Suzuki 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements

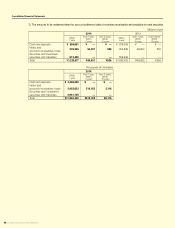

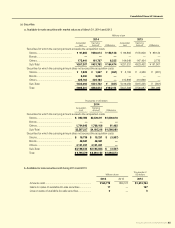

(b) Mattersforfairvaluesofthenancialinstruments

Carrying amounts in the consolidated balance sheet, fair values and difference as of March 31, 2014 and 2013 were as fol-

lows. Financial instruments whose fair value cannot be reliably determined are not included in the below table.

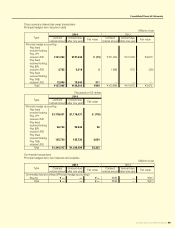

Millions of yen

2014 2013

Carrying

amount Fair value Difference Carrying

amount Fair value Difference

Cash and deposits ¥358,851 ¥358,851 ¥ — ¥279,009 ¥279,009 ¥ —

Notes and accounts receivables-trade 310,694 311,221 527 253,237 253,225 (12)

Short-term investment securities and

Investment securities

Available-for-sale securities

Investments in afliates

863,514

513 863,514

252 —

(261)738,687

513

738,687

357

—

(155)

Total of assets 1,533,573 1,533,838 265 1,271,448 1,271,279 (168)

Accounts payable-trade 433,819 433,819 —350,472 350,472 —

Short-term loans payable 197,413 197,413 —171,790 171,790 —

Current portion of long-term loans payable

38,748 38,779 (31)35,299 35,313 (14)

Accrued expenses

171,274 171,274 —155,519 155,519 —

Long-term loans payable 209,166 207,874 1,291 220,392 218,067 2,324

Total of liabilities 1,050,421 1,049,160 1,260 933,474 931,164 2,310

Derivatives

Hedge accounting is applied

Hedge accounting is not applied

51

1,160 51

1,160 —

—2,596

(1,845)

2,596

(1,845)

—

—

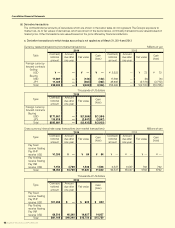

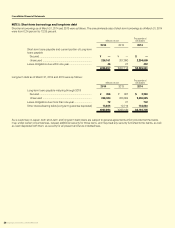

Thousands of US dollars

2014

Carrying

amount Fair value Difference

Cash and deposits $3,486,699 $3,486,699 $ —

Notes and accounts receivables-trade 3,018,792 3,023,913 5,121

Short-term investment securities and

Investment securities

Available-for-sale securities

Investments in afliates

8,390,152

4,989 8,390,152

2,448 —

(2,541)

Total of assets 14,900,634 14,903,215 2,580

Accounts payable-trade 4,215,115 4,215,115 —

Short-term loans payable 1,918,122 1,918,122 —

Current portion of long-term loans payable

376,487 376,791 (304)

Accrued expenses

1,664,151 1,664,151 —

Long-term loans payable 2,032,319 2,019,765 12,553

Total of liabilities 10,206,195 10,193,946 12,249

Derivatives

Hedge accounting is applied

Hedge accounting is not applied

504

11,280 504

11,280 —

—

(*): Assets or liabilities derived from derivatives are shown on a net basis and net liabilities are shown as ( ).