Suzuki 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 SUZUKI MOTOR CORPORATION

Corporate Governance Issues

(b) Policy for determination of the amount of remuneration for Directors and Company Auditors

In April 2015, The Company established “Advisory Committee on Personnel and Remuneration, etc.” with Outside Directors constituting

half or more of its members, as an advisory committee to the Board of Directors, in order to enhance the objectivity and transparency of

remuneration of Directors, etc.

(Remuneration of Directors)

Remuneration of Directors (excluding Outside Directors) shall consist of basic remuneration consisting of basic pay for each position

and evaluation of individual performance, bonus linked to the Company’s performance of each scal year and stock-based remunera-

tion linked to the Company’s mid- and long-term performance or stock price. Remuneration of Outside Directors shall be solely basic

remuneration (at the xed amount).

Also, remuneration of Directors shall be decided by the Board of Directors based on the deliberation results of “Advisory Committee on

Personnel and Remuneration, etc.” on the policy regarding the decision of Director’s remuneration, standards, remuneration system and

adequacy of the remuneration level.

The basic remuneration shall be within the range of the amount of remuneration limit (monthly amount) approved at a General Meeting

of Shareholders, and the amount of remuneration for each Director shall be determined and paid in consideration of the duties and re-

sponsibilities of each Director.

As for bonuses, a proposal based on the calculation method linked with the Company’s performance shall be submitted to an Ordinary

General Meeting of Shareholders for approval and then paid.

Bonuses for Outside Directors were abolished for the following years of scal 2013.

The stock-based remuneration shall be paid within the range of amount of remuneration limit (monthly amount) approved at the Gen-

eral Meeting of Shareholders, as the remuneration that is linked to mid-and long-term Company’s performance and stock price. Direc-

tors shall contribute such type of remuneration to the ocer stockholding association every month, acquire the Company’s shares and

continuously hold them during their term of oce.

(Remuneration of Company Auditors)

Remuneration of Company Auditors shall be solely basic remuneration (at xed amount), and the amount shall be decided and paid in

the discussion among Company Auditors within the range of the amount of remuneration limit (monthly amount) approved at a General

Meeting of Shareholders.

Bonuses for Company Auditors were abolished for the following years of scal 2013.

While the Company discontinued its retirement benets plan for ocers at the 140th Ordinary General Meeting of Shareholders, held on

29 June, 2006, it has introduced the granting of stock options as compensation (stock acquisition rights) with a view toward strength-

ening Directors’ connection to the Company’s performance and stock price and ensuring that Directors share with shareholders not

only the benets of any increases in the stock price, but also the risks of any declines, pursuant to the approval granted at the 146th

Ordinary General Meeting of Shareholders, held on 28 June, 2012.

However, the Company has decided not to newly grant options after granting them in July 2014.

(Reference)

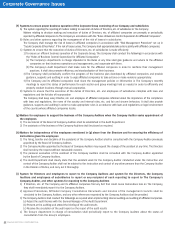

Remuneration of Directors are calculated using a method based on points set for each position of Directors as per below.

As for the calculation method, The Company received a document that states that all Company Auditors agreed on appropriateness of the method.

1. Calculation method

Paid amount = Consolidated net income × 0.18% × Each Director’s point ÷ Total of Director’s point

Notes: 1. “Indexes on prots for such accounting period” stated in Article 34(1)(iii)(a) of Corporation Tax Act of Japan is “Consolidated

net income”.

2. As of April 2015, amount of above-mentioned “Consolidated net income” used in the method is amount shown as “Net

income attributable to owners of the parent”, which is an amount before accounting loss of such paid remuneration amount.

3. Amount of consolidated net income multiplied by 0.18% is rounded down to the nearest million.

2. Number and point of Directors by position

Point Number of Directors Total Point

Chairman 30 130

Vice Chairman 18 118

President 22 122

Executive Vice President 18 118

Directors 13 339

Total ― 7 127

Note: Above number is based on number of Directors as of 30 June, 2015.