Square Enix 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

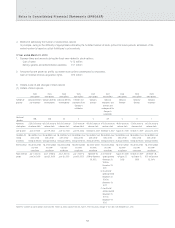

Business combinations

■ Year ended March 31, 2009

Common control transactions

1. Outline of the business combination

(1) Name of the company acquired and business operations subject

to the business combination

The Games (Offline), Games (Online), Mobile Phone Content,

Publication and Other businesses operated by SQUARE ENIX

HOLDINGS CO., LTD. (formerly SQUARE ENIX CO., LTD.)

(2) Legal form of the business combination

An incorporation-type company split that the Company was a

split company and a newly established wholly owned subsidiary

assumed Company’s Games (Offline) business operation, etc.

(3) Name of the post-combination company

Newly established company through an incorporation-type com-

pany split: SQUARE ENIX CO., LTD.

(4) Outline of the transaction including purpose of the transaction

The Company believes that it is crucial to maintain profitability

and achieve medium- and long-term growth through the provi-

sion of high-quality, sophisticated contents and services.

However, in recent years, as information technology (IT) and

telecommunications technology and infrastructure have rapidly

developed and seen widespread adoption, customer preferences

have become greatly diversified and the speed of technical

innovation has accelerated. In such a business environment, the

Company decided to shift to a pure holding-company structure.

As well as aiming to clarify the profitability of each business

and the accountability structure, this shift was determined to be

essential for facilitating Group management that can flexibly

engage in strategic business alliances, including capital alli-

ances with other companies.

2. Outline of the accounting treatment

The transaction was treated as a common control transaction

pursuant to “Accounting Standard for Business Combinations”

(Business Accounting Council, issued on October 31, 2003) and

“Implementation Guidance on Accounting Standard for Business

Combinations and Accounting Standard for Business

Divestitures” (Accounting Standards Board of Japan Guidance

No. 10, revised on November 15, 2007).

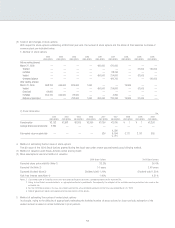

■ Year ended March 31, 2010

Application of the purchase method

1. Name of the company acquired and business operations subject

to the business combination, main purpose of the business

combination, date of business combination, legal form of busi-

ness combination, and name of the company and percentage of

voting rights held subsequent to business combination

(1) Name of the company acquired and its principal business

operations

Name of company: Eidos plc

(hereinafter “Eidos”)

Type of business: Games (interactive entertainment products)

(2) Purpose of the business combination

This acquisition was carried out based on the judgment that, by

combining the hit products of Eidos with the products of

SQUARE ENIX Group, it would further strengthen the position of

the SQUARE ENIX Group as one of the global leaders in the

interactive entertainment industry.

(3) Date of business combination

April 22, 2009

(4) Legal form of the business combination and name of the post-

combination company

Legal form of the business combination: Share acquisition

Post-combination name of the acquired company: Eidos Ltd.

(5) Percentage of voting rights acquired: 100%

2. Period for which the acquired company’s operating results have

been included in the Company’s consolidated financial

statements

April 22, 2009 to March 31, 2010

3. Acquisition cost of the company subject to business combination

and breakdown thereof

Acquisition price Eidos shares GBP84,418,536.85 (¥12,217 million)

Acquisition cost GBP84,418,536.85 (¥12,217 million)

The yen amount shown above was calculated using the

exchange rate prevailing on April 22, 2009.

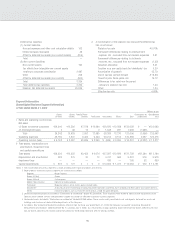

4. Amount of goodwill recognized, reasons for recognition, and

method and period of amortization

(1) Amount of goodwill recognized: GBP45,205,785.17

(¥6,542 million)

The yen amount shown above was calculated using the

exchange rate prevailing on April 22, 2009.

(2) Reasons for recognition of goodwill

Principally, in the regions where Eidos conducts its games busi-

ness, a portion of the excess earnings power its major game

titles are expected to generate could not be identified with spe-

cific assets, and this amount was recognized as goodwill.

(3) Method and period of amortization of goodwill

Amortized by the straight-line method over 10 years

59