Tesco 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

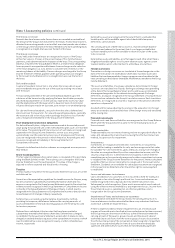

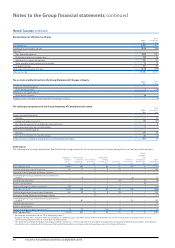

Note 6 Taxation continued

Reconciliation of effective tax charge

2014

£m

2013

(restated*)

£m

Profit before tax 2,259 2,057

Tax charge at 23.1% (2013: 24.2%) (522) (498)

Effect of:

Non-deductible expenses (109) (291)

Differences in overseas taxation rates (12) 36

Adjustments in respect of prior years 135 104

Share of profits of joint ventures and associates 14 18

Change in tax rate 147 102

Total income tax charge for the year (347) (529)

Effective tax rate 15.4% 25.7%

Tax on items credited directly to the Group Statement of Changes in Equity 2014

£m

2013

£m

Current tax credit/(charge) on:

Share-based payments 1(6)

Deferred tax (charge)/credit on:

Share-based payments (1) 1

Total tax on items charged to Group Statement of Changes in Equity –(5)

Tax relating to components of the Group Statement of Comprehensive Income

2014

£m

2013

(restated*)

£m

Current tax credit/(charge) on:

Pensions –43

Foreign exchange movements 58 (27)

Fair value of movement on available-for-sale investments –6

Fair value movements on cash flow hedges 4–

Deferred tax credit/(charge) on:

Pensions 67 56

Fair value movements on cash flow hedges 35 (3)

Total tax on items credited to Group Statement of Comprehensive Income 164 75

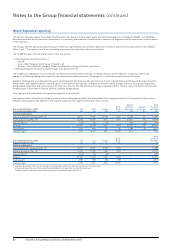

Deferred tax

The following are the major deferred tax (liabilities)/assets recognised by the Group and movements thereon during the current and prior financial years:

Property-

related

items**

£m

Retirement

benefit

obligation

£m

Share-based

payments

£m

Short-term

timing

differences

£m

Tax losses

£m

Financial

Instruments

£m

Other

pre/post

tax

temporary

differences

£m

Total

(restated*)

£m

At 25 February 2012 (1,689) 465 11 64 24 (22) 10 (1,137)

Credit to the Group Income Statement 87 17 9 9 21 1 1 145

Charge to Group Statement of Changes in Equity – – 1 – – – – 1

Credit/(charge) to Group Statement of Comprehensive

Income –56 –––(3) –53

Discontinued operations – – – 5 (8) –(3) (6)

Business combinations – – – 1 1 – (2) –

Foreign exchange and other movements*** (20) 1 – 4 2 – 1 (12)

At 23 February 2013 (1,622) 539 21 83 40 (24) 7(956)

Credit/(charge) to the Group Income Statement 282 29 19 9(19) 2 3 325

(Charge) to Group Statement of Changes in Equity – – (1) – – – – (1)

Credit/(charge) to Group Statement of Comprehensive

Income –67 – – – 35 –102

Discontinued operations – – 3 5 7 – – 15

Business combinations ––––––––

Foreign exchange and other movements*** 32 (1) –(13) (4) – – 14

At 22 February 2014 (1,308) 634 42 84 24 13 10 (501)

* Restated for amendments to IAS 19 as explained in Note 1.

** Property-related items include a deferred tax liability on rolled over gains of £294m (2013: £340m) and deferred tax assets on capital losses of £58m (2013: £71m).

The remaining balance relates to accelerated tax depreciation.

*** The deferred tax charge for foreign exchange and other movements is £14m credit (2013: £12m debit) relating to the retranslation of deferred tax balances at the balance

sheet date and is included within the Group Statement of Comprehensive Income under the heading currency translation differences.

84 Tesco PLC Annual Report and Financial Statements 2014

Notes to the Group financial statements continued