Suzuki 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements

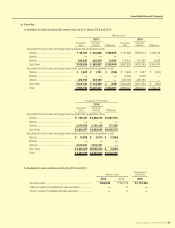

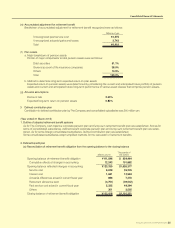

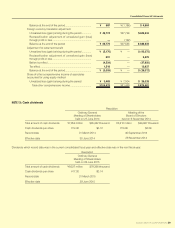

NOTE 5: Short-term debt and long-term debt

Short-term debt as of 31 March 2015 and 2014 were as follows. The annual interest rates of short-term debt as of 31 March 2015 were from 0.15

percent to 10.5 percent.

As is customary in Japan, both short-term and long-term bank loans are subject to general agreements which provide that the banks

may, under certain circumstances, request additional security for those loans, and may treat any security furnished to the banks, as well

as cash deposited with them, as security for all present and future indebtedness.

Millions of yen

Thousands of

US dollars

2015 2014 2015

Short-term loans payable and current portion of Long-term

loans payable

Unsecured ......................................................................... ¥281,950 ¥236,161 $2,346,265

Lease obligations due within one year ................................. 43 46 365

¥281,994 ¥236,207 $2,346,631

Long-term debt as of 31 March 2015 and 2014 were as follows:

Millions of yen

Thousands of

US dollars

2015 2014 2015

Long-term loans payable maturing through 2020

Secured .............................................................................. ¥ — ¥ 236 $ —

Unsecured ......................................................................... 272,717 208,930 2,269,426

Lease obligations due more than one year .......................... 49 72 408

Other interest-bearing debts (Long-ter m guarantee deposited)

13,731 13,655 114,270

¥286,497 ¥222,894 $2,384,104

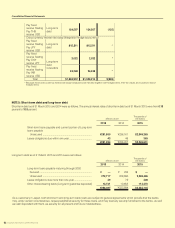

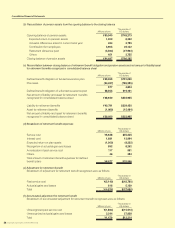

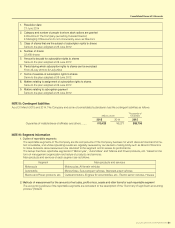

Pay xed

receive oating

Pay THB

receive USD

Long-term

debt 124,507 124,507 (135)

Cross currency interest rate swap (Integration hedge accounting)

Pay xed

receive oating

Pay JPY

receive USD

Long-term

debt 815,511 815,511 *

Pay xed

receive oating

Pay CNY

receive JPY Long-term

debt

receivable

2,022 2,022 *

Pay xed

receive oating

Pay INR

receive USD

24,248 24,248 *

Total $1,568,932 $1,528,214 $(559)

* Because these cross currency interest rate swap transactions are handled together with hedged items, their fair values are included in that of

hedged items.