Suzuki 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 SUZUKI MOTOR CORPORATION

Management Policy

(b) Compliance system for employees

In order to ensure that employees execute their duties in compliance with the law and the Articles of Incorporation of The Com-

pany, The Company is making eort to keep everyone informed about the “Suzuki Employees’ Activity Charter” which lays out the

norms of action of employees, the “Approval Procedures” and the “Job Description” which set up the proceedings of execution

of their duties in details, and other rules of The Company. They are revised whenever necessary. Furthermore, in accordance with

the “Suzuki Rules of Corporate Ethics”, The Company has developed compliance system for employees including internal report

system, and has been educating them through various training and in-house seminars regarding compliance. And, in accordance

with the “Rule of Internal Auditing”, the audit department audits on the correctness of various control systems, organizations and

rules, and properness of function of internal control, etc.

(c) Crisis management system

“Crisis Management Procedures” are laid down within the “Suzuki Rules of Corporate Ethics” as a countermeasure to crisis that

may occur from illegalities and injustices inside/outside The Company, or natural disasters or terrorism, which are impossible for

The Company to prevent. When the “Corporate Ethics Committee” nds risks that may cause urgent and serious damages to the

corporate management and business operations, the committee immediately sets up a “Crisis Management Task Force” in line

with the “Crisis Management Procedures” in order to deal with the crisis. This organization swiftly disuccsses and decides on the

policies and measures to be taken against the risk occurred and gives instructions to the appropriate departments and divisions

which are then able to communicate each other to solve the problem.

(d) System to ensure proper business operation of the corporate group

To ensure a proper business operation of the corporate group which consists of The Company and its subsidiaries, The Company

has established the “Rules of Business Control Supervision”. It is revised whenever necessary. The subsidiaries report to The

Company on their business operation and consult with The Company on important matters in accordance with those rules, and

departments in charge give guidance and advice to them to enhance their management structure. And our audit department

helps to make rules for the subsidiaries, conducts guidance, supporting and auditing for their regulatory compliance. It also pro-

motes eciency and standardization of their business.

