Square Enix 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

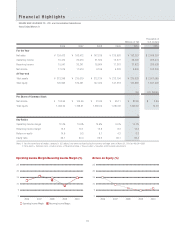

To Our Shareholders

Recurring income Net sales

Billions of yen

Net sales Recurring income

60

50

40

30

20

10

0

240

160

80

0

2004 2005 2006 2007 2008 2009 2010

18.2

25.9

15.5

26.2

18.9

11.3

63.2 73.9

124.5

163.5 147.5 135.7

192.3

27.8

Years ended March 31

Net Sales and Recurring Income

Figure 2

Billions of yen

30

25

20

15

10

5

0

Games Amusement Publication Mobile

Phone

Content

Merchandising

FY2009

FY2010

6.7

23.8

2.9 4.1 4.6

1.8

3.3 3.5 4.2

0.8

254.0%

11.8% 16.4% 8.1%

124.2%

Operating Income by Business Segment

Figure 3

30

25

20

15

10

5

0

North America

Japan

OtherEurope

13.62

11.05 12.23

16.93

14.41

11.61

26.66

2004 2005 2006 2007 2008 2009 2010

(44)

(28)

(27)

(1)

Years ended March 31

Millions units

*Composition percentage in parentheses

Game Software Sales by Region

Figure 4

The Year’s Record Profit: Broad-Based Success

In the year under review, sales and profit reached record levels,

while nearly all business segments showed increased profit.

Furthermore, sales across all geographic segments of Japan,

North America and Europe achieved record levels (Figures 2 - 4).

Key Factors to Enter the Next Growth Stage

As I’ve mentioned, we have been able to manage our current

businesses very effectively under a challenging operating

environment.

So, are we prepared to enter the next growth stage?

I would like to give the following overview from this perspective.

We have identified three key success factors.

1. Globalization

2. Becoming “Network Centric”

3. Strengthening Own-IPs

Since our creation by merger between ENIX and SQUARE,

these fundamental themes have not changed.

Globalization

Entertainment in so many forms is destined to spread around

the world.

While digital entertainment has been the most recent to enter

the market, computer games and network communications

have already pervaded virtually every part of the world. Based

on this, the whole world has become game companies’ target

market. The only choice available to individual companies in the

industry is where to set up content development and marketing

operations to best serve global markets.

For us, we have chosen the path of complete globalization.

Our substantial first step in this process was the acquisition

of U.K.-based Eidos. A year on since the acquisition, progress

has been extremely smooth as we not only completed the

organizational integration but also have begun to collaborate on

certain development projects.

As a result, we’ve been able to strengthen our development

and marketing structures in North America and Europe. And

while we are still developing in this area, our composition of

human resources is now more balanced across regions, forming

a solid foundation for global business development (Figures 5 - 6).

When I say that we’ve built a foundation, I don’t mean that

we will then simply expand these operations by functional

extensions based on the status quo.

In fact, each location has differences in personnel skills and

performance as well as costs and trading conditions. This world-

wide location framework will provide the basis for the most

efficient resource allocation in the globalization of our businesses.

Figure 7 shows the geographical breakdown of sales of game

titles achieving over 3 million units during the fiscal year under review.

04