Suzuki 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 7

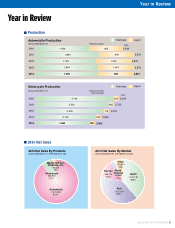

Year in Review

Overseas Markets

1. Overview of Suzuki’s Main Overseas Automobile Markets

Sales of automobiles (passenger cars and multi-utility vehicles) in India fell by 6% year-on-year to 2,504,000 units. One reason for the de-

crease was higher fuel prices brought about by a weaker rupee. Another was higher interest rates. Sales in the ve key ASEAN countries

(Indonesia, Thailand, Vietnam, the Philippines, and Malaysia) fell by 8% year-on-year to 3,364,000 units. A key reason for the decrease was

that consumers in Thailand were reluctant to buy vehicles before the government launched a tax incentive scheme. Sales in Europe (the

European Union and the European Free Trade Association) rose by 3% year-on-year to 12,593,000 units owing to signs of economic recov-

ery. Sales in China rose by 16% year-on-year to 22,491,000 units.

2. Suzuki Sales

Suzuki’s overseas automobile sales volume in scal 2013 was roughly at on the year; it slipped by 0.3% to 1,983,000 units in the midst of

uncertain market conditions. Suzuki’s sales in India rose by 0.3% year-on-year to 1,054,000 units. Despite a slowdown in the Indian econ-

omy, the Company enjoyed rm demand for compact cars including the new Celerio and the Swift. Suzuki’s sales in China declined by 8%

year-on-year to 233,000 units. The Company launched the SX4 S-CROSS in China at the end of the scal year, but overall demand for com-

pact cars was down. Suzuki’s sales in the ve key ASEAN countries (Indonesia, Thailand, Vietnam, the Philippines, and Malaysia) surged by

19% year-on-year to 225,000 units owing partly to strong sales of the Ertiga and partly to the launch in Indonesia of a model that meets the

government’s requirements for LCGC (Low-Cost Green Car) scheme. Suzuki’s sales in Europe (the European Union and the European Free

Trade Association) rose by 7% year-on-year to 160,000 units owing largely to the launch of the SX4 S-CROSS.

3. Suzuki Topics in Fiscal 2013

• In September 2013, Suzuki conducted the Indonesian launch of the WagonR, which meets the government’s requirements for LCGC (Low-

Cost Green Car) scheme.

• Also in September 2013, Suzuki launched the SX4 S-CROSS. The

rst market to receive this model was Europe.

• Suzuki announced the establishment in India of the completely

Suzuki-owned automobile production subsidiary Suzuki Motor

Gujarat. The new subsidiary will enable Suzuki to accommodate

growth in the Indian automobile market and increase exports

from the country. Production is scheduled to start in 2017.

• In February 2014, Suzuki unveiled a global model called the

Celerio. The Celerio for Thailand meets the government’s require-

ments for its eco-car project.

• Maruti Suzuki’s sales volume in India exceeded one million units

for the fourth scal year in a row. Iwata Plant

(Multi-purpose vehicle and commercial vehicle assembling)

Kosai Plant

(Passenger car and automobile engines assembling)

Sagara Plant

(Passenger car and automobile engines assembling,

foundry of engine components, machining)