Square Enix 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

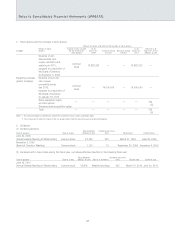

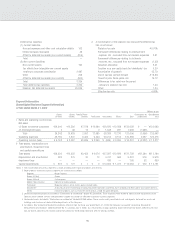

5. Investment securities whose fair values are not readily

determinable:

Millions of yen

Book value

Other investment securities

Unlisted securities (excluding OTC securities) ¥180

Unlisted overseas bonds 0

6. Redemption schedule of other securities with maturities and

held-to-maturity securities

Not applicable

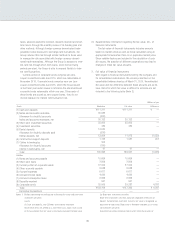

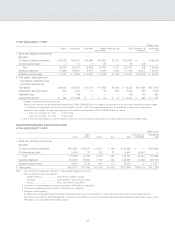

■ Year ended March 31, 2010

1. Held-for-sale securities

Not applicable

2. Held-to-maturity securities with market value

Not applicable

3. Other investment securities with market value:

Millions of yen

Type Book value Acquisition

cost

Difference

Securities with

book value

exceeding

acquisition cost

(1) Stocks ¥ 86 ¥ 54 ¥ 32

(2) Bonds

a. Government

bonds and

municipal

bonds

—— —

b. Corporate

bonds —— —

c. Other —— —

(3) Other —— —

Subtotal 86 54 32

Securities with

acquisition cost

exceeding book

value

(1) Stocks 393 441 (47)

(2) Bonds

a. Government

bonds and

municipal

bonds

—— —

b. Corporate

bonds —— —

c. Other —— —

(3) Other 35,000 35,000 —

Subtotal 35,393 35,441 (47)

Total ¥35,480 ¥35,495 ¥(15)

Note: Unlisted shares (Amount shown on the consolidated balance sheets: ¥87

million) are not included in the above table “Other Investment Securities”

owing to the recognition of their lack of market prices and the extreme

difficulty in estimating fair value.

