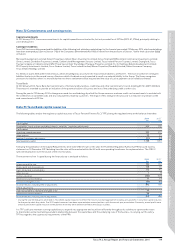

Tesco 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

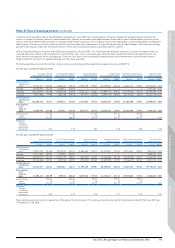

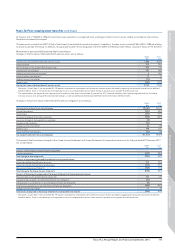

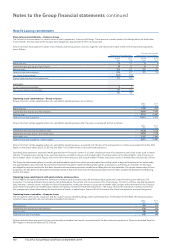

Note 34 Leasing commitments

Finance lease commitments – Group as lessee

The Group has finance leases for various items of plant, equipment, fixtures and fittings. There are also a small number of buildings which are held under

finance leases. The fair value of the Group’s lease obligations approximate to their carrying value.

Future minimum lease payments under finance leases and hire purchase contracts, together with the present value of the net minimum lease payments,

are as follows:

Minimum lease payments

Present value of net

minimum lease payments

2014

£m

2013

£m

2014

£m

2013

£m

Within one year 12 13 66

Greater than one year but less than five years 49 52 14 15

After five years 185 212 101 107

Total minimum lease payments 246 277 121 128

Less future finance charges (125) (149)

Present value of minimum lease payments 121 128

Analysed as:

Current finance lease payables 66

Non-current finance lease payables 115 122

121 128

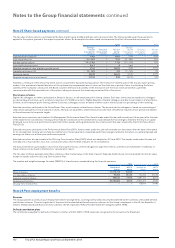

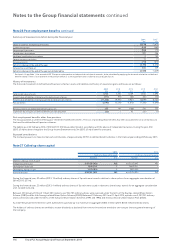

Operating lease commitments – Group as lessee

Future minimum rentals payable under non-cancellable operating leases are as follows:

2014

£m

2013

£m

Within one year 1,334 1,404

Greater than one year but less than five years 4,676 4,999

After five years 9,911 10,867

Total minimum lease payments 15,921 17, 270

Future minimum rentals payable under non-cancellable operating leases after five years are analysed further as follows:

2014

£m

2013

£m

Greater than five years but less than ten years 4,250 4,756

Greater than ten years but less than fifteen years 2,894 3,128

After fifteen years 2,767 2,983

Total minimum lease payments – after five years 9,911 10,867

Future minimum rentals payable under non-cancellable operating leases associated with the discontinued operations in China are excluded from the 2014

figures in the above tables (2013: £1,633m). See Note 7 for further details on discontinued operations.

Operating lease payments represent rentals payable by the Group for certain of its retail, distribution and office properties and other assets such as motor

vehicles. The leases have varying terms, purchase options, escalation clauses and renewal rights. Purchase options and renewal rights, where they occur,

are at market value. Escalation clauses are in line with market practices and include inflation linked, fixed rates, resets to market rents and hybrids of these.

The Group has lease break options on certain sale and leaseback transactions, which are exercisable if an existing option to buy back leased assets at market value

at a specified date is also exercised. No commitment has been included in respect of the buy-back option as the option is at the Group’s discretion. The Group is

not obliged to pay lease rentals after that date, therefore minimum lease payments exclude those falling after the buy-back date. The current market value of these

properties is £5.4bn (2013: £5.2bn) and the total lease rentals, if they were to be incurred following the option exercise date, would be £4.2bn (2013: £4.1bn) using

current rent values.

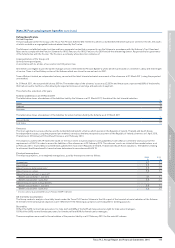

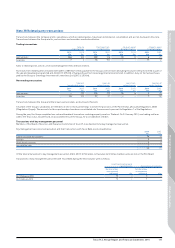

Operating lease commitments with joint ventures and associates

Since 1988 the Group has entered into several joint ventures and associates and sold and leased back properties to and from these joint ventures and

associates. The Group entered into a property sale and leaseback transaction with an associate in this financial year. The terms of these sale and leasebacks

vary, however, common factors include: the sale of the properties to the joint venture or associate at market value; options within the lease for the Group to

repurchase the properties at market value; market rent reviews; and 20 to 30 full-year lease terms. The Group reviews the substance as well as the form of

the arrangements when determining the classification of leases as operating or finance. All of the leases under these arrangements are operating leases.

Operating lease receivables – Group as lessor

The Group both rents out its properties and also sublets various leased buildings under operating leases. At the balance sheet date, the following future

minimum lease payments are contractually receivable from tenants: 2014

£m

2013

£m

Within one year 193 258

Greater than one year but less than five years 256 348

After five years 196 260

Total minimum lease receivables 645 866

Future minimum lease payments that are contractually receivable from tenants associated with the discontinued operations in China are excluded from the

2014 figures in the above tables (2013: £153m).

120 Tesco PLC Annual Report and Financial Statements 2014

Notes to the Group financial statements continued