Suzuki 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 59

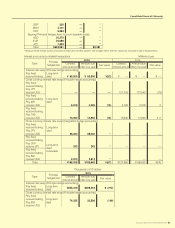

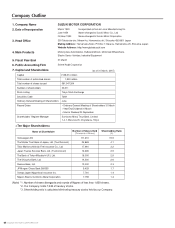

Dividends which record date was in the current consolidated scal year and effective date was in the next scal year:

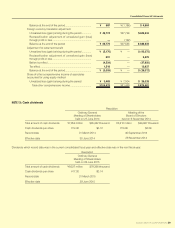

NOTE 13: Cash dividends

Resolution

Ordinary General

Meeting of Shareholders

held on 27 June 2014

Meeting of the

Board of Directors

held on 6 November 2014

Total amount of cash dividends ¥7,854 million $65,362 thousand ¥5,610 million $46,687 thousand

Cash dividends per share ¥14.00 $0.12 ¥10.00 $0.08

Record date 31 March 2014 30 September 2014

Effective date 30 June 2014 28 November 2014

Resolution

Ordinary General

Meeting of Shareholders

held on 26 June 2015

Total amount of cash dividends ¥9,537 million $79,368 thousand

Cash dividends per share ¥17.00 $0.14

Record date 31 March 2015

Effective date 29 June 2015

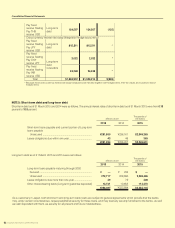

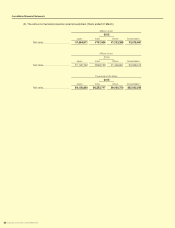

Balance at the end of the period ....................................... ¥ 587 ¥ (1,196)$ 4,884

Foreign currency translation adjustment

Unrealized loss (gain) arising during the period .............. ¥ 46,774 ¥27,748 $389,233

Reclassification adjustment of unrealized gain (loss)

through prot or loss .......................................................... —(192) —

Balance at the end of the period ¥ 46,774 ¥27,555 $ 389,233

Adjustment for retirement benet

Unrealized loss (gain) arising during the period .............. ¥ (5,176)¥ — $ (43,072)

Reclassification adjustment of unrealized gain (loss)

through prot or loss .......................................................... 651 —5,422

Before tax effect ................................................................. (4,524)—(37,650)

Tax effect ............................................................................ 1,518 —12,637

Balance at the end of the period ....................................... ¥ (3,005)¥ — $ (25,012)

Share of other comprehensive income of associates

accounted for using equity method

Unrealized loss (gain) arising during the period ¥ 3,489 ¥ 7,504 $ 29,038

Total other comprehensive income ............................... ¥105,579 ¥81,459 $ 878,581