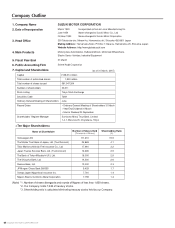

Suzuki 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

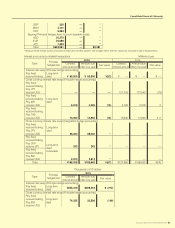

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 57

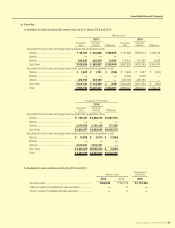

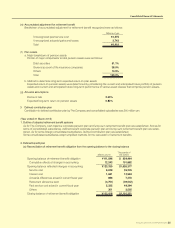

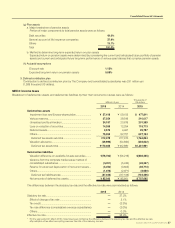

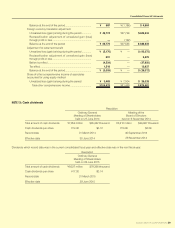

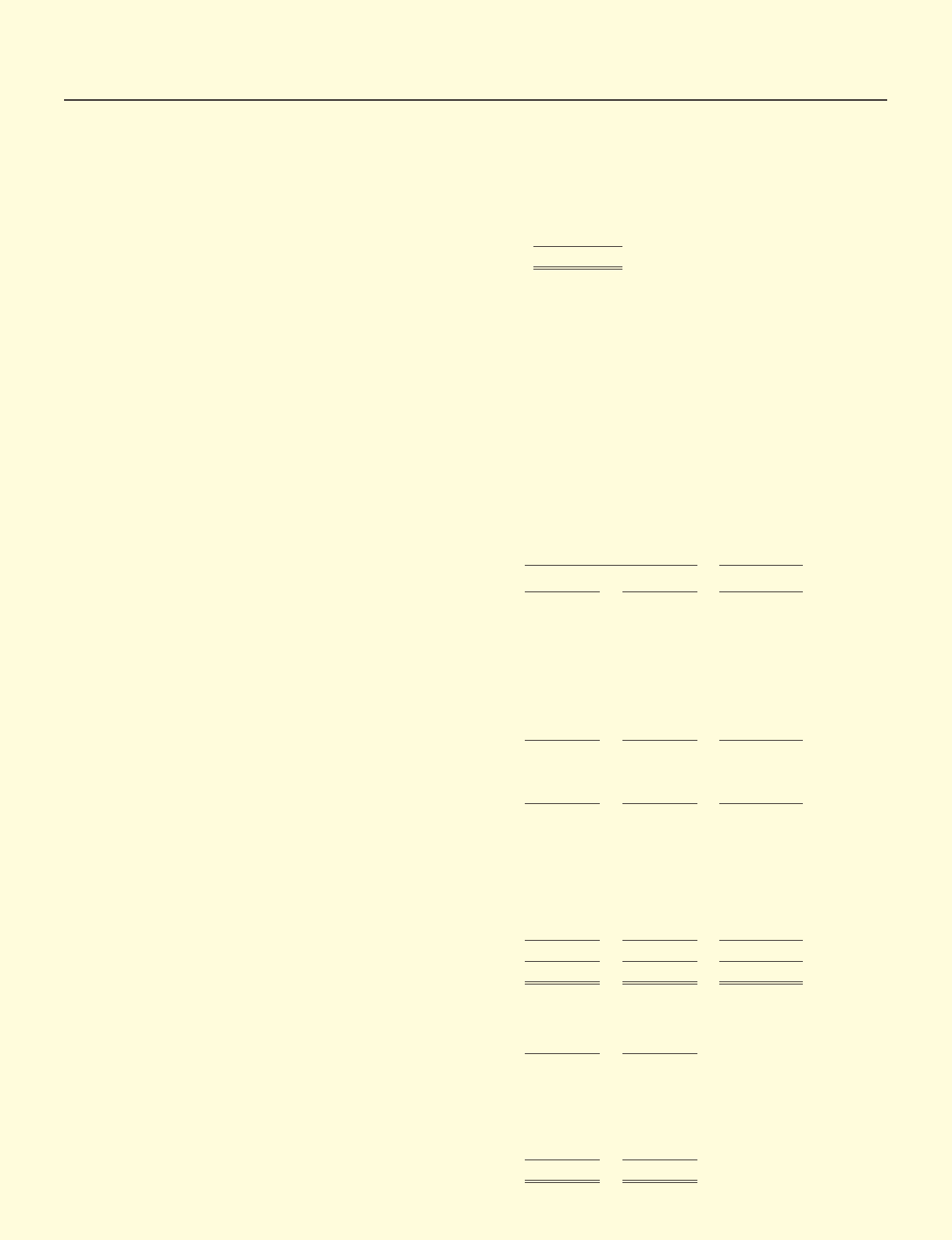

NOTE 8: Income taxes

Breakdown of deferred tax assets and deferred tax liabilities by their main occurrence causes were as follows:

Millions of yen

Thousands of

US dollars

2015 2014 2015

Deferred tax assets

Impairment loss and Excess-depreciation ....................... ¥ 57,418 ¥ 59,105 $ 477,811

Various reserves ................................................................. 37,254 39,548 310,017

Unrealized prots elimination ............................................ 24,197 20,876 201,359

Loss on valuation of securities .......................................... 14,265 12,254 118,713

Deferred assets ................................................................. 3,579 3,367 29,787

Others ................................................................................. 75,362 82,757 627,134

Deferred tax assets sub-total .......................................... 212,078 217,910 1,764,824

Valuation allowance ........................................................... (39,996)(54,930)(332,832)

Deferred tax assets total ................................................. ¥172,082 ¥162,980 $1,431,991

Deferred tax liabilities

Valuation difference on available-for-sale securities ........ ¥(76,700)¥ (56,219)$(638,265)

Variance from the complete market value method of

consolidated subsidiaries ................................................. (5,811)(5,243)(48,357)

Reserve for advanced depreciation of noncurrent assets

... (3,450)(3,603)(28,713)

Others ................................................................................. (1,076)(2,071)(8,959)

