Suzuki 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

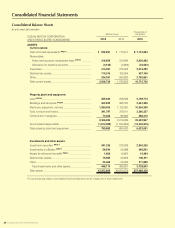

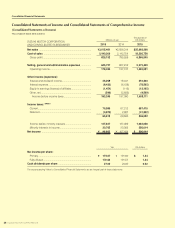

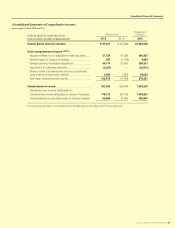

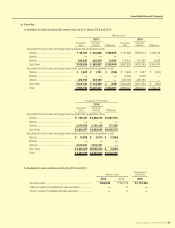

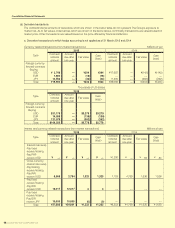

40 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements

Notes to Consolidated Financial Statements

NOTE 1:Basisofpresentingconsolidatednancialstatements

The accompanying consolidated nancial statements of Suzuki Motor Corporation (The Company), consolidated Subsidiaries,

and Afliates (The Group) have been prepared on the basis of generally accepted accounting principles and practices in Japan,

and the consolidated nancial statements were led with the Financial Services Agency as required by the Financial Instruments

and Exchange Act of Japan.

The preparation of the consolidated nancial statements requires the management to select and adopt accounting standards and

make estimates and assumptions that affect the reported amount of assets and liabilities, revenue and expenses, and the cor-

responding methods of disclosure.

As such, the management’s estimates are made reasonably based on historical results. But due to the inherent uncertainty in-

volved in making estimates, actual results could differ from these estimates.

For the convenience of readers outside Japan, certain reclassications and modications have been made to the original consoli-

dated nancial statements.

As permitted, an amount of less than one million yen has been omitted. For the convenience of readers, the consolidated nancial

statements, including the opening balance of shareholders’ equity, have been presented in US dollars by translating all Japanese

yen amounts on the basis of 120.17 to US$1, the rate of exchange prevailing as of 31 March 2015. Consequently, the totals shown

in the consolidated nancial statements (both in yen and in US dollars) do not necessarily agree with the sum of the individual

amounts.

NOTE 2:Summaryofsignicantaccountingpolicies

(a) Principles of consolidation

The consolidated nancial statements for the years ended 31 March 2015 and 2014, include the accounts of The Group. And

the numbers of consolidated subsidiaries are both 133. All signicant inter-company accounts and transactions are eliminated

in consolidation. Investments in afliated companies are accounted for by the equity method.

The difference at the time of acquisition between the cost and underlying net equity of investments in consolidated subsidiar-

ies (goodwill) and in afliated companies accounted for under the equity method is, as a rule, amortized on a straight-line

basis over a period of ve years after appropriate adjustments.

Consolidated subsidiaries that settled the account in 31 December without provisional account settlement as of consolidated

account settlement date were consolidated with the nancial statements based on their nancial statements as of 31 Decem-

ber and made necessary adjustments for consolidation regarding important transactions that occurred between 31 December

and consolidated account settlement date.

From this consolidated scal year, Suzuki Motor Iberica, S.A.U. and other 5 subsidiaries have changed the settlement date

from 31 December to 31 March and Suzuki Motor (Thailand) Co., Ltd. and other 16 subsidiaries have been consolidated

based on the nancial statements of provisional account as of consolidated account settlement date. As a result, subsidiary

which has been consolidated based on the nancial statements as of 31 December is 1 subsidiary.

With regard to these changing mentioned above, the net income (loss) of three months from 1 January to 31 March 2014 has

been recognized in retained earnings.

As a result, retained earnings decreased by ¥1,384 million from the beginning of this consolidated scal year.

The account settlement date of Magyar Suzuki Corporation Ltd. and other 4 subsidiaries is 31 December, but they are con-

tinuously consolidated based on the nancial statements of provisional account settlement as of 31 March.

The account settlement date of other consolidated subsidiaries is the same as the consolidated account settlement date.

(b) Allowance for doubtful accounts

In order to allow for loss from bad debts, estimated uncollectible amount based on actual ratio of bad debt is appropriated as

to general receivable. As for specic receivable with higher default possibility, recoverable amount is estimated respectively

and uncollectible amount is appropriated.

(c) Allowance for investment loss

The differences between the book value and the fair value of securities and investment not quoted at an exchange are deter-

mined and appropriated as reserve in order to allow for losses from these investments.

(d) Provision for product warranties

The provision is appropriated into this account based on the warranty agreement and past experience in order to allow for

expenses related to the maintenance service of products sold.

(e) Provision for directors’ bonuses

In order to defray bonuses for directors and company auditors, estimated amount of such bonuses is appropriated.

(f) Provisionfordirectors’retirementbenets

The amount to be paid at the end of scal year had been posted pursuant to The Company’s regulations on the retirement

allowance of Directors and Company Auditors. However, The Company’s retirement benet system for them was abolished at

the closure of the Ordinary General Meeting of Shareholders held on 29 June 2006. And it was approved at Ordinary General

Meeting of Shareholders that reappointed Directors and Company Auditors were paid their retirement benet at the time of

their retirement, based on their years of service. Estimated amount of such retirement benets is appropriated at the end of the

current consolidated scal year. Furthermore, for the Directors and Company Auditors of some consolidated subsidiaries, the

amount to be paid at the end of the year was posted pursuant to their regulation on the retirement allowance of Directors and

Company Auditors.