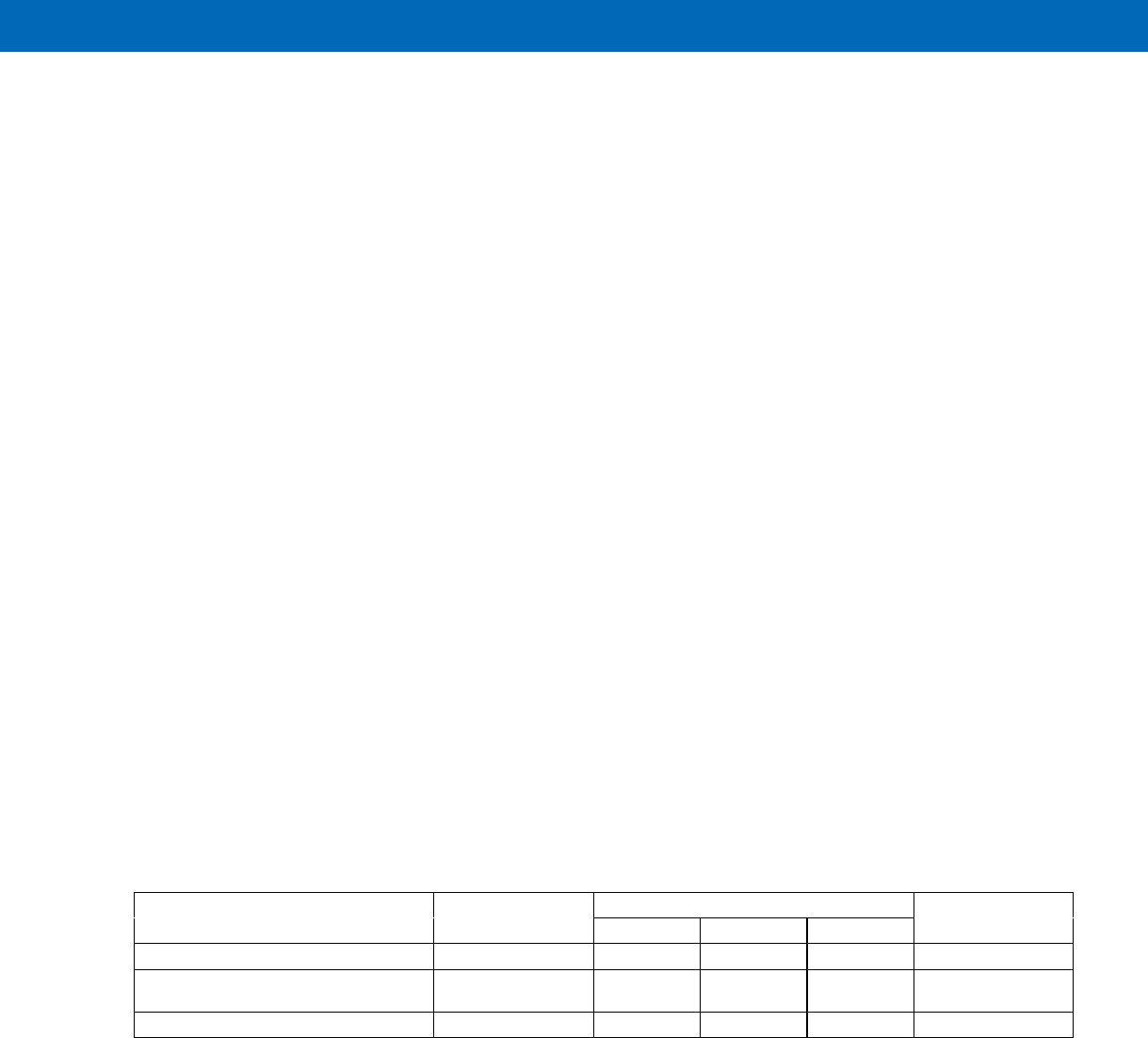

(4) Remuneration for Directors and Company Auditors for current scal year

(a) Remuneration paid to Directors and Company Auditors is as follows:

(Amount of remuneration: million yen, Number of payees: person)

Classication Total amount of

remuneration

Amount of each type of remuneration Number of payees

Basic pay Stock option Bonus

Directors (excluding Outside Directors) 576 305 85 185 10

Company Auditors

(excluding Outside Company Auditors) 57 40 - 16 2

Outside Directors/Company Auditors 29 22 - 7 5

Notes: 1. The amount of remuneration limit for Directors (¥80 million per month) was resolved at the 135th Ordinary General Meeting of Share-

holders held on June 28, 2001.

2. The amount of remuneration limit for Company Auditors (¥8 million per month) was resolved at the 123rd Ordinary General Meeting of

Shareholders held on June 29, 1989.

3. The maximum amount of remuneration for Directors for stock options as compensation (¥170 million per year) was resolved at the 146th

Ordinary General Meeting of Shareholders held on June 28, 2012 and 147th Ordinary General Meeting of Shareholders held on June 27, 2013.

4. The above-mentioned Stock option are recorded as stock options as compensation in current scal year as expenses.

5. The above-mentioned bonuses are recorded as provision for Directors' bonuses at the end of current scal year and treated as ex-

penses of current scal year.

6. The above includes 3 Directors who retired at the end of the 147th Ordinary General Meeting of Shareholders held on June 27, 2013.

7. In addition to the above, ¥47 million was paid to 2 retired Directors as retirement benets for Directors under the resolution at the

140th Ordinary General Meeting of Shareholders held on June 29, 2006.

8. The following information is disclosed in 148th annual securities report

• Total amount of consolidated remuneration paid to persons who received consolidated remuneration of ¥100 million or more each.