Square Enix 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

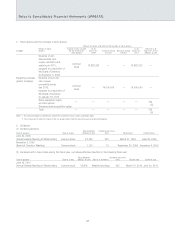

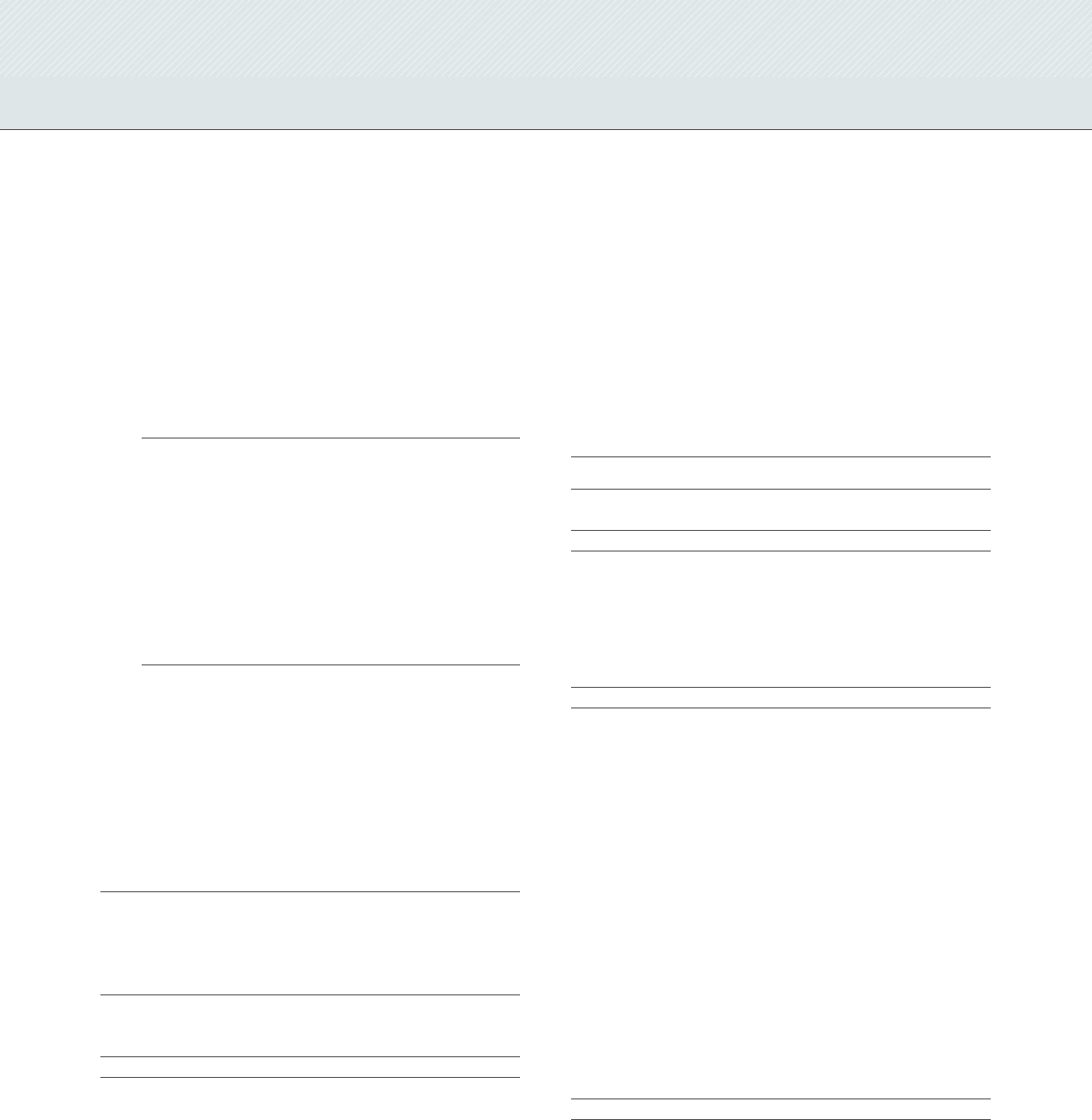

Notes to Consolidated Statements of Cash Flows

■ Year ended March 31, 2009

*1 A reconciliation of cash and cash equivalents in the consoli-

dated statements of cash flows to the corresponding amount dis-

closed in the consolidated balance sheets is as follows:

