Square Enix 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

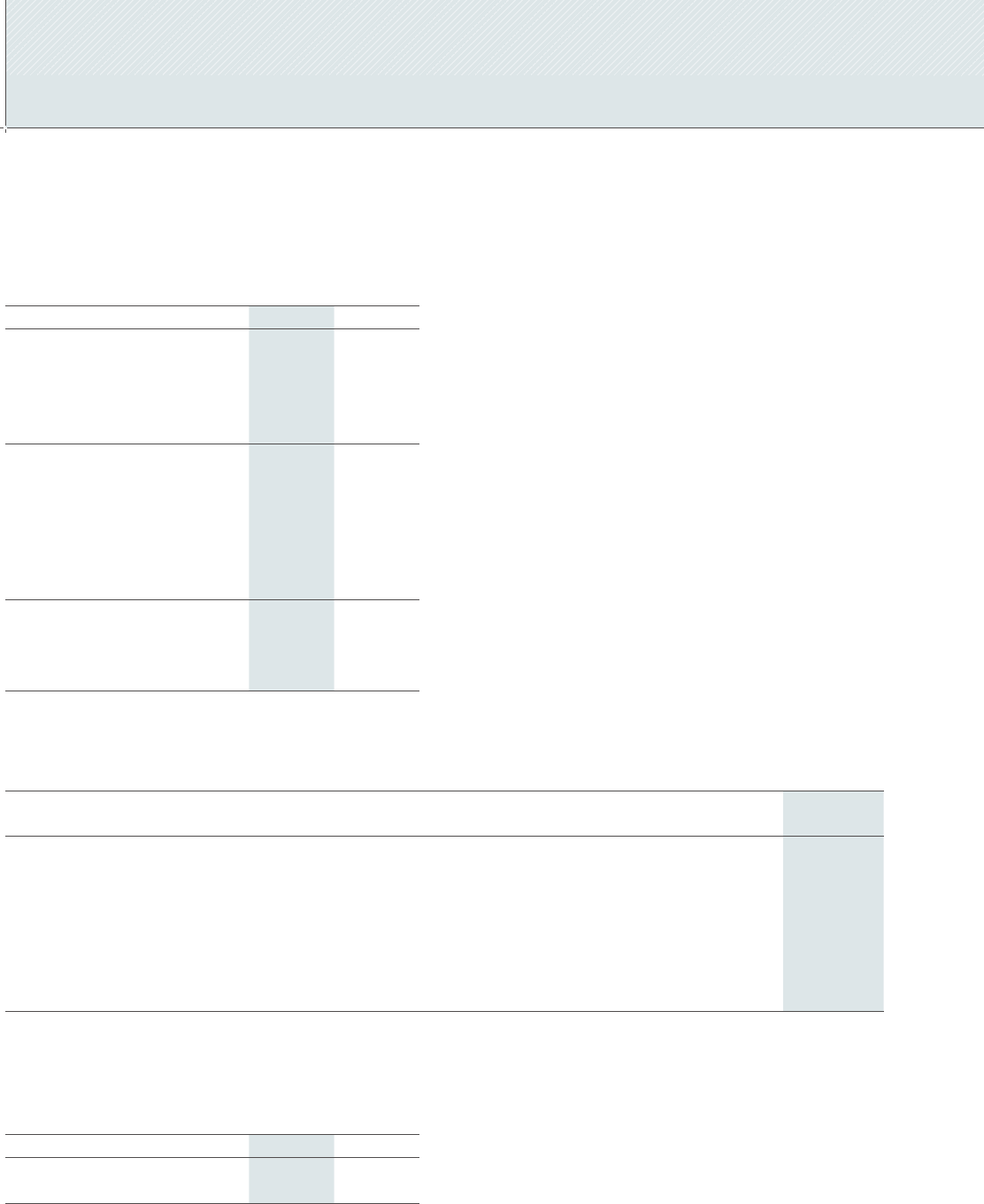

■ Shareholders’ Equity/Net Assets

Millions of yen

March 31 2009 2010 Change

Common stock ¥ 15,134 ¥ 15,204 ¥ 69

Capital surplus 44,375 44,444 69

Retained earnings 93,220 98,848 5,627

Treasury stock (852) (856) (3)

Total shareholders’ equity 151,879 157,641 5,762

Unrealized gain on

revaluation of other

investment securities

(71) (9) 62

Foreign currency translation

adjustments (4,488) (4,951) (462)

Total valuation and translation

adjustments (4,560) (4,960) (399)

Stock acquisition rights 410 715 304

Minority interests in

consolidated subsidiaries 995 861 (133)

Total net assets ¥148,724 ¥154,258 ¥5,533

As of March 31, 2010, total shareholders’ equity amounted to

¥157,641 million, an increase of ¥5,762 million compared with the

previous fiscal year-end. Common stock and capital surplus

increased owing to the exercise of stock options (stock acquisition

rights).

■ Consolidated Statements of Income

Net Sales and Operating Income

Millions of yen

Years ended March 31 2009 Composition 2010 Composition Amount

change

Percent

change

Net sales ¥135,693 100.0% ¥192,257 100.0% ¥56,563 41.7%

Gross profi t 56,166 41.4% 83,721 43.5% 27,555 49.1%

Reversal of allowance for sales returns 1,135 0.8% 4,863 2.5% 3,727 328.1%

Provision for allowance for sales returns 1,598 1.2% 4,046 2.1% 2,448 153.2%

Net gross profi t 55,703 41.1% 84,538 44.0% 28,834 51.8%

Selling, general and administrative expenses 43,426 32.0% 56,303 29.3% 12,877 29.7%

Operating income 12,277 9.0% 28,235 14.7% 15,957 130.0%

Comparisons by segment with the preceding fiscal year are provided on pages 8–11.

Management’s Discussion and Analysis of Operating Results and Financial Position (JPNGAAP)

In the previous fiscal year, foreign exchange loss amounted to

¥1,715 million.

Non-Operating Income and Expenses

Millions of yen

Years ended March 31 2009 2010 Change

Non-operating income ¥ 909 ¥ 758 ¥(150)

Non-operating expenses 1,925 1,171 (754)

Non-operating income decreased by ¥150 million, to ¥758 million,

mainly owing to a decrease in interest income.

Non-operating expenses amounted to ¥1,171 million, primarily

owing to a foreign exchange loss of ¥842 million.

24