Securities

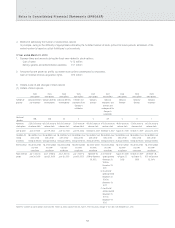

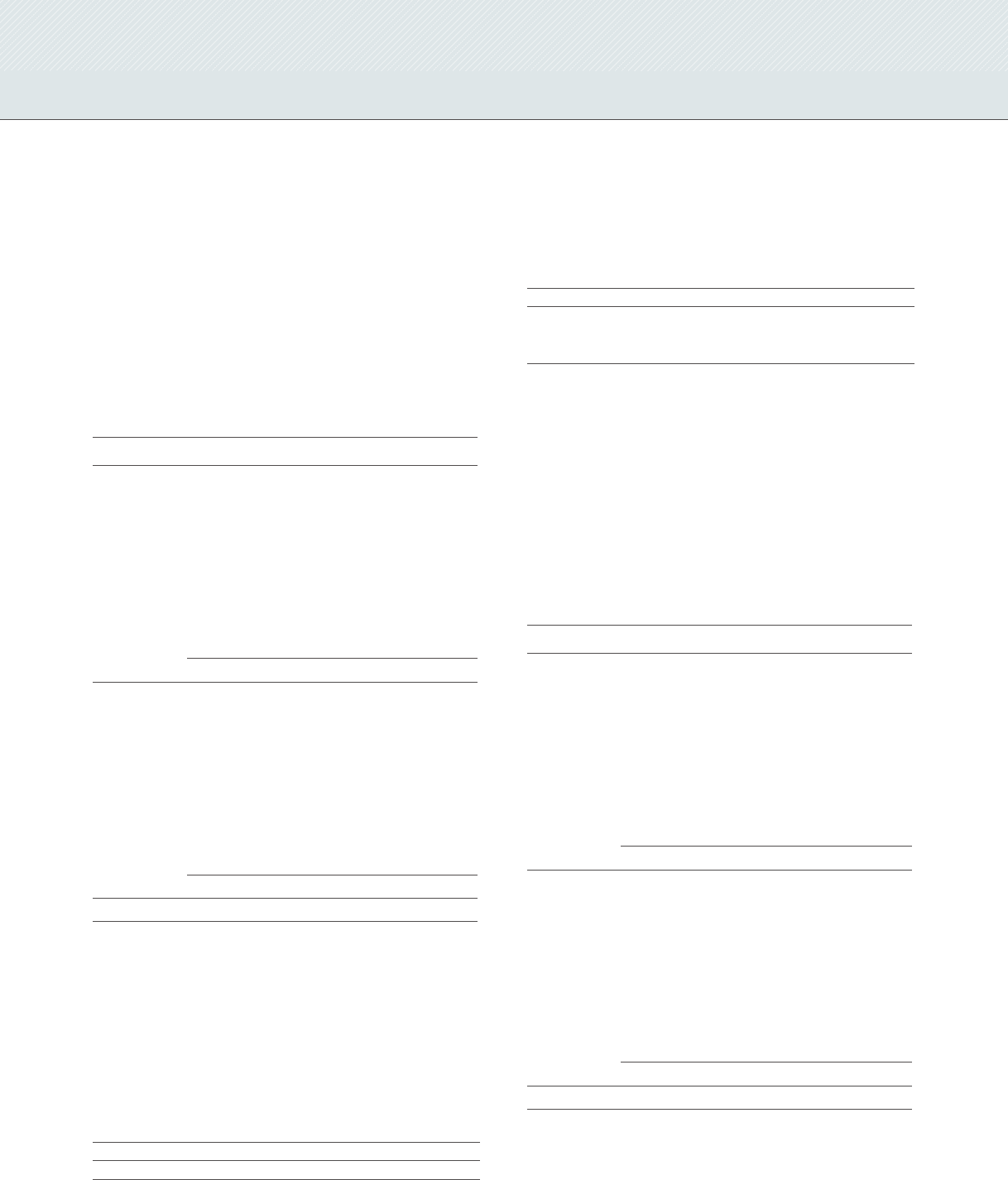

■ Year ended March 31, 2009

1. Held-for-sale securities

Not applicable

2. Held-to-maturity securities with market value

Not applicable

3. Other investment securities with market value:

Millions of yen

Type Acquisition

cost

Book value Difference

Securities with

book value

exceeding

acquisition cost

(1) Stocks ¥ 0 ¥ 0 ¥ 0

(2) Bonds

a. Government

bonds and

municipal

bonds

—— —

b. Corporate

bonds —— —

c. Other —— —

(3) Other —— —

Subtotal 00 0

Securities with

acquisition cost

exceeding book

value

(1) Stocks 1,997 1,881 (115)

(2) Bonds

a. Government

bonds and

municipal

bonds

—— —

b. Corporate

bonds —— —

c. Other —— —

(3) Other —— —

Subtotal 1,997 1,881 (115)

Total ¥1,998 ¥1,882 ¥(115)

Note: For the fiscal year ended March 31, 2009, the impairment loss associated

with the fair market value determination of other investment securities with

market value was ¥15 million. Impairment loss on securities is charged to

income when the market price at the end of the fiscal year falls less than

50% of the acquisition cost. In addition, impairment loss on securities is

charged to income when the market price at the end of the fiscal year falls

between 30% and 50% of the acquisition cost after considering factors such

as the significance of the amount and the likelihood of recovery.

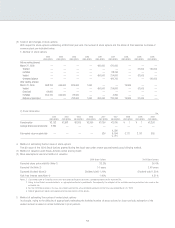

4. Securities sold during the fiscal year ended March 31, 2009

Millions of yen

Amount of sale Gain on sale Loss on sale

¥4 ¥0 ¥17

47