Square Enix 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

& supervisory board members are determined through

consultations among the audit & supervisory board

members within the scope of the total remuneration amount

approved by a General Meeting of Shareholders.

(5) Matters relating to the Company’s holdings of

shares

Matters relating to shares held by the Company, which has

the largest balance-sheet value of investments in shares

within the Square Enix Group, are as follows:

(i) Number of companies in which shares are held and the

total amount presented on the balance sheets for

investments in shares for purposes other than purely

investment purposes:

There are no applicable items.

(ii) Companies in which shares are held, investment category,

number of shares, amount presented on the balance

sheets and investment purpose for investments in shares

for purposes other than purely investment purposes:

There are no applicable items.

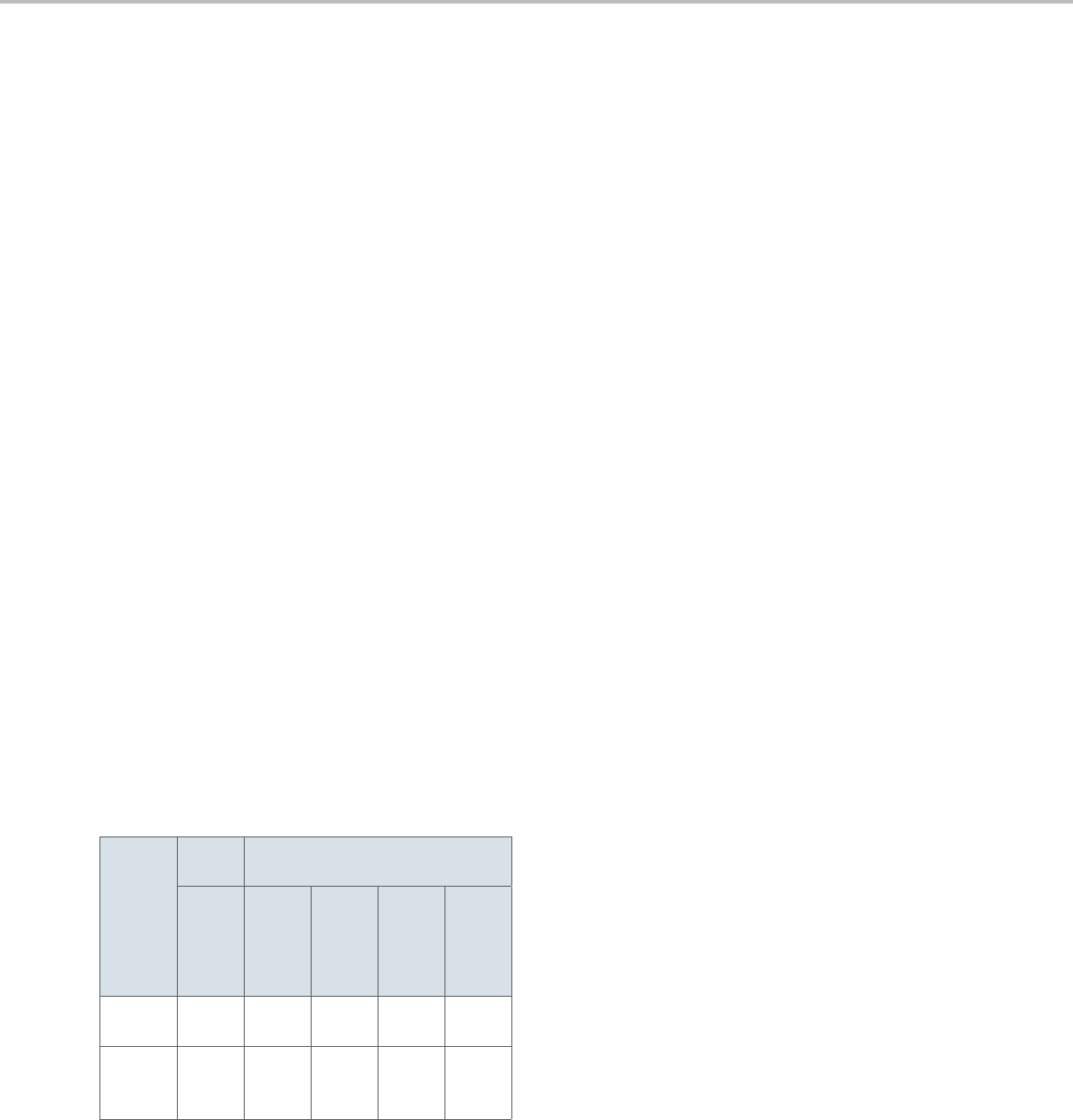

(iii) Total amount presented on balance sheets for the fiscal

years ended March 31, 2012 and March 31, 2013; and

total dividends received, total gain on sale of shares and

total loss on revaluation of shares for the fiscal year

ended March 31, 2013 for investments in shares for

purely investment purposes:

Millions of yen

Category

Previous fiscal

year Fiscal year ended March 31, 2013

Total amount

presented on

balance

sheets

Total amount

presented on

balance

sheets

Total

dividends

received

Total gain on

sale of shares

Total loss on

revaluation of

shares

Unlisted

shares 31 30 2 8 (Note 1)

(—)*

Shares

other than

those

above

484 371 4 — 63

(0)*

Notes: 1. Owing to unlisted shares having no market price and recognizing the

extreme difficulty in determining fair value, gain or loss on revaluation of

unlisted shares is not presented in the table above.

2. Figures denoted with an asterisk under “Total loss on revaluation of

shares” indicate impairment losses for the fiscal year under review.

(iv) Companies in which shares are held, number of shares,

amount presented on the balance sheets for investments

in shares for which the purpose of investment has

changed from “purely investment purposes” to “purposes

other than purely investment purposes”:

There are no applicable items.

(v) Companies in which shares are held, number of shares,

amount presented on the balance sheets for investments

in shares for which the purpose of investment has changed

from “purposes other than purely investment purposes”

to “purely investment purposes”:

There are no applicable items.

(6) Names of certified public accountants (CPAs) and

name of statutory audit firm that conducted audits

of the Company

The Company retains Ernst & Young ShinNihon as its

statutory audit firm pursuant to the Companies Act and the

Financial Instruments and Exchange Law to perform

independent third-party accounting audits. The Company

cooperates fully with the statutory audit firm to ensure its

smooth performance of duties.

The following CPAs conducted audits of the Company

during the fiscal year ended March 31, 2013.

• CPAs performing audits:

Limited-liability partners: Takashi Nagasaka, Tatsuya

Yokouchi and Hiroyoshi Kaneno

• Personnel providing audit assistance:

12 CPAs, 7 assistant CPAs

(7) Overview of liability limitation agreements

The Company has liability limitation agreements in place with

its outside director and audit & supervisory board members

(external) in accordance with Article 427, Paragraph 1, of

the Companies Act to limit liabilities provided under Article

423, Paragraph 1, of the Companies Act. These agreements

limit the liability of the outside director and each audit &

supervisory board member (external) to ¥10 million or the

legally specified amount, whichever is greater, on condition

that the director or audit & supervisory board members have

performed their duties in good faith and without gross

negligence.

23