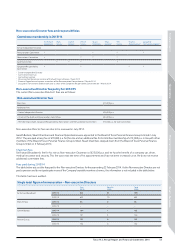

Awards may incorporate the right (in cash or shares) to receive

the value of dividends between grant and exercise in respect

of the number of shares that vest. The calculation of dividend

equivalents may assume reinvestment of those dividends in

Company shares on a cumulative basis.

The Committee has the discretion to scale back deferred share

awards and performance share awards prior to the satisfaction

of awards in the event that results are materially misstated or the

participant has contributed to serious reputational damage of the

Company or one of its business units or his conduct has amounted

to serious misconduct, fraud or misstatement. Other elements

of remuneration are not subject to clawback or malus.

If the Committee considers it to be appropriate, it may determine

that share awards may be settled in cash.

The Committee may amend the terms of awards or the rules

of share plans within the scope defined in the rules of the plans.

For share awards, in the event of a variation of the Company’s

share capital or a demerger, delisting, special dividend, rights issue

or other event, which may, in the Remuneration Committee’s

opinion affect the current or future value of awards, the number

of shares subject to an award may be adjusted.

The Committee may amend performance targets in accordance

with the terms of an award or if a transaction occurs which causes

the Committee to consider (taking into account the interest of

shareholders) that an amended performance condition would be

more appropriate and would continue to achieve the original purpose.

The Committee reserves the right to make any remuneration

payments and payments for loss of office (including exercising

any discretions available to it in connection with such payments)

notwithstanding that they are not in line with the Policy set out in

this report where the terms of the payment were agreed (i) before

the policy came into effect or (ii) at a time when the relevant

individual was not a Director of the Company and, in the opinion

of the Committee, the payment was not in consideration for

the individual becoming a Director of the Company. For these

purposes ‘payments’ includes the Committee satisfying awards

of variable remuneration, and an award over shares is ‘agreed’

at the time the award is granted.

The Committee may make minor changes to this Policy for

regulatory, exchange control, tax or administrative purposes

or to take account of a change in legislation without seeking

shareholder approval for that amendment.

Prior to 2011 Executive Directors were granted market value

options under the Company’s 2004 Discretionary Share Option

plan. Outstanding awards are no longer subject to performance

and may be exercised until the 10th anniversary of the date of

award. No further awards will be made under this plan.

58 Tesco PLC Annual Report and Financial Statements 2014

Directors’ remuneration report continued

2013/14 Policy Report