Square Enix 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

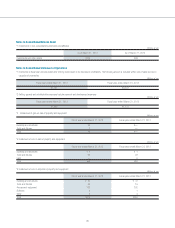

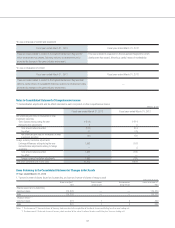

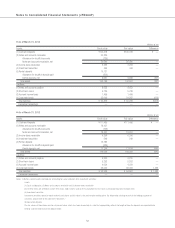

1) Acquisition cost, accumulated depreciation and net book value of leased assets: Millions of yen

As of March 31, 2013 As of March 31, 2012

Acquisition cost Accumulated

depreciation Net book value Acquisition cost Accumulated

depreciation Net book value

Buildings and structures ¥ 62 ¥ 53 ¥ 8 ¥114 ¥ 83 ¥30

Tools and fixtures 103 92 10 210 168 42

Total ¥165 ¥146 ¥19 ¥325 ¥252 ¥73

Note: The total amount of future lease payments at the end of the year constituted an insignificant portion of net property and equipment at the end of the year. Accordingly, total acquisition cost

included the interest portion thereon.

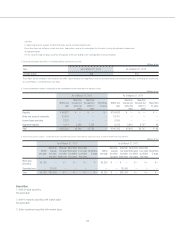

2) Ending balances of future lease payments:

Millions of yen

As of March 31, 2013 As of March 31, 2012

Ending balances of future lease payments

Due within one year ¥19 ¥49

Due after one year — 23

Total ¥19 ¥73

Note: The total future lease payments at the end of the year constituted an insignificant portion of total property and equipment at the end of the year. Accordingly, total future lease payments included

the interest portion thereon.

3) Lease payments and depreciation expense: Millions of yen

Fiscal year ended March 31, 2013 Fiscal year ended March 31, 2012

Lease payments ¥50 ¥95

Depreciation expense 50 95

4) Method of calculation for depreciation:

Depreciation is calculated using the straight-line method over a useful life with no residual value.

(Impairment loss)

No impairment loss was recognized on leased assets.

2. Operating lease transactions

Future lease payments on noncancellable leases:

Millions of yen

As of March 31, 2013 As of March 31, 2012

Due within one year ¥44 ¥251

Due after one year — 46

Total ¥44 ¥298

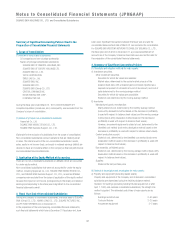

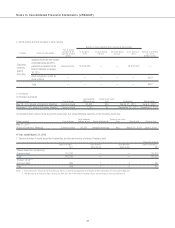

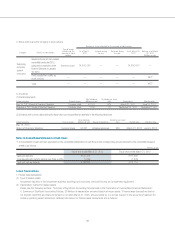

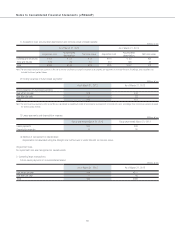

Notes to Consolidated Financial Statements (JPNGAAP)