Tesco 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

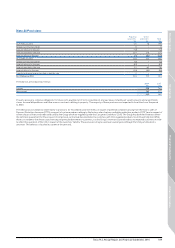

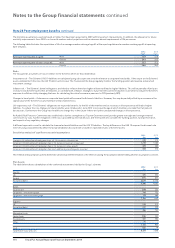

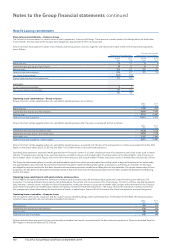

Capital commitments

At 22 February 2014, there were commitments for capital expenditure contracted for, but not provided for of £270m (2013: £1,278m), principally relating to

store development.

Contingent liabilities

Tesco PLC has irrevocably guaranteed the liabilities of the following Irish subsidiary undertakings for the financial year ended 22 February 2014, which undertakings

have been exempted pursuant to Section 17(1) of the Companies (Amendment) Act 1986 of Ireland from the provisions of Section 7 (other than subsection (1)(b))

of that Act:

Monread Developments Limited; Edson Properties Limited; Edson Investments Limited; Cirrus Finance (2009) Limited; Commercial Investments Limited;

Chirac Limited; Clondalkin Properties Limited; Golden Island Management Services Limited; Tesco Ireland Pension Trustees Limited; Orpingford; Tesco

Trustee Company of Ireland Limited; WSC Properties Limited, Thundridge; Pharaway Properties Limited; R.J.D. Holdings; Nabola Development Limited;

PEJ Property Investments Limited; Cirrus Finance Limited; Tesco Ireland Limited; Wanze Properties (Dundalk) Limited; Valiant Insurance Company;

Tesco Ireland Holdings Limited.

For details of assets held under finance leases, which are pledged as security for the finance lease liabilities, see Note 11. There are a number of contingent

liabilities that arise in the normal course of business which if realised are not expected to result in a material liability to the Group. The Group recognises

provisions for liabilities when it is more likely than not that a settlement will be required and the value of such a payment can be reliably estimated.

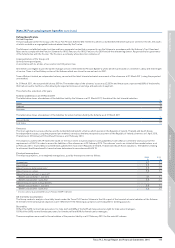

Tesco Bank

At 22 February 2014, Tesco Bank had commitments of formal standby facilities, credit lines and other commitments to lend, totalling £9.7bn (2013: £8.0bn).

The amount is intended to provide an indication of the potential volume of business and not of the underlying credit or other risks.

During the year to 22 February 2014 a change was made to a methodology by which the Group measures undrawn credit card commitments to exclude both

the credit limits on cancelled cards and any overpayments made by customers. The impact of this change in the prior year is a reduction in undrawn credit

card commitments of £0.5bn.

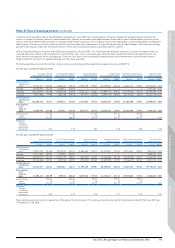

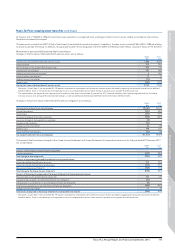

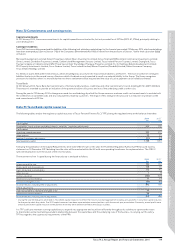

Note 33 Tesco Bank capital resources

The following tables analyse the regulatory capital resources of Tesco Personal Finance PLC (‘TPF’), being the regulated entity at the balance sheet date:

2014

£m

2013*

£m

Tier 1 capital:

Shareholders’ funds and non-controlling interests, net of tier 1 regulatory adjustments 913 705

Tier 2 capital:

Qualifying subordinated debt 235 372

Other interests 33 25

Total tier 2 regulatory adjustments (21) (64)

Total regulatory capital 1,160 1,038

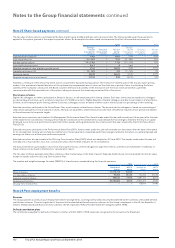

Following the publication of the Capital Requirements Directive (‘CRD’) IV rules in the year, the Prudential Regulation Authority (‘PRA’) issued a policy

statement on 19 December 2013 detailing how the rules will be enacted within the UK with corresponding timeframes for implementation. The CRD IV

rules will be phased in over the course of the next five years.

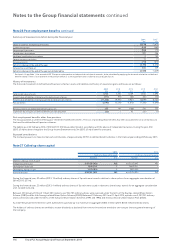

The movement of tier 1 capital during the financial year is analysed as follows:

2014

£m

2013*

£m

At beginning of the year 705 744

Share capital and share premium 140 45

Profit attributable to shareholders 115 93

Other reserves 1(1)

Ordinary dividends (100) (105)

Movement in material holdings 11 (11)

Increase in intangible assets (30) (60)

At end of the year, excluding CRD IV adjustments 842 705

CRD IV adjustments

Deferred tax liabilities related to intangible assets 32 –

Movement in material holdings 39 –

At end of the year, including CRD IV adjustments 913 705

* During the year the Group has amended its Tesco Bank capital resources to reflect the industry standard approach of including annual profits in full within capital resources

for the year to which they relate. The 2013 capital resources have been represented on a consistent basis with the current year presentation. Previously, annual profits were

only included within capital resources at the point at which they were deemed verified by the Group’s auditors.

It is TPF’s policy to maintain a strong capital base, to expand it as appropriate and to utilise it efficiently throughout its activities to optimise the return

to shareholders while maintaining a prudent relationship between the capital base and the underlying risks of the business. In carrying out this policy,

TPF has regard to the supervisory requirements of the PRA.

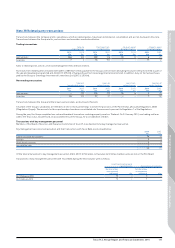

Note 32 Commitments and contingencies

Other information

Governance Financial statementsStrategic report

Tesco PLC Annual Report and Financial Statements 2014 119