(As of March 31, 2009)

Cash and deposits ¥111,981 million

Time deposits with maturity

periods over three months (106 million)

Cash and cash equivalents ¥111,875 million

*2 Not applicable

■ Year ended March 31, 2010

*1 A reconciliation of cash and cash equivalents in the consoli-

dated statements of cash flows to the corresponding amount dis-

closed in the consolidated balance sheets is as follows:

(As of March 31, 2010)

Cash and deposits ¥111,211 million

Time deposits with maturity

periods over three months (1,494 million)

Cash and cash equivalents ¥109,717 million

*2 Breakdown of principal assets and liabilities of companies newly

included in the Company’s scope of consolidation resulting from

share acquisition

Due to the inclusion of EIDOS LTD. and one affiliate of EIDOS LTD.

in the Company’s scope of consolidation through a share acquisi-

tion, the following is a breakdown of principal assets and liabilities

at the time of the aforementioned commencement of inclusion in the

scope of consolidation as well as the share acquisition costs and

the relationship to the payment for share acquisition—net.

Millions of yen

Current assets ¥ 7,849

Non-current assets 14,910

Goodwill 6,637

Current liabilities (14,654)

Non-current liabilities (223)

Share acquisition costs 14,519

Amount paid during the fiscal year ended March 31, 2009 (1,503)

Cash and cash equivalents (814)

Payment for share acquisition—net ¥12,202

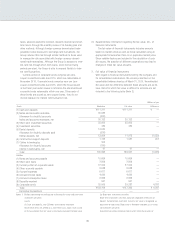

Lease Transactions

■ Year ended March 31, 2009

Finance lease transactions

Finance lease transactions that do not transfer ownership

(1) Type of leased assets

Amusement facilities in the Amusement business (buildings and

structures)

(2) Depreciation method for leased assets

Please see the following sections: “Summary of Significant

Accounting Policies Used in the Preparation of Consolidated

Financial Statements; 4. Summary of Significant Accounting

Policies; (2) Method of depreciation and amortization of major

assets.”

Finance lease transactions that do not transfer ownership and

that commenced on or before March 31, 2008, are accounted

for in a similar manner to the accounting treatment for ordinary

operating lease transactions. Detailed information for finance

lease transactions are as follows:

1. Acquisition cost, accumulated depreciation and net book value

of leased assets:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

Buildings and structures ¥1,246 ¥ 788 ¥457

Tools and fixtures 973 650 323

Total ¥2,219 ¥1,438 ¥781

Note: The total amount of future lease payments at the end of the year constituted

an insignificant portion of net property and equipment at the end of the year.

Accordingly, total acquisition cost included the interest portion thereon.

2. Ending balances of future lease payments:

Due within one year ¥527 million

Due after one year 253 million

Total ¥781 million

Note: The total future lease payments at the end of the year constituted an

insignificant portion of total property and equipment at the end of the

year. Accordingly, total future lease payments included the interest portion

thereon.

3. Lease payments and depreciation expense:

Lease payments ¥426 million

Depreciation expense 426 million

4. Method of calculation for depreciation

Depreciation is calculated using the straight-line method over a

useful life with no residual value.

(Impairment loss)

No impairment loss was recognized on leased assets.

Operating lease transactions

Future lease payments on noncancellable leases:

Due within one year ¥2,045 million

Due after one year 1,115 million

Total ¥3,161 million

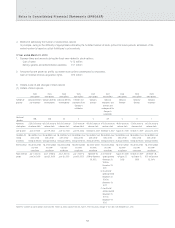

■ Year ended March 31, 2010

(1) Type of leased assets

Amusement facilities in the Amusement business (buildings and

structures)

(2) Depreciation method for leased assets

Please see the following sections: “Summary of Significant

Accounting Policies Used in the Preparation of Consolidated

Financial Statements; 4. Summary of Significant Accounting

Policies; (2) Method of depreciation and amortization of major

assets.”

43