Deferred tax liabilities total .............................................. (87,038)(67,138)(724,296)

Net amounts of deferred tax assets .................................. ¥ 85,043 ¥ 95,841 $ 707,695

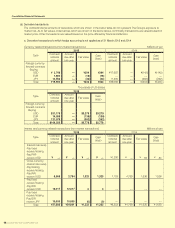

The differences between the statutory tax rate and the effective tax rate were summarized as follows:

2015 2014

Statutory tax rate .................................................................... —37.2%

Effect of change of tax rate ............................................... —3.1%

Tax credit ............................................................................ —(3.3%)

Tax rate difference (consolidated overseas subsidiaries) —(2.0%)

Others ................................................................................. —0.3%

Effective tax rate .................................................................... —35.3%

* For the year ended 31 March 2015, notes have been omitted as the difference between the statutory tax rate and the effective tax rate

after adoption of tax effect accounting was less than 5% of the statutory tax rate.

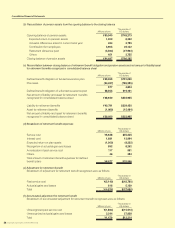

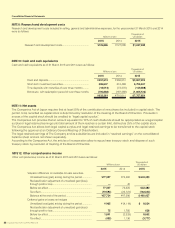

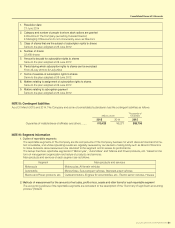

(g) Plan assets

a. Major breakdown of pension assets

Portion of major components to total pension assets were as follows:

Debt securities 49.0%

General account of life insurance companies 37.9%

Others 13.1%

Total 100.0%

b. Method to determine long-term expected return on plan assets

Expected return on pension assets were determined by considering the current and anticipated future portfolio of pension

assets and current and anticipated future long-term performance of various asset classes that comprise pension assets.

(h) Actuarial assumptions

Discount rate 1.12%

Expected long-term return on pension assets 0.88%

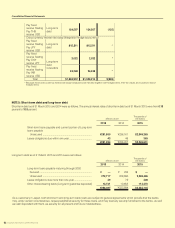

3.Denedcontributionplan

Contribution to dened contribution plan by The Company and consolidated subsidiaries was 231 million yen

(1,926 thousand US dollars).