Suzuki 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements

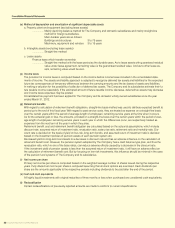

(o) Methodofdepreciationandamortizationofsignicantdepreciableassets

a. Property, plant and equipment (excluding lease assets)

................. Mainly declining balance method for The Company and domestic subsidiaries and mainly straight-line

method for foreign subsidiaries.

Main durable years are as follows:

Buildings and structures 3 to 75 years

Machinery, equipment and vehicles 3 to 15 years

b. Intangible assets (excluding lease assets)

................. Straight-line method

c. Lease assets

Finance lease which transfer ownership

................. Straight-line method with the lease period as the durable years. As to lease assets with guaranteed residual

value under lease agreement, remaining value is the guaranteed residual value. And as to other lease as-

sets, remaining value would be zero.

(p) Income taxes

The provision for income taxes is computed based on the income before income taxes included in the consolidated state-

ments of income. The assets and liability approach is adopted to recognize deferred tax assets and liabilities for the expected

future tax consequences of temporary differences between the carrying amounts and the tax bases of assets and liabilities.

In making a valuation for the possibility of collection of deferred tax assets, The Company and its subsidiaries estimate their fu-

ture taxable income reasonably. If the estimated amount of future taxable income decrease, deferred tax assets may decrease

and income taxes expenses may be posted.

Consolidated tax payment has been applied to The Company and its domestic wholly owned subsidiaries since the year

ended March 31, 2012.

(q) Retirementbenets

With regard to calculation of retirement benet obligations, straight-line basis method was used to attribute expected benet to

period up to the end of this scal year. With regard to past service costs, they are treated as expense on a straight-line basis

over the certain years within the period of average length of employees’ remaining service years at the time when it occurs.

As for the actuarial gain or loss, the amounts, prorated on a straight-line basis over the certain years within the period of aver-

age length of employees’ remaining service years in each year in which the differences occur, are respectively treated as

expenses from the next term of the year in which they arise.

Retirement benet cost and retirement benet obligation are calculated based on the actuarial assumptions, which include

discount rate, assumed return of investment ratio, revaluation ratio, salary rise ratio, retirement ratio and mortality ratio. Dis-

count rate is decided on the basis of yield on low-risk, long-term bonds, and assumed return of investment ratio is decided

based on the investment policies of pension assets of each pension system etc.

Decreased yield on long-term bond leads to a decrease in discount rate and has an adverse inuence on the calculation of

retirement benet cost. However, the pension system adopted by The Company has a cash balance type plan, and thus the

revaluation ratio, which is one of the base ratios, can reduce adverse effects caused by a decrease in the discount rate.

If the investment yield of pension assets is less than the assumed return of investment ratio, it will have an adverse effect on

the calculation of retirement benet cost. But by focusing on low-risk investments, this inuence should be minimal in the case

of the pension fund systems of The Company and its subsidiaries.

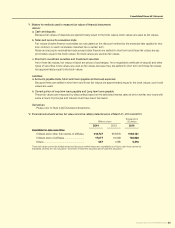

(r) Net income per share

Primary net income per share is computed based on the weighted average number of shares issued during the respective

years. Fully diluted net income per share is computed assuming that all stock options are exercised. Cash dividends per

share are the amounts applicable to the respective periods including dividends to be paid after the end of the period.

(s) Cash and cash equivalents

All highly liquid investments with original maturities of three months or less when purchased are considered cash equivalents.

(t) Reclassication

Certain reclassications of previously reported amounts are made to conform to current classications.