Suzuki 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 47

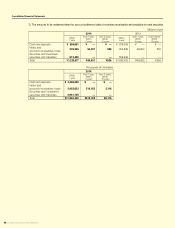

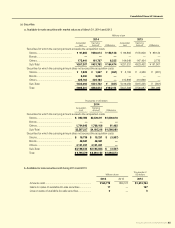

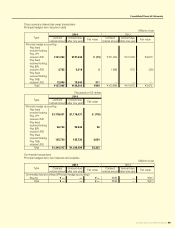

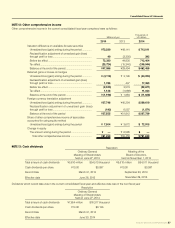

Commodity-related transactions (market transactions) Millions of yen

Type

2014 2013

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Commodity

Futures contract

Buying ¥4,545 —¥(55)¥(55)¥7,592 —¥97 ¥97

Total ¥4,545 —¥(55)¥(55)¥7,592 —¥97 ¥97

Thousands of US dollars

Type

2014

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Commodity

Futures contract

Buying $44,164 —$(537)$(537)

Total $44,164 —$(537)$(537)

Earthquake-related transactions

Fair values for derivative contract relating to earthquakes were not measured due to characteristic of instruments. So they are

not accounted for at fair values.

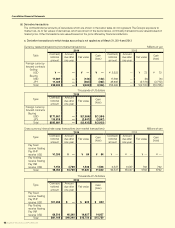

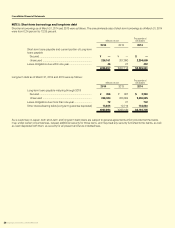

b. Derivative transactions to which hedge accounting is applied as of March 31, 2014 and 2013

Currency related transactions

Principle hedged item: Account receivable-trade, account payable-trade and long-term debt Millions of yen

Type

2014 2013

Contract/

notional amount

Amount due

after one year Fair value

Contract/

notional amount

Amount due

after one year Fair value

Foreign currency forward contracts (Principle hedge accounting)

Selling

USD ¥ 3,847 —¥ (35)¥22,369 —¥ 745

EUR 1,367 —(7)18,902 —(130)

CAD 80 — 0 1,583 —(30)

AUD 3,265 —(95)2,941 —(151)

NZD 1,256 —(40)515 —(14)

GBP 221 —(1)522 —(49)

MXN 827 —(6)832 —(25)

Buying

USD 70 — 2 1,498 —(46)

EUR 7,225 —(3)2,304 —(19)

JPY ———7,200 —(1,158)

Currency option transactions (Principle hedge accounting)

Buying

JPY ———2,578 —(356)

Foreign currency forward contracts (Exceptional hedge accounting)

Selling

USD 616 — * 5,654 — *

EUR 8,947 — * 6,831 — *

CAD 15 — * 1,279 — *

AUD 2,039 — * 3,455 — *

NZD 350 — * 563 — *

GBP 301 — * 1,173 — *

MXN 691 — * 1,149 — *

CNY 56 — * 295 — *

Buying

USD — — * 383 — *

EUR 679 — * 477 — *

JPY — — * 412 — *

Total ¥31,862 —¥(188)¥82,925 —¥(1,237)