Suzuki 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 9

Year in Review

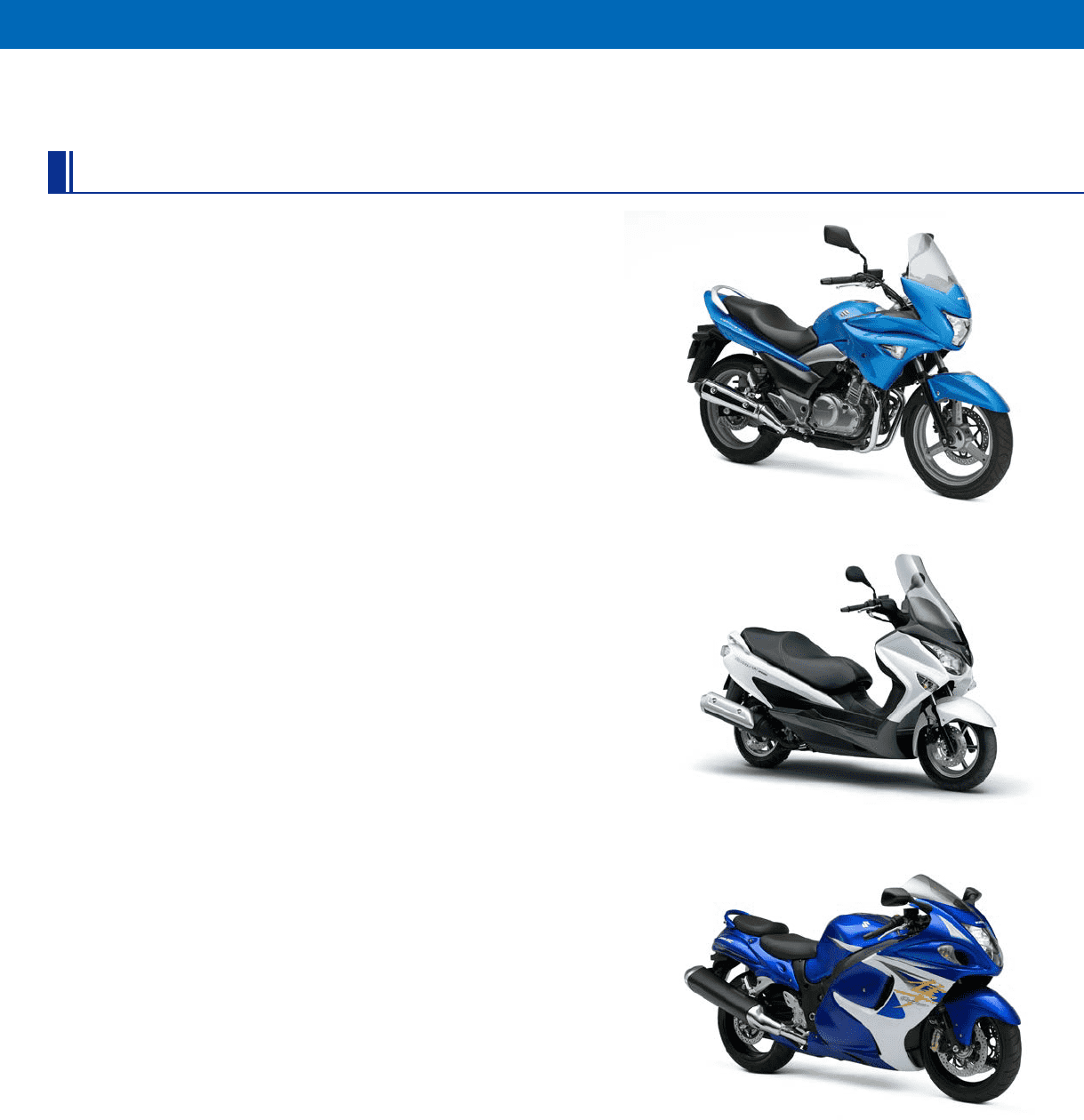

Half-faired GSR250S

Light, compact scooter BURGMAN 200

Japan-specication Hayabusa

Motorcycles

Suzuki’s Worldwide Manufacturing and Sales

Total overseas motorcycle production (including ATVs) in scal 2013 decreased to 1,882,000

units, 89.6% compared to the previous scal year. Worldwide production, including production in

Japan, also decreased to 2,063,000 units, 90.9% compared to the previous scal year.

Sales of motorcycles (including ATVs) in overseas market decreased to 1,953,000 units, 87.4%

compared to the previous scal year, while total global sales, including Japan, also decreased to

2,027,000 units, 87.7% compared to the previous scal year.

Operating Results by Segment

In the motorcycle business, the operating loss of ¥11.9 billion in the previous fis-

cal year became an operating income of ¥100 million, slightly turning into the black

for the rst time in six scal years, mainly owing to improvement in income of large-

displacement motorcycles.

The Japanese Market

1. Overview of Japanese Motorcycle Market

The total domestic motorcycle sales (factory shipments) of the four Japanese manufac-

turers in scal 2013 rose by 9% year-on-year to 438,000 units owing partly to a rush to

buy motorcycles ahead of a hike in the rate of consumption tax. Sales of models with

engine displacements of 126cm3 and higher were up 33% year-on-year at 90,000 units.

Sales of models with engine displacements up to 125cm3 were up 4% year-on-year at

348,000 units. The domestic motorcycle market began shrinking after the nancial crisis

of 2008, but sales of models with engine displacements of 126cm3 and higher are now

trending upward; they have grown for three years in a row.

2. Suzuki Sales

Suzuki’s domestic sales (factory shipments) of models with engine displacements of

126cm3 and higher surged by 35% year-on-year to 13,000 units owing partly to new

products including the GSR250S, the Burgman 200, and the Japan-specication Hayabu-

sa. Sales of models with engine displacements up to 125cm3 declined by 6% year-on-

year to 59,000 units owing partly to inventory adjustments that involved a reduction in

shipments. Total sales were roughly at on the year; they were down 1% at 72,000 units.

Suzuki’s sales of models with engine displacements of 126cm3 and higher have reected

the market trend by growing for three years in a row. The Company plans to treat these

highly protable models as the focus of its sales-promotion eorts.

3. Suzuki Topics in Fiscal 2013

• In January 2014, Suzuki launched the half-faired GSR250S to complement the

GSR250, an on-road sportbike that has been popular since its launch in July 2012

owing to its bold styling and rider-friendly engine.

• Suzuki launched the Burgman 200, a light, compact scooter with superior accelera-

tion, in February 2014. The Company had already launched this model overseas.

• Suzuki launched the Japan-specication Hayabusa in February 2014. This motorcycle

satises Japanese regulations while delivering the same maximum output and torque

as the European version. It is the rst motorcycle in Japan to have a transponder for

electronic toll collection as standard equipment*.

* Based on Suzuki research in January 2014.