Square Enix 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

pay under the lump-sum retirement plan if all eligible employees

were to voluntarily terminate their employment at the balance

sheet date.

F) Allowance for directors’ retirement benefits

At the Company and certain consolidated subsidiaries an allow-

ance for directors’ retirement benefits is provided to adequately

cover the costs of directors’ retirement benefits, which are

accounted for on an accrual basis in accordance with internal

policy.

■ Year ended March 31, 2010

A) Allowance for doubtful accounts

Same as the year ended March 31, 2009

B) Reserve for bonuses

Same as the year ended March 31, 2009

C) Allowance for sales returns

At certain consolidated subsidiaries prior to the fiscal year

ended March 31, 2010, allowances are provided for losses

on the return of published materials, at an amount calculated

based on historical experience prior to this fiscal year and allow-

ances are provided for losses on the return of game software

and other, comprising an estimated amount of future losses

assessed for each game title.

D) Allowance for closing of game arcades

Same as the year ended March 31, 2009

E) Allowance for employees’ retirement benefits

Same as the year ended March 31, 2009

F) Allowance for directors’ retirement benefits

Same as the year ended March 31, 2009

(5) Translation of foreign currency transactions and accounts:

■ Year ended March 31, 2009

All monetary assets and liabilities of the Company and its overseas

consolidated subsidiaries denominated in foreign currencies are

translated at the balance sheet date at the year end rates. The

resulting translation gains or losses are credited or charged to

income. All monetary assets and liabilities of overseas consolidated

subsidiaries are translated as of the balance sheet date at the year

end rates, and all income and expense accounts are translated at

rates for their respective periods. The resulting translation adjust-

ments are recorded in net assets as “Foreign currency translation

adjustments” and are included in minority interests in consolidated

subsidiaries.

■ Year ended March 31, 2010

Same as the year ended March 31, 2009

(6) Additional accounting policies used to prepare consolidated

financial statements:

■ Year ended March 31, 2009

Accounting treatment of consumption taxes

Income statement items are presented exclusive of consumption taxes.

■ Year ended March 31, 2010

Accounting treatment of consumption taxes

Same as the year ended March 31, 2009

5. Valuation of Assets and Liabilities of Consolidated

Subsidiaries

■ Year ended March 31, 2009

All assets and liabilities of consolidated subsidiaries are revalued on

acquisition.

■ Year ended March 31, 2010

Same as the year ended March 31, 2009

6. Amortization of Goodwill

■ Year ended March 31, 2009

Goodwill is amortized using the straight-line method over a period of

20 years. However, goodwill whose value has been extinguished is

fully amortized during the fiscal year in which it was incurred.

■ Year ended March 31, 2010

Goodwill is amortized using the straight-line method over a period

of either 10 years or 20 years. However, goodwill whose value has

been extinguished is fully amortized during the fiscal year in which

it was incurred.

7. Scope of Cash and Cash Equivalents in the Consolidated

Statements of Cash Flows

■ Year ended March 31, 2009

Cash and cash equivalents in the consolidated statements of cash

flows are comprised of cash on hand, bank deposits which are able

to be withdrawn on demand and highly liquid short-term invest-

ments with an original maturity of three months or less and with

minor risk of significant fluctuations in value.

■ Year ended March 31, 2010

Same as the year ended March 31, 2009

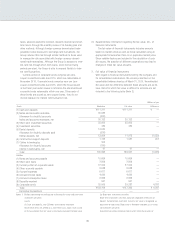

New Accounting Standards

■ Year ended March 31, 2009

(Changes in Standards and Valuation Methods for Major Assets)

Inventories

Previously, ordinary inventories held for sale had principally stated

at cost determined by the identified cost method. However, effec-

tive from the fiscal year ended March 31, 2009, accompany-

ing the adoption of the “Accounting Standard for Measurement

of Inventories” (Accounting Standards Board of Japan (ASBJ)

Statement No. 9, issued on July 5, 2006), inventories are primarily

stated at cost, based on the identified cost method (the value stated

on the balance sheet was calculated by writing down the book

value based on declining profitability). As a result, in the fiscal year

ended March 31, 2009, on a consolidated basis, operating income

decreased ¥685 million. There was no impact on recurring income,

37