Tesco 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

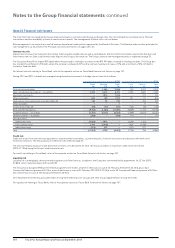

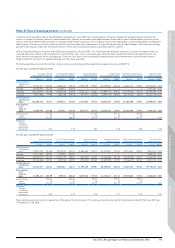

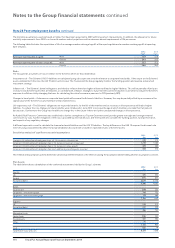

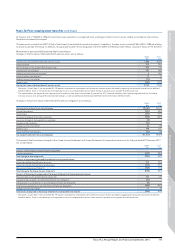

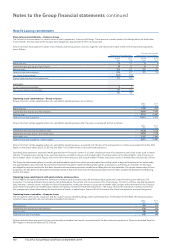

Note 25 Share-based payments continued

ix) The Discretionary Share Option Plan (2004) was adopted on 5 July 2004. This scheme permits the grant of approved, unapproved and international

options in respect of ordinary shares to selected executives. Options are normally exercisable between three and ten years from the date of grant at a price

not less than the middle-market quotation or average middle-market quotations of an ordinary share for the dealing day or three dealing days preceding the

date of grant. The exercise of options will normally be conditional upon the achievement of a specified performance target related to the annual percentage

growth in earnings per share over a three-year period. There were no discounted options granted under this scheme.

x) The Group New Business Incentive Plan (2007) was adopted on 29 June 2007. This scheme permits the grant of options in respect of ordinary shares to

selected executives. Options will normally vest in four tranches: four, five, six and seven years after the date of grant and will be exercisable for up to two

years from the vesting dates for nil consideration. The exercise of options will normally be conditional upon the achievement of specified performance

targets related to the return on capital employed over the seven-year plan.

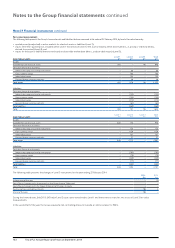

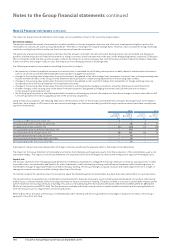

The following tables reconcile the number of share options outstanding and the weighted average exercise price (‘WAEP’):

For the year ended 22 February 2014

Savings-related

Share Option Scheme

Irish Savings-related

Share Option Scheme

Approved Share

Option Scheme

Unapproved

Share Option Scheme

International Executive

Share Option Scheme

Nil cost share

option schemes

Options WAEP Options WAEP Options WAEP Options WAEP Options WAEP Options WAEP

Outstanding at

23 February

2013 127,212,551 338.85 4,886,834 338.78 12,592,329 399.01 80,439,020 382.62 53,665,107 387.64 19,778,825 0.00

Granted 29,258,434 322.00 1,294,873 322.00 – – – – – – 7,0 03,76 4 0.00

Forfeited (24,352,865) 365.89 (1,081,476) 353.68 (3,785,217) 418.07 (21,694,176) 419.27 (17,70 4,212) 415.76 (2,458,290) 0.00

Exercised (9,515,992) 314.96 (200,710) 318 .29 (654,147) 306.38 (5,94 0,411) 302.00 (3,374,535) 322.10 (3,225,216) 0.00

Outstanding at

22 February

2014 122,602,128 331.31 4,899,521 331. 89 8,152,965 397. 59 52,804,433 376.63 32,586,360 379.15 21,099,083 0.00

Exercisable as

at 22

February

2014 15,894,484 353.09 837,652 370.38 8,145,517 397.58 52,801,878 376.63 32,546,360 379.12 4,206,723 0.00

Exercise price

range

(pence)

311.0 0

to

410.00

311.0 0

to

386.00

253.25

to

473.75

253.25

to

473.75

253.25

to

473.75 0.00

Weighted

average

remaining

contractual

life (years) 0.44 0.44 3.63 3.78 3.88 4.18

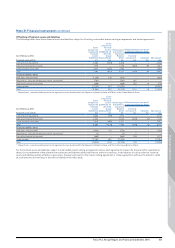

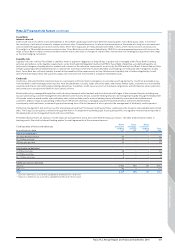

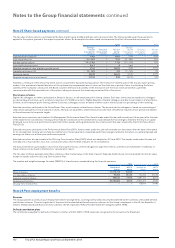

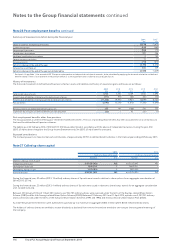

For the year ended 23 February 2013

Savings-related

Share Option Scheme

Irish Savings-related

Share Option Scheme

Approved Share

Option Scheme

Unapproved Share

Option Scheme

International Executive

Share Option Scheme

Nil cost share

option schemes

Options WAEP Options WAEP Options WAEP Options WAEP Options WAEP Options WAEP

Outstanding at

25 February

2012 131,921,033 350.28 4,975,203 352.95 13,668,564 395.47 87,418,835 377. 80 59,751,420 385.37 17, 801,914 0.00

Granted 32,771,389 282.00 1,407,939 282.00 – – – – – – 7,369,204 0.00

Forfeited (25,049,015) 333.25 (1,055,775) 336.01 (604,143) 410.43 (3,130,086) 401.30 (4,379,756) 397.07 (3,064,780) 0.00

Exercised (12,430,856) 321.54 (440,533) 323.97 (472,092) 281.87 (3,849,729) 257.90 (1,706,557) 284.22 (2,327,513) 0.00

Outstanding at

23 February

2013 127,212,551 338.85 4,886,834 338.78 12,592,329 399.01 80,439,020 382.62 53,665,107 387.6 4 19,778,825 0.00

Exercisable as

at 23

February

2013 16,192, 212 381.09 709,010 360.40 9,319,436 391.70 61,754,447 371.37 39,218,022 375.74 5,630,056 0.00

Exercise price

range

(pence)

328.00

to

410.00

328.00

to

410.00

197.50

to

473.75

197.50

to

473.75

197.50

to

473.75 0.00

Weighted

average

remaining

contractual

life (years) 0.43 0.43 4.59 4.71 4.90 5.24

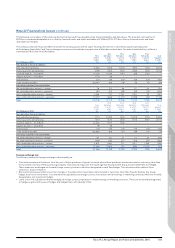

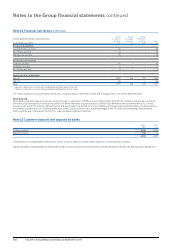

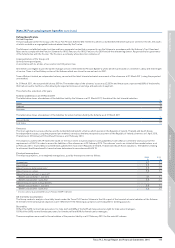

Share options were exercised on a regular basis throughout the financial year. The average share price during the financial year ended 22 February 2014 was

349.48p (2013: 328.39p).

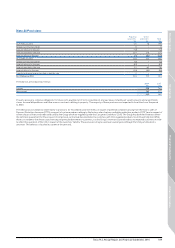

Other information

Governance Financial statementsStrategic report

Tesco PLC Annual Report and Financial Statements 2014 111