Suzuki 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

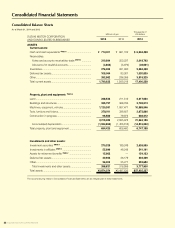

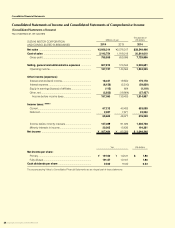

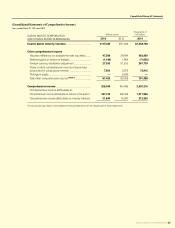

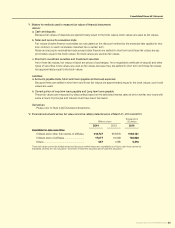

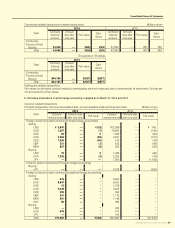

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 37

Consolidated Statements of Cash Flows

Years ended March 31, 2014 and 2013

SUZUKI MOTOR CORPORATION

AND CONSOLIDATED SUBSIDIARIES

Millions of yen

Thousands of

US dollars

2014 2013 2014

Cashowsfromoperatingactivities

Income before income taxes ............................................. ¥197,090 ¥139,403 $1,914,987

Depreciation and amortization .......................................... 117,188 93,680 1,138,639

Impairment loss ................................................................. 1,029 458 10,000

Increase (decrease) in provision for loss on liquidation of

subsidiaries and afliates .................................................. (5,521)5,521 (53,648)

Increase (decrease) in allowance for doubtful accounts (699)44 (6,798)

Interest and dividends income .......................................... (18,441)(19,550)(179,178)

Interest expenses .............................................................. 6,158 5,510 59,839

Foreign exchange losses (gains) ...................................... 6,718 670 65,278

Equity in (ear nings) losses of afliates .............................. 115 (664)1,119

Loss (gain) on valuation of securities ............................... 44 3,849 428

Loss (gain) on sales of investment securities ................... (17)—(167)

Loss (gain) on sales of property, plant and equipment ... (290)200 (2,823)

Decrease (increase) in notes and accounts receivable-trade

(49,559)10,247 (481,530)

Decrease (increase) in inventories ................................... (10)(3,029)(101)

Increase (decrease) in notes and accounts payable-trade

72,664 (8,142)706,030

Increase (decrease) in accrued expenses ...................... 12,680 11,608 123,207

Other, net ............................................................................ 12,621 (30,049)122,633

Subtotal 351,772 209,759 3,417,917

Interest and dividends income received .......................... 18,999 19,466 184,601

Interest expenses paid ...................................................... (5,646)(5,211)(54,861)

Income taxes paid ............................................................. (42,209)(33,957)(410,119)

Net cash provided by (used in) operating activities 322,915 190,057 3,137,537

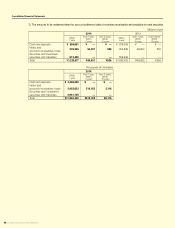

Cashowsfrominvestingactivities

Payments into time deposits ............................................. (77,477)(32,908)(752,797)

Proceeds from withdrawal of time deposits...................... 38,842 41,603 377,409

Purchases of short-term investment securities ................ (209,912)(113,726)(2,039,567)

Proceeds from sales of short-term investment securities

165,156 64,127 1,604,705

Purchases of property, plant and equipment ................... (204,739)(163,929)(1,989,302)

Proceeds from sales of property, plant and equipment ... 4,421 3,505 42,956

Purchases of investment securities .................................. (2,712)(4,002)(26,356)

Proceeds from sales of investment securities .................. 623 —6,059

Payments of loans receivable ........................................... (1,086)(436)(10,556)

Collection of loans receivable ........................................... 555 673 5,392

Other, net ............................................................................ (230)(5,465)(2,235)

Net cash provided by (used in) investing activities (286,559)(210,559)(2,784,292)

Cashowsfromnancingactivities

Net increase (decrease) in short-term loans payable ...... 24,691 (8,603)239,907

Proceeds from long-term loans payable .......................... 30,000 190,482 291,488

Repayment of long-term loans payable ........................... (38,488)(54,708)(373,966)

Redemption of bonds ........................................................ —(149,975)—

Purchase of treasury stock ................................................ (5)(5)(54)

Cash dividends paid ......................................................... (11,219)(8,975)(109,012)

Cash dividends paid to minority shareholders ................. (2,133)(1,814)(20,727)

Other, net ............................................................................ (35)(32)(340)

Net cash provided by (used in) nancing activities 2,809 (33,632)27,295

Effect of exchange rate changes on cash and cash equivalents

10,342 4,706 100,495

Net increase (decrease) in cash and cash equivalents 49,508 (49,427)481,035

Cash and cash equivalents at beginning of period 661,102 710,530 6,423,463

Cash and cash equivalents at end of period *NOTE 10 ¥710,611 ¥661,102 $6,904,498

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.