Tesco 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C. Accountability Whilst no internal control system can guarantee that losses will not occur, the

Board is satisfied that management have remained diligent in their efforts to

ensure that an appropriate level of control remains in place.

C.3 Role and responsibilities of the Audit Committee

The Audit Committee supports the Board in its responsibilities in relation to

corporate reporting and risk management and internal controls, and with

maintaining a relationship with the Company’s auditors.

The Audit Committee’s report on pages 33 to 36 sets out a description of the

work of the Committee.

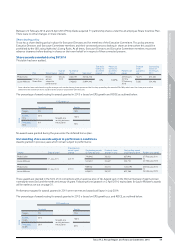

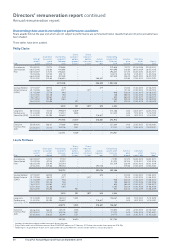

D. Remuneration

D.1 Level and elements of remuneration

The Directors’ Remuneration Report on pages 41 to 61 explains the level of

remuneration received by the Directors and how the Company has aligned the

remuneration received to corporate and individual performance.

D.2 Development of remuneration policy

The development of our remuneration policy and our rationale for the level

and structure of the remuneration for our senior management is set out in the

Directors’ Remuneration Report on pages 56 to 61.

E. Relations with shareholders

E.1 Shareholder engagement

We are committed to conducting constructive dialogue with shareholders to ensure

that we understand what is important to them and enable clear communication of

our position. The Chairman, CEO and CFO hold regular meetings with shareholders

and update the Board on the outcome of those meetings. Investor Relations

keep the Board informed of broker and analyst views and report and present formally

to the Board twice a year. In addition we carry out a survey each year of a cross-section

of shareholders in order to assess shareholder perception of the Company.

We support greater engagement with institutional shareholders as envisaged

by the Stewardship Code. We are also keen to develop engagement with private

shareholders through various channels of communication, including the AGM,

the Company’s website and social media.

E.2 Constructive use of the AGM

Our 2014 AGM will be held in London on 27 June 2014. The whole Board is

expected to attend the AGM and be available to answer questions from

shareholders present.

In 2013 Ken Hanna was unable to attend the AGM due to a long-standing prior

engagement. All other Directors were present and talked to a number of

shareholders before and after the meeting.

To encourage shareholder participation, we offer electronic proxy voting and

voting through the CREST electronic proxy appointment service. At our AGM all

resolutions are proposed and voted upon individually by shareholders or their

proxies. All votes taken during the AGM are by way of electronic poll. This follows

best practice guidelines and allows the Company to count all votes, not just those

of shareholders attending the meeting.

C.1 Financial and business reporting

The Directors’ statement of responsibilities for the preparation of the Annual

Report and Financial Statements 2014 can be found on page 64. Information on

the Company’s business model can be found on pages 10 and 11 and its strategy

can be found on pages 3 to 7.

The Directors’ confirmation that the business is a going concern can be found

on page 63.

C.2 Risk management and internal control systems

The Board has overall responsibility for ensuring the Group has appropriate

risk management and internal controls in place and that they continue to

work effectively.

There is a comprehensive process for the review and consideration of risk at Tesco.

Risk Registers are in place for all businesses and some key Group functions also

maintain a specific Risk Register. The Group also maintain a Group Key Risk

Register which describes key risks faced by the Group and their likelihood and

impact, as well as the controls and procedures implemented to mitigate them.

Group risks are determined by discussion with senior management and are

reviewed by the GroupExecutive Committee and then agreed by the Board.

In addition to reviewing the Group Risk Register, the Board carries out in-depth

reviews of key risk areas eachyear.

The Company maintains a comprehensive framework of internal controls

addressing the key strategic, financial, legal, reputational and operational risks to

the business and the accountability for operating these controls rests with senior

management as a first line of defence.

Colleagues are required to confirm annually that they complied with the Code

ofBusiness Conduct which sets out individual obligations and responsibilities for

anyone working at Tesco.

Group Finance is responsible for preparing the Group’s financial statements.

Last year it took steps to make the processes more robust by developing a key

financial control framework to describe a mandatory suite of controls across key

business processes. Compliance is monitored by an annual self-assessment.

A number of key management committees play a role in monitoring compliance

with internal controls. The Group Compliance Committee is responsible for

monitoring legal compliance across the Group, including receiving reports from

the individual business unit compliance committees.

The Audit Committee reports each year on its assessment of the effectiveness

of the risk management and internal controls systems. Throughout the year the

Committee receives regular reports from the external auditor covering topics such

as quality ofearnings and technical accounting developments. Internal Audit and

senior management also regularly provide updates to the Committee and any

significant breaches of control, together with the appropriate remediation

arrangements are discussed.

The Board conducted a review of the effectiveness of the Company’s risk management

and internal controls during the year. To support the Board in their annual assessment,

a summary report is prepared which describes the arrangements that the Board has

put in place for internal control and risk management systems and summarises the

key issues or non-compliances arising from those processes.

These arrangements include:

1. The Annual Risk Management Process (as described in the principal risks and

uncertainties section on pages 20 to 25) – there is a comprehensive process for

the review and consideration of risk at Tesco. Risk Registers are in place for all

Business Units and for some key Group Functions, including Group Finance.

These are considered regularly by subsidiary boards to assess their control

systems and have all been reviewed at least once in the last year. The Group Key

Risk Register was reviewed by the Executive Committee in January 2014 and the

Board in February 2014. During the reviews all the Group risks were challenged

and refreshed.

2. The Internal Audit Programme – a risk-based programme of Internal Audit is

conducted annually and the findings of those audits, together with the

monitoring of the progress of management’s remediation programmes is

reviewed by the Board.

3. Evaluation of the Control Findings from External Audit – PwC are not a part of

Tesco’s internal control system. However, they do form an assessment on the

financial control environment as they conduct their audit work and this is

another point of reference and information for the Board and senior

management to consider on the operation of our controls.

4. Assessment of Compliance Activities at a Group and Business Unit Level – the

results of a number of other key compliance activities are also considered during

the review of the effectiveness of risk management and internal control

arrangements. These include: the outputs from the Group and Business Unit

Compliance Committee processes; the returns from the Annual Code of

Business Conduct declaration process; the results of the Key Financial Controls

Self-Assessment process; the results of store-based compliance reviews of stock,

cash and price integrity processes; the results of the Group Technical and

Trading Law assessments including ethical audits; the outputs from the Tesco

Bank Risk Assurance and Compliance process; reports from the Fraud and Code

of Conduct Investigations; and, the results from the Information Security

reviews and incidents that occurred in the year.

40 Tesco PLC Annual Report and Financial Statements 2014

Corporate governance report continued