Tesco 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

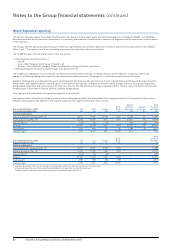

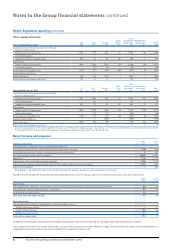

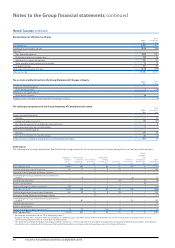

Note 7 Discontinued operations and non-current assets classified as held for sale continued

Discontinued operations

During the period, the Group entered into definitive agreements, subject to the usual regulatory approvals, with China Resources Enterprise, Limited (‘CRE’)

to combine respective Chinese retail operations. The definitive agreements allow for the exchange of the Group’s Chinese retail and property interests plus

cash of HK$4,325m for a 20% interest in the combined businesses.

In the second half of the financial year, independent valuations were completed, for accounting purposes, of both businesses separately to determine the fair

value of the consideration for the disposal. As a result of these valuations, the Group has concluded a charge of £540m is required to remeasure the assets

and liabilities of the disposal group to the fair value less costs to sell. The valuation was completed by considering a number of different commercial valuation

methodologies rather than relying on any single method. The different methodologies included discounted cash flows, enterprise value (‘EV’) / revenue multiples

and income approach for Tesco and CRE businesses as appropriate. Observable and unobservable inputs have been used in the models and therefore the fair

value is classified as level 3 within the fair value hierarchy. The key unobservable inputs used included discount rates (from 7.5% to 10.5%), long term growth

rates (from 3.0% to 4.0%) and EV/revenue multiples (from 0.6x to 1.0x).

IFRS 13 ‘Fair value measurement’ requires these valuations to be produced on a standalone existing basis for each business and consequently they do not

incorporate the significant long term synergies and strategic value that the Directors believe exist in the new enlarged business.

On 27 November 2013 the Group completed a sale of the substantive part of its US operations to YFE Holdings, Inc. The remaining assets of the US operation

are in the process of being disposed of as part of an orderly restructuring process. In addition, the exit of the Japanese operations was successfully completed

on 1 January 2013.

The above operations have been classified as disposal groups classified as held for sale in accordance with IFRS 5 ‘Non-current assets held for sale and

discontinued operations’.

The tables below show the results of the discontinued operations which are included in the Group Income Statement, Group Balance Sheet and Group Cash

Flow Statement respectively. At 23 February 2013, the Group’s Chinese operations had not yet been classified as held for sale; assets and liabilities of the

disposal group at this date comprise only those of the US.

US China Total

Income Statement 2014

£m

2013

£m

2014

£m

2013

£m

2014

£m

2013

£m

Revenue 496 697 1,489 1,420 1,985 2,117

Cost of sales*(532) (1,567) (2,060) (1,485) (2,592) (3,052)

Administrative expenses (104) (50) (89) (80) (193) (130)

Loss arising on property-related items (125) (286) – (49) (125) (335)

Share of post-tax losses on joint ventures and associates – – (17) (18) (17) (18)

Finance costs (1) (4) 3 (10) 2(14)

Loss before tax of discontinued operations (266) (1,210) (674) (222) (940) (1,432)

Taxation 6(5) (8) (16) (2) (21)

Loss after tax of discontinued operations (260) (1,215) (682) (238) (942) (1,453)

Loss after tax of discontinued operations in Japan** –(51)

Total loss after tax of discontinued operations (942) (1,504)

Loss per share impact from discontinued operations

Basic (11.68p) (18.72p)

Diluted (11.66p) (18.71p)

* Including total operating lease expense of £149m (2013: £60m).

** The results of Japan are for the 44 weeks ended 1 January 2013, when there was an exit from the operations.

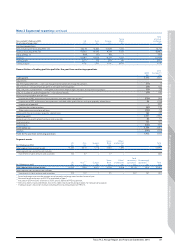

US China Total

2014

£m

2013

£m

2014

£m

2013

£m

2014

£m

2013

£m

Non-GAAP measure: underlying loss before tax

Loss before tax on discontinued operations (266) (1,210) (674) (222) (940) (1,432)

Adjustments for:

IAS 32 and IAS 39 ‘Financial Instruments’ – fair value remeasurements – – (5) (1) (5) (1)

IAS 17 ‘Leases’ – impact of annual uplifts in rent and rent-free periods 6514 11 20 16

Restructuring and other one-off costs*

Impairment of PPE and onerous lease provisions 118 812 –25 118 837

Impairment of goodwill –80 540 –540 80

Other restructuring and one-off costs 28 113 28 37 56 150

Other losses arising on property-related items 19 28 –49 19 77

Underlying loss before tax of discontinued operations in the US & China (95) (172) (97) (101) (192) (273)

Underlying loss before tax of discontinued operations in Japan** (21)

Total underlying loss before tax of discontinued operations (294)

* Comprises fair value remeasurements, less costs to sell.

** The results of Japan are for the 44 weeks ended 1 January 2013, when there was an exit from the operations.

86 Tesco PLC Annual Report and Financial Statements 2014

Notes to the Group financial statements continued