Suzuki 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 55

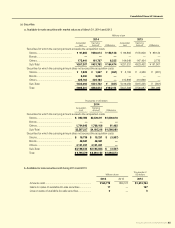

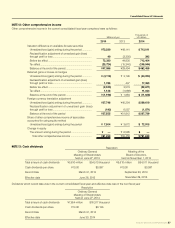

NOTE 8: Income taxes

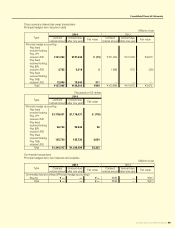

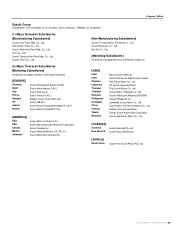

Breakdown of deferred tax assets and deferred tax liabilities by their main occurrence causes were as follows:

Millions of yen

Thousands of

US dollars

2014 2013 2014

Deferred tax assets

Excess-depreciation and Impairment loss ....................... ¥ 59,105 ¥ 68,083 $ 574,283

Various reserves ................................................................. 39,548 41,433 384,268

Unrealized prots elimination ............................................ 20,876 18,725 202,839

Loss on valuation of securities .......................................... 12,254 12,648 119,071

Deferred assets and others ............................................... 3,367 3,154 32,723

Others ................................................................................. 82,757 76,845 804,095

Gross deferred tax assets total ....................................... 217,910 220,892 2,117,283

Valuation allowance ........................................................... (54,930)(48,183)(533,715)

Deferred tax assets total ................................................. ¥162,980 ¥172,708 $1,583,567

Deferred tax liabilities

Valuation difference on available-for-sale securities ........ ¥(56,219)¥ (30,468)$(546,247)

Variance from the complete market value method of

consolidated subsidiaries ................................................. (5,243)(5,167)(50,948)

Reserve for advanced depreciation of noncurrent assets

... (3,603)(3,555)(35,012)

Others ................................................................................. (2,071)(4,140)(20,131)

Deferred tax liabilities total .............................................. (67,138)(43,332)(652,340)

Net amounts of deferred tax assets .................................. ¥ 95,841 ¥129,376 $ 931,226

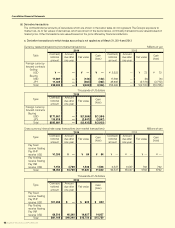

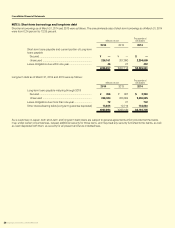

The differences between the statutory tax rate and the effective tax rate were summarized as follows:

2014 2013

Statutory tax rate .................................................................... 37.2% 37.2%

Effect of change of tax rate ............................................... 3.1% 2.7%

Tax credit ............................................................................ (3.3%) (5.9%)

Tax rate difference (consolidated overseas subsidiaries) (2.0%) —%

Others ................................................................................. 0.3% 0.7%

Effective tax rate .................................................................... 35.3% 34.7%