Square Enix 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

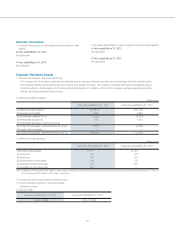

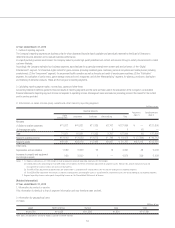

Matters Relating to Real Estate Leases, Etc.

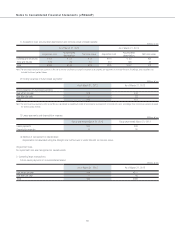

■ Year ended March 31, 2013

Not applicable

■ Year ended March 31, 2012

Not applicable

Segment Information

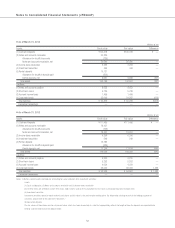

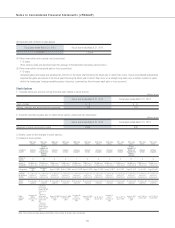

[Consolidated Business Segment Information]

[Segment Information]

■ Year ended March 31, 2013

1. Outline of reporting segments

The Company’s reporting segments are business units for which abstracted financial data is available and periodically reviewed by the Board of Directors to

determine resource allocation and to evaluate business performance.

In a rapidly evolving business environment, the Company seeks to provide high-quality entertainment content and services through a variety of environment to match

customer lifestyles.

Accordingly, the Company maintains four business segments, each dedicated to a particular entertainment content and service format: (1) the “Digital

Entertainment” segment, for interactive digital content for game consoles (including handheld game machines), personal computers and mobile phones (including

smartphones); (2) the “Amusement” segment, for amusement facility operation as well as the sale and rental of arcade game machines; (3) the “Publication”

segment, for publication of comic books, game strategy books and comic magazines; and (4) the “Merchandising” segment, for planning, production, distribution

and licensing of derivative products. These are the Company’s reporting segments.

2. Calculating reporting segment sales, income (loss), assets and other items

Accounting treatment methods applied to financial results of reporting segments are the same as those used in the preparation of the Company’s consolidated

financial statements. Reporting segment income corresponds to operating income. Intersegment sales are based on prevailing prices in the market for the content

and/or services provided.

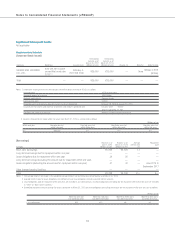

3. Information on sales, income (loss), assets and other items by reporting segment

Millions of yen

Reporting Segments Adjustment

(Note 1)

Consolidated total

(Note 2)

Digital

Entertainment Amusement Publication Merchandising Total

Net sales

(1) Sales to outside customers ¥89,482 ¥44,276 ¥11,086 ¥3,137 ¥147,981 ¥ — ¥147,981

(2) Intersegment sales 0 — 0 127 127 (127) —

Total 89,482 44,276 11,086 3,264 148,109 (127) 147,981

Segment operating income ¥ 44 ¥ (353) ¥ 2,484 ¥ 667 ¥ 2,842 ¥ (8,924) ¥ (6,081)

Segment assets ¥57,927 ¥19,192 ¥ 5,337 ¥3,065 ¥ 85,522 ¥116,986 ¥202,509

Other items

Depreciation and amortization 2,235 4,384 88 23 6,730 570 7,301

Increases in property and equipment

and intangible assets 3,339 4,934 199 84 8,558 3,950 12,508

Notes: 1. (1) Segment adjustments (¥8,924 million) include unallocated corporate operating expenses (¥8,965 million).

(2) Unallocated assets amounting to ¥116,986 million are included in the ¥117,043 million adjustment to segment assets. Most of this amount comprises funds for

management of surplus funds (cash and cash equivalents).

(3) The ¥570 million adjustment to depreciation and amortization is associated with unallocated assets that do not belong to any reporting segment.

(4) The ¥3,950 million adjustment to increases in property and equipment and intangible assets is associated with unallocated assets that do not belong to any reporting segment.

2. Segment operating income corresponds to operating income on the Consolidated Statements of Income.

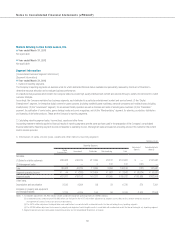

Notes to Consolidated Financial Statements (JPNGAAP)