Tesco 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Activities during the year

During the year the Committee received update reports from a

number of businesses, including Tesco Bank, and also from the

Disclosure Committee and Compliance Committee. It also received

updates from Internal Audit on its work, including findings from its

internal audit programme. The Committee considered a variety of

matters including the Group Finance Risk Register; fraud, bribery

and corruption; business continuity management; the Grocery

Supply Chain Compliance Code; whistleblowing arrangements;

and non-audit fees.

In relation to the financial statements the Committee: reviewed

and recommended approval of the half-yearly results and annual

financial statements; conducted impairment reviews; reviewed and

recommended dividend levels; reviewed corporate governance

disclosures and monitored the statutory audit. The Committee also

advised the Board on whether the financial statements, taken as a

whole, were fair, balanced and understandable and provide the

necessary information to assess the Company’s performance,

business model and strategy.

The Committee assessed the effectiveness of the external audit

process by means of a detailed questionnaire completed by key

stakeholders, including the Board, the Executive Committee,

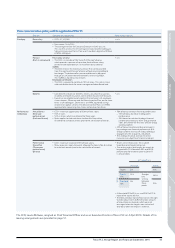

Significant financial statement reporting issues

Issue How the issue was addressed by the Committee

Going concern basis

for the financial

statements

The Committee reviewed management’s assessment of going concern with consideration of forecast cash flows, including sensitivity to trading and

expenditure plans and potential mitigating actions. The Committee also considered the availability of financing facilities and the capital and liquidity

plans of Tesco Bank. Based on this the Committee confirmed that the application of the going concern basis for the preparation of the financial

statements continued to be appropriate.

Fixed asset

impairment

The Committee assessed management’s impairment testing of property assets, considering the appropriateness of key assumptions and

methodologies for both value in use models and fair value measurements. This included review of cashflows, growth rates and discount rates

and the use of independent third party valuers. The Group has recognised a £(734)m charge for the impairment of European stores in the year.

China disposal group

valuation

The China disposal group is measured at the lower of cost and fair value less costs to sell. The Committee considered the methodology and

assumptions used in the valuation including review of cashflows, growth rates and discount rates used, valuation multiples for similar transactions

and companies and the appropriate level of synergies to include in the valuation. As part of this procedure, the Committee met with the independent

expert valuers engaged by management to assist in the valuation process. A £(540)m write-down to fair value less costs to sell was recognised at year

end. See Note 7 to the financial statements.

Goodwill impairment The Committee reviewed management’s process for testing goodwill for potential impairment. This review included consideration of key

assumptions, principally cash flow forecasts, long-term growth rates and discount rates. The Committee concurred with management's judgement

that no impairment was required. See Note 10 to the financial statements, ‘Goodwill and other intangible assets’ for more details.

Tesco Bank

judgemental matters

The Committee reviewed management’s judgements made in relation to Tesco Bank’s provisions for customer redress, loan impairment provisions

and insurance reserves. The Committee received detailed reports from management regarding these judgements and interfaced directly with the

Bank’s own audit committee and board to develop a detailed understanding of the matters. During the year, an additional £(63)m of provisions for

customer redress were recognised. See Note 24 of the financial statements.

Income statement

non-GAAP measure

presentation

The Committee considered the presentation of the Group financial statements and, in particular, the appropriateness of the presentation of one-off

items in the calculation of underlying profit in light of the latest FRC guidance on the matter. It reviewed the nature of items identified and whether

treatment was even-handed, consistent across years and appropriately presented movements on items which have an effect over a number of years.

The total restructuring and other one-off charge for the year was £(801)m.

The Committee notes that commercial income was an area of focus for the external auditors based on their assessment of gross risks.

It is the Committee’s view that whilst commercial income is a significant income for the Group and involves an element of judgement,

management operates an appropriate control environment which minimises risks in this area. As a result, the Committee does not

consider that this is a significant issue for disclosure in its report.

members of senior management and Internal Audit.

The questionnaire assessed external audit in the following

areas: qualification; expertise and resources; operational

effectiveness; independence and leadership. The results are

rated against an ideal standard and compared to prior years

to assess the consistency of performance.

The effectiveness of the Internal Audit function was assessed

by means of a detailed questionnaire which was also completed

by key stakeholders. The assessment covered the Internal Audit

function’s understanding of its role and responsibility, its charter,

the quality of its communications, its performance and the skills

and expertise of the team.

The Committee carried out a review of its effectiveness during

the year via the Committee Chairman conducting interviews with

key stakeholders and the use of a questionnaire. The Committee

concluded that it continues to be effective and has sufficient

resources to carry out its duties.

The Committee considered a number of significant issues in the

year taking into account in all instances the views of the Company’s

external auditors. The issues and how they were addressed by the

Committee are detailed below:

34 Tesco PLC Annual Report and Financial Statements 2014

Corporate governance report continued