Tesco 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

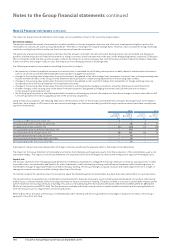

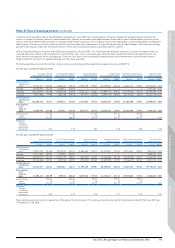

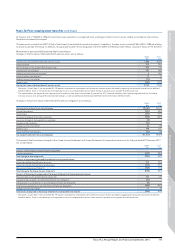

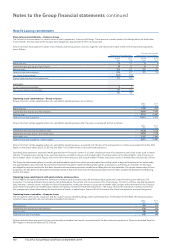

Summary of movements in deficit during the financial year

2014

£m

2013*

£m

Deficit in schemes at beginning of the year (2,378) (1,872)

Current service cost (542) (482)

Net pension finance cost (106) (73)

Contributions by employer 531 486

Additional contribution by employer 4180

Foreign currency translation 11 (7)

Remeasurements (713) (610)

Deficit in schemes at the end of the year (3,193) (2,378)

Deferred tax asset (Note 6) 634 539

Deficit in schemes at the end of the year net of deferred tax (2,559) (1,839)

* Restated – As per Note 1, the amended IAS 19 requires retrospective restatement of net interest amounts, to be calculated by applying the discount rate to the net defined

benefit liability. There is no movement in the pension deficit as asset outperformance is taken to actuarial gains/losses.

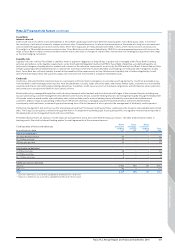

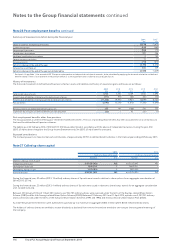

History of movements

The historical movement in defined benefit pension schemes’ assets and liabilities and history of experience gains and losses are as follows:

2014

£m

2013

£m

2012

£m

2011

£m

2010

£m

Total market value of assets 8,124 7,20 6 6,169 5,608 4,696

Present value of liabilities relating to unfunded pension schemes (111) (91) (60) (65) (54)

Present value of liabilities relating to partially funded pension schemes (11, 206) (9,493) ( 7,9 81) (6,899) (6,482)

Pension deficit (3,193) (2,378) (1,872) (1,356) (1,840)

Remeasurements on defined benefit pension assets 253 94 (168) 278 733

Experience (losses)/gains on defined benefit pension obligation (22) 143 (25) (1)

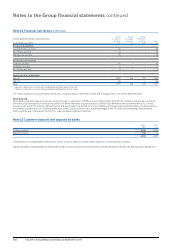

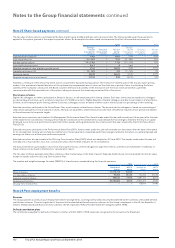

Post-employment benefits other than pensions

The Group operates a scheme offering post-retirement healthcare benefits. The cost of providing these benefits has been accounted for on a similar basis to

that used for defined benefit pension schemes.

The liability as at 22 February 2014 of £12m (2013: £12m) was determined in accordance with the advice of independent actuaries. During the year, £1m

(2013: £1m) has been charged to the Group Income Statement and £1m (2013: £1m) of benefits were paid.

Expected contributions

The Company expects to make normal cash contributions of approximately £579m to defined benefit schemes in the financial year ending 28 February 2015.

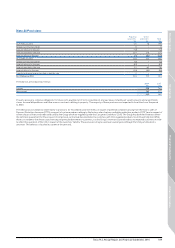

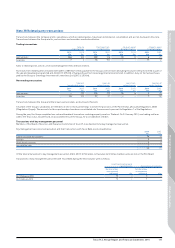

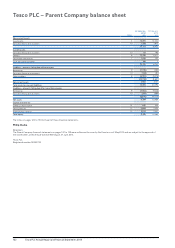

Note 27 Called up share capital

2014 2013

Ordinary shares of 5p each Ordinary shares of 5p each

Number £m Number £m

Allotted, called up and fully paid:

At beginning of the year 8,054,054,930 403 8,031,812,445 402

Share options exercised 19,662,145 118,632,251 1

Share bonus awards issued 22,104,016 13,610,234 –

At end of the year 8,095,821,091 405 8,054,054,930 403

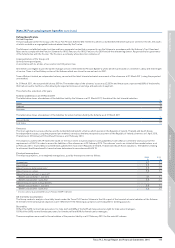

During the financial year, 20 million (2013: 19 million) ordinary shares of 5p each were issued in relation to share options for an aggregate consideration of

£61m (2013: £57m).

During the financial year, 22 million (2013: 4 million) ordinary shares of 5p each were issued in relation to share bonus awards for an aggregate consideration

of £1.1m (2013: £0.2m).

Between 23 February 2014 and 11 April 2014 options over 942,705 ordinary shares were exercised under the terms of the Savings-related Share Option

Scheme (1981) and the Irish Savings-related Share Option Scheme (2000). Between 23 February 2014 and 11 April 2014, options over 2,207,051 ordinary

shares were exercised under the terms of the Executive Share Option Schemes (1994 and 1996) and the Discretionary Share Option Plan (2004).

As at 22 February 2014, the Directors were authorised to purchase up to a maximum in aggregate of 806.5 million (2013: 804.0 million) ordinary shares.

The holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share at general meetings of

the Company.

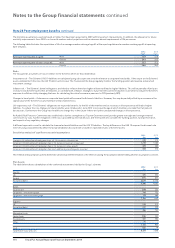

Note 26 Post-employment benefits continued

116 Tesco PLC Annual Report and Financial Statements 2014

Notes to the Group financial statements continued