Suzuki 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 45

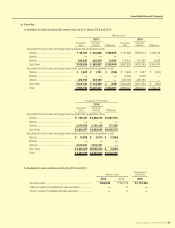

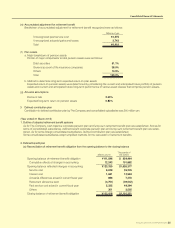

*1.Mattersformethodsusedtomeasurefairvaluesofnancialinstruments

Assets:

a. Cash and deposits

Because fair values of deposits are approximately equal to the book values, book values are used as fair values.

b. Notes and accounts receivables-trade

Fair values of sales nance receivables are calculated on the discount method by the expected rate applied to new

loan contract, on each receivable classied into a certain term.

Notes and accounts receivables-trade except sales nance are settled in short term and those fair values are ap-

proximately equal to the book values. So book values are used as fair values.

c. Short-term investment securities and Investment securities

As to these fair values, fair values of stock are prices of exchanges. As to negotiable certicate of deposit and other

types of securities, book values are used as fair values because they are settled in short term and those fair values

are approximately equal to the book values.

Liabilities:

a. Accounts payable-trade, Short-term loans payable and Accrued expenses

Because these are settled in short term and those fair values are approximately equal to the book values, such book

values are used.

b. Current portion of long-term loans payable and Long-term loans payable

These fair values are measured by discounting based on the estimated interest rates at which similar new loans with

same amount of principal and interest could have been borrowed.

Derivatives:

Please refer to Note 4 (d) Derivative transactions.

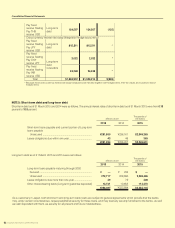

*2. Financial instruments whose fair value cannot be reliably determined as of 31 March 2015 and 2014

Millions of yen

Thousands of

US dollars

2015 2014 2015

Available-for-sale securities

Unlisted stock other than stocks of afliates ¥18,748 ¥18,747 $156,013

Unlisted stock of afliates ............................. 23,084 17,077 192,098

Others ............................................................ 119 557 997

Those fair values cannot be reliably measured because market values are unavailable and future cash ows cannot be

estimated. So they are not included in “short-term investment securities and investment securities”.