Suzuki 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements

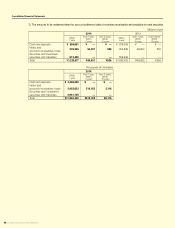

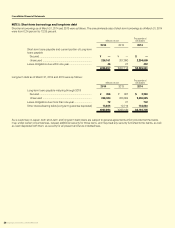

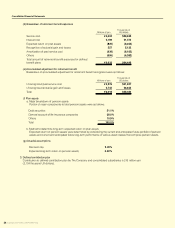

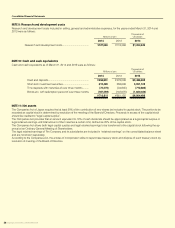

(d)Breakdownofretirementbenetexpenses

Millions of yen

Thousands of

US dollars

Service cost ¥6,024 $58,538

Interest cost 2,199 21,373

Expected return on plan assets (825)(8,022)

Recognition of actuarial gain and losses 527 5,122

Amortization of past service cost (636)(6,182)

Others (656)(6,382)

Total amount of retirement benet expenses for dened

benet plans ¥6,633 $64,448

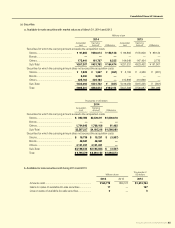

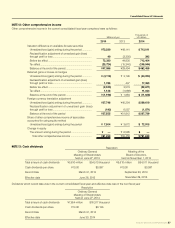

(e)Accumulatedadjustmentforretirementbenet

Breakdown of accumulated adjustment for retirement benet recognized were as follows:

Millions of yen

Thousands of

US dollars

Unrecognized past service cost ¥3,276 $31,837

Unrecognized actuarial gain and losses 2,742 26,642

Total ¥6,018 $58,480

(f) Plan assets

a. Major breakdown of pension assets

Portion of major components to total pension assets were as follows:

Debt securities 51.1%

General account of life insurance companies 38.0%

Others 10.9%

Total 100.0%

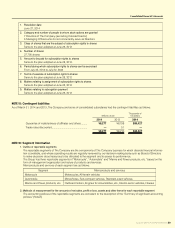

b. Method to determine long-term expected return on plan assets

Expected return on pension assets were determined by considering the current and anticipated future portfolio of pension

assets and current and anticipated future long-term performance of various asset classes that comprise pension assets.

(g) Actuarial assumptions

Discount rate 2.00%

Expected long-term return on pension assets 0.82%

3.Denedcontributionplan

Contribution to dened contribution plan by The Company and consolidated subsidiaries is 216 million yen

(2,104 thousand US dollars).