Square Enix 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

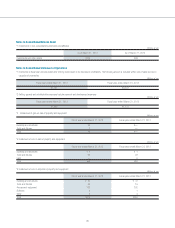

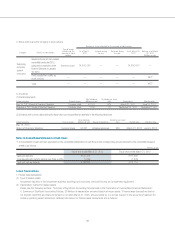

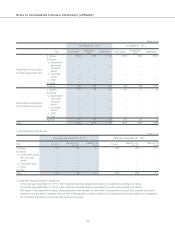

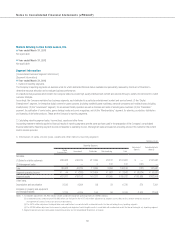

■ As of March 31, 2013

Millions of yen

Assets: Book value Fair value Difference

(1) Cash and deposits ¥100,418 ¥100,418 ¥ —

(2) Notes and accounts receivable 30,226

Allowance for doubtful accounts (135)

Notes and accounts receivable, net 30,090 30,090 —

(3) Income taxes receivable 2,223 2,223 —

(4) Investment securities 444 444 —

(5) Rental deposits 10,121

Allowance for doubtful deposits paid (500)

Rental deposits, net 9,621 9,383 (237)

Total assets 142,799 142,561 (237)

Liabilities:

(1) Notes and accounts payable 8,653 8,653 —

(2) Short-term loans 5,726 5,726 —

(3) Accrued income taxes 1,499 1,499 —

(4) Corporate bonds 35,000 34,387 (612)

Total liabilities ¥ 50,879 ¥ 50,266 ¥(612)

Derivative transactions — — —

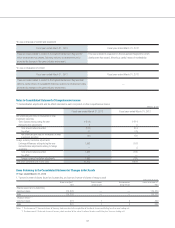

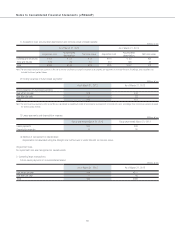

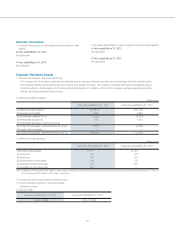

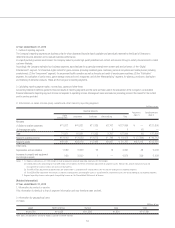

■ As of March 31, 2012

Millions of yen

Assets: Book value Fair value Difference

(1) Cash and deposits ¥111,495 ¥111,495 ¥ —

(2) Notes and accounts receivable 18,431

Allowance for doubtful accounts (123)

Notes and accounts receivable, net 18,307 18,307 —

(3) Income taxes receivable 6,396 6,396 —

(4) Investment securities 549 549 —

(5) Rental deposits 12,785

Allowance for doubtful deposits paid (526)

Rental deposits, net 12,259 11,614 (645)

Total assets 149,009 148,364 (645)

Liabilities:

(1) Notes and accounts payable 9,220 9,220 —

(2) Short-term loans 5,253 5,253 —

(3) Accrued income taxes 4,034 4,034 —

(4) Corporate bonds 35,000 36,452 1,452

Total liabilities ¥ 53,509 ¥ 54,961 ¥ 1,452

Derivative transactions — — —

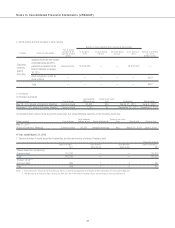

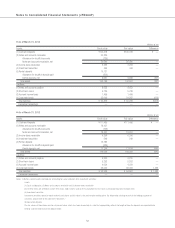

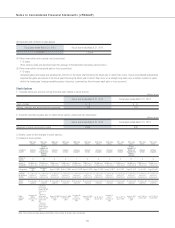

Notes: 1. Matters concerning the methods for estimating fair value and short-term investment securities

Assets

(1) Cash and deposits, (2) Notes and accounts receivable and (3) Income taxes receivable

Since these items are settled on a short-term basis, book value is used on the assumption that fair value is principally equivalent to book value.

(4) Investment securities

Investment securities comprise stock market listed shares and fair value is the stock-market trading price. For information relating to each of the holding purposes of

securities, please refer to the note titled “Securities.”

(5) Guarantee deposits

The fair values of these items are the net present value, which has been discounted at a rate that appropriately reflects the length of time the deposits are expected to be

held for and the credit risk of the deposit holder.

Notes to Consolidated Financial Statements (JPNGAAP)