Suzuki 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 SUZUKI MOTOR CORPORATION

A Message from the Management

Management results of this scal year

The management environment of the Group for FY2013 in over-

seas economy mainly in developed countries is showing positive

trend toward recovery, despite inuence by tapering of monetary

easing in the US, nancial problem in Europe and unpredictable

economic outlook for emerging countries such as India and Indo-

nesia. Japanese economy also continues to be on recovery trend.

On the other hand, there is a concern about the impact of recoil

reduction of last-minute demand due to increase in consumption

tax rate.

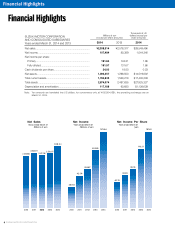

Under these circumstances, the consolidated net sales of this

scal year (April 2013 to March 2014) increased by ¥360.0 billion

(14.0%) to ¥2,938.3 billion compared to the previous scal year,

owing to increase in Japan, Asia, and Europe. The Japanese do-

mestic net sales increased by ¥91.8 billion (8.8%) to ¥1,132.7 bil-

lion year-on-year, by covering the decrease in OEM sales with the

sales of Suzuki brand vehicles. The overseas net sales increased

by ¥268.2 billion (17.4%) to ¥1,805.6 billion year-on-year.

In terms of the consolidated income, the operating income in-

creased by ¥43.1 billion (29.9%) to ¥187.7 billion year-on-year,

and the net income increased by ¥27.1 billion (33.7%) to ¥107.5

billion year-on-year. The operating income increased mainly ow-

ing to improvement in export prot from Japan by the impact of

the exchange rate and increase in income in Asia.

The Company has decided to distribute year-end dividends

amounting to ¥14.00 per share for this fiscal year (¥10.00 per

share for the previous scal year). As a result, the annual divi-

dends including interim dividends were ¥24.00 per share and up

by ¥6.00 per share from the previous scal year.

Outstanding issues

The Group set a basic policy of “Think smarter, work harder and

unite as a Suzuki group; overcome our challenges and navigate

our way to a brighter future” and will tackle following issues amid

challenging condition.

-Strengthening and expansion of sales network

To respond to intensifying competition at various regions and

products, the Group will be expanding and strengthening its sales

network both in Japan and overseas, and execute marketing ac-

tivities in a close contact with the market.

-Product development and strengthening of research and devel-

opment

The Group will make eort to strengthen its ability of research

and development such as environment technology, fuel ecient

technology, weight reduction technology, safety technology, infor-

mation and communications technology and product designing

ability. Also, the Group will make eort to manufacture cars with

lower cost by improving eciency of development by integrating

engine, powertrain and platform, and cost reduction.

-Strengthening of manufacturing capability

Based on the concept of “local production for local consump-

tion,” the Group will continue to strengthen manufacturing out-

side Japan. Especially in Asia, which has a growing demand for

automobiles, the Group will strive to increase the ratio of in-

house manufacturing, expand global procurement and enhance

production capability at respective local markets. Moreover, along

with the advancement of economic cooperation among dierent

regions through FTA and the trend of the foreign currency market,

the Group will also work to optimize the balance of manufacturing

activities in and outside Japan.

-Reconstruction of motorcycle business

As for the Motorcycle business, although business as a whole

slightly turned into the black mainly owing to improvement in

income of large-displacement motorcycles, compact motorcycle

business mainly in Asia is still in the middle of reform. The Group

will continuously be aiming at recovering its presence in the

motorcycle market by uniting the planning, technology and sales

functions and by developing new products that suit the market

needs further. The Group will particularly be focusing on compact

motorcycle business in Asia where growth potential is high, and at

the same time, the Group will also be strengthening its lineup of

middle and large-sized motorcycles

-Commitment to global environmental problem

Concerning the environmental issues, the Group has been oer-

ing minivehicles in Japan and many types of compact vehicles

that are highly fuel-ecient in places like India and other Asian

countries. The Group believes that a spread of such compact ve-

hicles would be one of the best ways to contribute to solving the

environmental issues. In addition to enhancement of next genera-

tion environmental technology in “SUZUKI GREEN Technology”, the

Group will continue to tackle global environmental problem based

on “Suzuki Environmental Plan 2015” and “Suzuki Biodiversity

Protection Guideline”.

A Message from the Management