Tesco 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

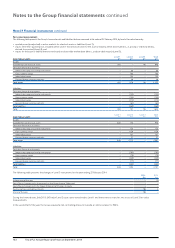

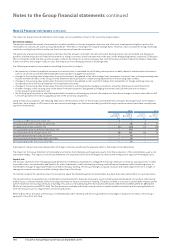

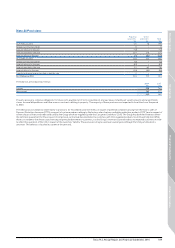

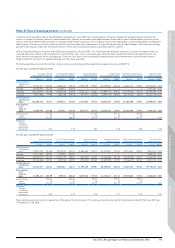

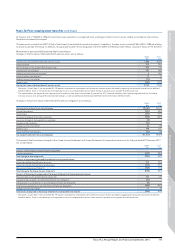

Note 22 Financial risk factors continued

The following is an analysis of the undiscounted contractual cash flows payable under financial liabilities and derivatives. The potential cash outflow of

£18.2bn is considered acceptable as it is offset by financial assets and trade receivables of £14.8bn (2013: £17.4bn offset by financial assets and trade

receivables of £14.4bn).

The undiscounted cash flows will differ from both the carrying values and fair value. Floating rate interest is estimated using the prevailing rate

at the balance sheet date. Cash flows in foreign currencies are translated using spot rates at the balance sheet date. For index-linked liabilities, inflation is

estimated at 3% for the life of the liability.

At 22 February 2014

Due

within

1 year

£m

Due

between

1 and 2

years

£m

Due

between

2 and 3

years

£m

Due

between

3 and 4

years

£m

Due

between

4 and 5

years

£m

Due

beyond

5 years

£m

Non-derivative financial liabilities

Bank and other borrowings (1,835) (523) (1,514) (921) ( 743) (5,372)

Interest payments on borrowings (459) (404) (377) (306) (270) (3,152)

Customer deposits – Tesco Bank (4,725) (1,10 0) (141) (29) (122) –

Deposits by banks – Tesco Bank (772) (8) – – – –

Finance leases (12) (13) (12) (12) (12) (185)

Trade and other payables (10,441) (82) (19) (2) (2) (49)

Derivative and other financial liabilities

Net settled derivative contracts – receipts 76 29 68 22 44 538

Net settled derivative contracts – payments (91) (75) (59) (52) (70) (345)

Gross settled derivative contracts – receipts 4,768 713 1,323 1,758 39 1,493

Gross settled derivative contracts – payments (4,727) (648) (1,277) (1,499) (24) (1,132)

Total (18,218) ( 2,111) (2,008) (1,041) (1,160) (8,204)

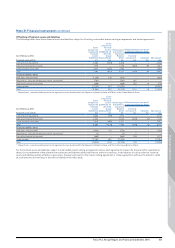

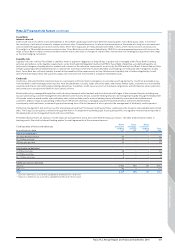

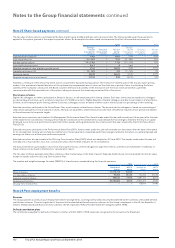

At 23 February 2013

Due

within

1 year

£m

Due

between

1 and 2

years

£m

Due

between

2 and 3

years

£m

Due

between

3 and 4

years

£m

Due

between

4 and 5

years

£m

Due

beyond

5 years

£m

Non-derivative financial liabilities

Bank and other borrowings (711) (1,081) (553) (1,550) (575) (5,805)

Interest payments on borrowings (451) (441) (402) (375) (301) ( 3,511)

Customer deposits – Tesco Bank (5,323) (577) (100) – – –

Deposits by banks – Tesco Bank (9) (6) – – – –

Finance leases (13) (13) (13) (13) (13) (212)

Trade and other payables (10,865) (93) ( 31) (19) (12) (74)

Derivative and other financial liabilities

Net settled derivative contracts – receipts 63 62 27 71 20 608

Net settled derivative contracts – payments (106) (78) (71) (50) (47) (362)

Gross settled derivative contracts – receipts 3,610 1,588 157 1,057 1,369 1,008

Gross settled derivative contracts – payments (3,564) (1,485) (57) (916) (1,000) (531)

Total (17,369) ( 2,124) (1,043) (1,795) (559) (8,879)

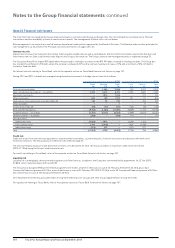

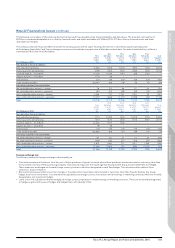

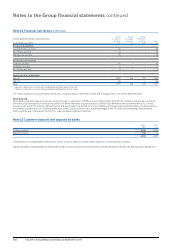

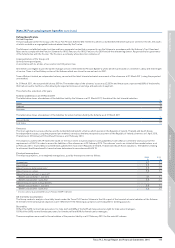

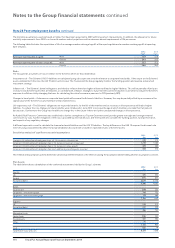

Foreign exchange risk

The Group is exposed to foreign exchange risk principally via:

• Transactional exposure that arises from the cost of future purchases of goods for resale, where those purchases are denominated in a currency other than

the functional currency of the purchasing company. Transactional exposures that could significantly impact the Group Income Statement are hedged.

These exposures are hedged via forward foreign currency contracts which are designated as cash flow hedges. The notional and fair value of these

contracts is shown in Note 21.

• Net investment exposure that arises from changes in the value of net investments denominated in currencies other than Pounds Sterling. The Group

hedges a part of its investments in its international subsidiaries via foreign currency transactions and borrowings in matching currencies which are formally

designated as net investment hedges.

• Loans to non-UK subsidiaries that are hedged via foreign currency transactions and borrowings in matching currencies. These are not formally designated

as hedges as gains and losses on hedges and hedged loans will naturally offset.

Other information

Governance Financial statementsStrategic report

Tesco PLC Annual Report and Financial Statements 2014 105