Suzuki 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 7

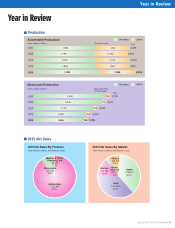

Year in Review

Overseas Markets

1. Overview of Suzuki’s Main Overseas Automobile Markets

Sales of automobiles (passenger cars and multi-utility vehicles) in India grew in scal 2014 by 4% year-on-year to 2,601,000 units. One rea-

son for this growth was evidence of a moderate economic pickup following the change of government in May 2014. Sales in the ve key

ASEAN countries (Indonesia, Thailand, Vietnam, the Philippines, and Malaysia) fell by 8% year-on-year to 3,088,000 units. The drop was par-

ticularly marked in Indonesia and Thailand. Sales fell in Indonesia because of an economic slump and a weak rupiah. Sales fell in Thailand

because the previous government’s policies had left households with greater debt and because less nancing was available for purchases.

Sales in Europe (the European Union and the European Free Trade Association) grew by 8% year-on-year owing to an economic recovery

that began the previous scal year. Sales in China grew by 5% year-on-year to 23,702,000 units.

2. Suzuki Sales

Suzuki’s overseas automobile sales volume in scal 2014 grew by 7% year-on-year to 2,111,000 units as economic conditions in the Com-

pany’s overseas markets showed moderate recovery. Suzuki’s sales in India rose by 11% year-on-year to 1,171,000 units owing to strong

demand for models including the new Celerio, Alto K10, and Ciaz. Suzuki’s sales in the ve key ASEAN countries fell by 18% year-on-year to

184,000 units owing mainly to an economic slump. Suzuki’s sales in China grew by 11% year-on-year to 257,000 units owing mainly to the

launch of the SX4 S-CROSS. Suzuki’s sales in Europe (the European Union and the European Free Trade Association) grew by 1% year-on-

year to 161,000 units owing partly to the launch of the Celerio and Vitara and partly to sales of the SX4 S-CROSS throughout the scal year.

3. Suzuki Topics in Fiscal 2014

• In April 2014, Suzuki launched a minivehicle-based WagonR in Pakistan.

• In August 2014, cumulative worldwide sales of the Swift (a series

that Suzuki launched in 2004) reached four million units.

• In October 2014, Suzuki began a series of launches for the Ciaz

by putting it on the market in India.

• In November 2014, Suzuki launched a completely updated Alto K10.

• In January 2015, Suzuki ceremonially laid the foundation stone for

a new plant in Gujarat.

• In March 2015, Suzuki held a ceremony as the rst unit of the

Europe-specication Vitara rolled o the production line.

• Maruti Suzuki India’s sales volume in India exceeded one million

units for the fth scal year in a row.

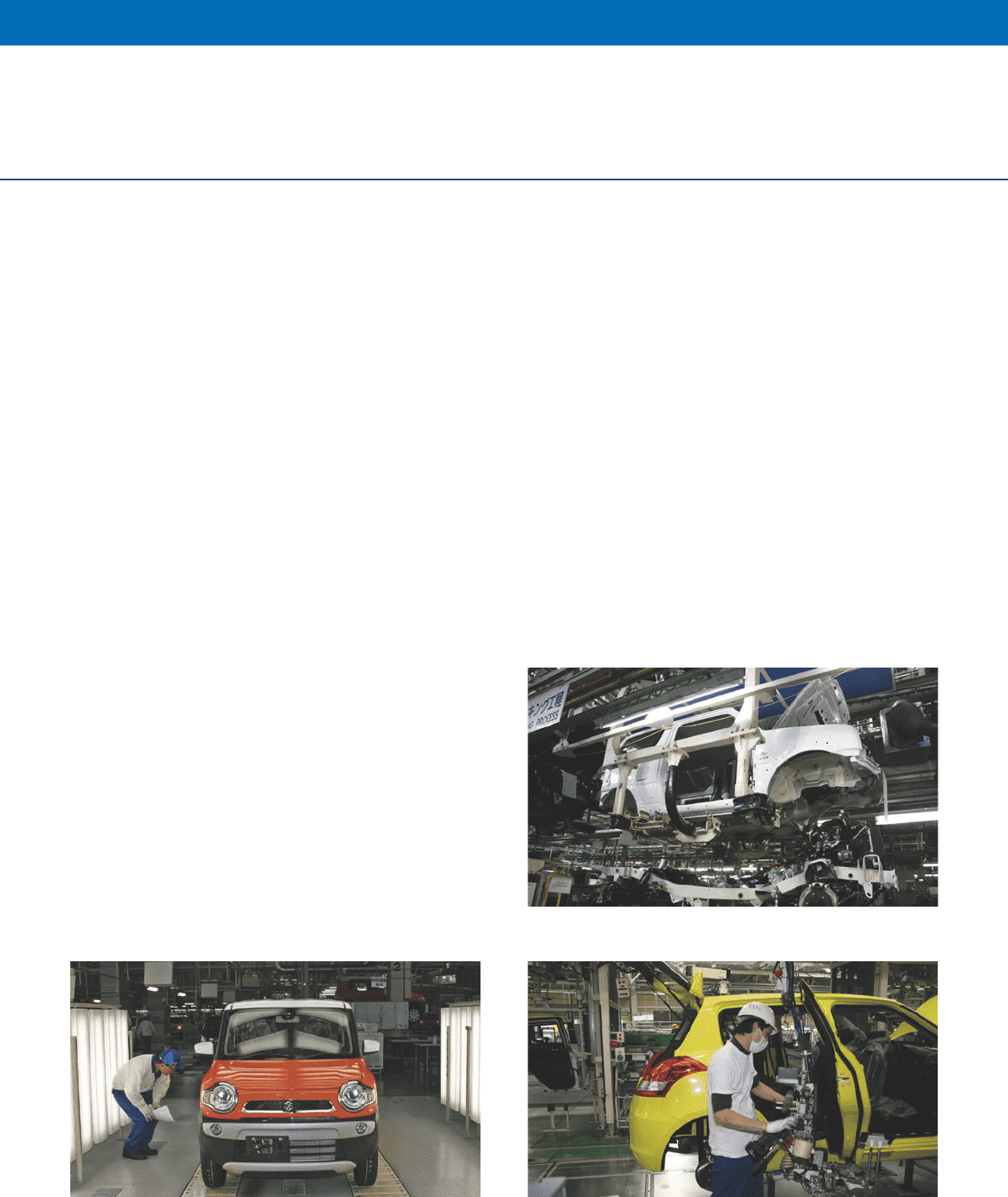

Iwata Plant

(Multi-purpose vehicle and commercial vehicle assembling)

Kosai Plant

(Passenger car and automobile engines assembling)

Sagara Plant

(Passenger car and automobile engines assembling,

foundry of engine components, machining)