Tesco 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

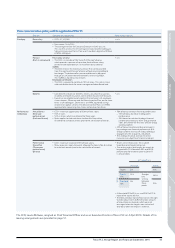

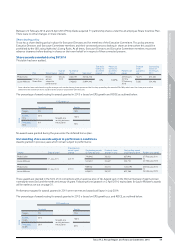

Remuneration policy for Executive Directors

Fixed element (c.20% of total reward assuming maximum performance)

Salary + pension + benefits

Performance related element (c.80% of total reward assuming maximum performance)

Short-term performance Long-term performance

Cash bonus Deferred share

bonus Performance Share Plan

Financial measures (76%):

Profitability (50%) and strategic

financial measures (26%)

Strategic non-financial

measures (24%)

Matrix of EPS growth and return

on capital employed (‘ROCE’)

The following report outlines our remuneration strategy and philosophy, how remuneration policy was implemented in 2013/14 and how

the Committee intends to apply policy in 2014/15. This Annual Remuneration Report will be submitted to an advisory shareholder vote at

the AGM on 27 June 2014.

Remuneration strategy

Tesco’s most important asset is its people. Business success depends on the performance and contribution of each individual colleague

but outstanding performance comes from teamwork. Our approach to remuneration throughout Tesco is guided by a framework of

common objectives and principles which are outlined in the table below.

Reward objectives Reward principles

Attract

• Enable Tesco to recruit the

right people

Motivate

• Incentivise colleagues to deliver

our business goals together

Recognise

• Acknowledge individual

contribution and performance

Align

• Create shareholder value and

support the achievement of

the business’ core purpose by

focusing colleagues on making

what matters better

Retain

• Foster loyalty and pride in Tesco so

that colleagues want to stay with

us and strive to do their best

Competitive

• We assess competitiveness on

atotal reward basis including

financial and non-financial

rewards

• Reward reflects an individual’s

role, experience, performance

andcontribution

• Reward is set with reference to

external market practice and

internal relativity

Simple

• Reward is simple, clear, and easy

to understand

• We avoid unnecessary complexity

• Reward is delivered accurately

Total Reward

C

o

m

p

e

t

i

t

i

v

e

F

a

i

r

F

a

i

r

S

u

s

t

a

i

n

a

b

l

e

F

a

i

r

S

i

m

p

l

e

Fair

• Policies are transparent, and

applied consistently and equitably

• Reward decisions are trusted and

properly governed

• Reward is legal and compliant

Sustainable

• Reward is aligned to the business

strategy, reflects our performance,

and is affordable

• Our reward framework is flexible

tomeet the changing needs of

thebusiness

• We reward in a responsible way

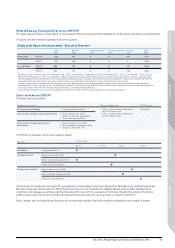

Linking executive pay with strategy

•Alignment with strategy

Our strategic focus is to build a stronger business that

is sustainable and equipped to compete in the future.

The majority of our reward is linked to the delivery of

stretching performance over the short and long term

aligned with the achievement of our business vision and

our strategy (see the Report from the Chief Executive on

pages 3 to 7). The majority of reward is delivered in shares.

Our short-term performance is measured in relation to

profit growth and the delivery of other strategic financial

and non-financial objectives. Our long-term performance is

measured by assessing the growth in our earnings per share

and the level of our return on capital. These metrics are a key

measure of the success of the delivery of shareholder value.

• Simple, collegiate approach to remuneration

Our remuneration arrangements are designed to be simple to

provide clarity to our Executives and to shareholders. Executive

Directors and other management participate in a common

incentive framework to ensure teamwork in delivering our key

strategic goals.

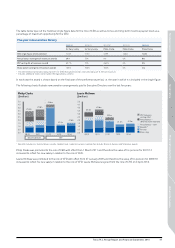

•Creating alignment with shareholders by building

a shareholding in our business

We believe that it is important that our colleagues are shareholders

in the business to create alignment with other shareholders.

The CEO’s shareholding guideline is to hold shares with a value of

four times salary, the CFO is required to hold shares with a value of

three times salary and other senior managers are required to hold

shares with a value of one times salary.

The following chart and accompanying table provide a summary

of how remuneration policy will be applied in 2014/15.

42 Tesco PLC Annual Report and Financial Statements 2014

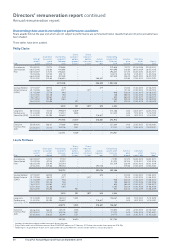

Directors’ remuneration report continued

Annual remuneration report