Square Enix 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

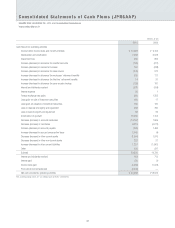

Millions of yen

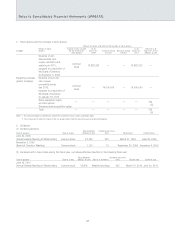

Impairment

Location Usage Category amount

Kawasaki-shi, Idle assets Land ¥ 43

Kanagawa

Kita-Karuizawa, Assets planned Land and 9

Nagano for disposal buildings

Tokushima-shi, Assets planned Land 119

Tokushima for disposal

Shibuya-ku, Tokyo, Idle assets Telephone 9

and others subscription rights

Shibuya-ku, Tokyo, Assets planned Amusement 74

and others for disposal equipment

Total ¥255

In the fiscal year ended March 31, 2010, due to the inclusion

of Eidos Ltd. and its consolidated subsidiaries within the Company’s

scope of consolidation, the Group revised its method of grouping

assets. In the Amusement business segment, each business loca-

tion is classified as one asset-grouping unit. In other business

segments, classification of asset groups is carried out based on the

relationships between businesses. Idle assets that are not used for

operational purposes and assets planned for disposal are classified

individually, separately from those mentioned above.

With regard to idle assets presented in the table above, market

value had fallen substantially below book value and the future use

of these assets was deemed uncertain. For these reasons, the book

value of these idle assets has been written down to the applicable

market value. With regard to assets planned for disposal, their

recoverable value was recognized as falling below book value.

Consequently, their book value has been written down to the appli-

cable recoverable value.

In principle, the recoverable amounts for these assets are

determined based on their fair value calculated using market prices.

*8 Accelerated amortization of goodwill

Accelerated amortization of goodwill is the amount of goodwill

amortized in this fiscal year ended March 31, 2010 relating

to TAITO CORPORATION. A change in business circumstances

caused a revision in the estimate of the goodwill’s useful life

and recoverable value.

Notes to Consolidated Financial Statements (JPNGAAP)

*9 Loss associated with business restructuring

This item principally comprises business restructuring losses

relating to an overhaul of the Group’s game development and

sales structures in Europe and the United States due to the

acquisition of the Eidos Group.

*10 Income taxes for prior periods

With regard to transactions between the Company and its sub-

sidiaries in the United States and the United Kingdom, although

the Company had been preparing to file mutual agreement

based on the bilateral advance pricing agreement (BAPA) system

relating to transfer pricing taxation, during this fiscal year, a

mutual agreement became effective between the governments

of Japan and the United States. Japan and the United Kingdom

plan to reach a mutual agreement in the near future. The

amount presented as income taxes for prior periods is the net

amount after offsetting taxes paid and estimated taxes payable

against tax refunds under the aforementioned mutual

agreements.

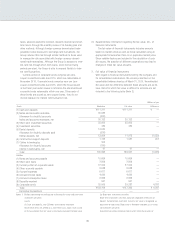

Items Pertaining to the Consolidated Statements of

Changes in Net Assets

■ Year ended March 31, 2009

1. Type and number of shares issued and outstanding, and type

and number of shares of treasury stock

Thousands of shares

Shares as Share Share Shares as

of March 31, increases decreases of March 31,

2008 during the year during the year 2009

Shares issued and

outstanding

Common stock*1 115,117 188 — 115,305

Total 115,117 188 — 115,305

Treasury stock*2

Common stock 291 4 0 295

Total 291 4 0 295

*1 The increase of 188 thousand shares of common stock issued and outstanding

was due to the exercise of stock options.

*2 The increase of 4 thousand shares of treasury stock was due to the acquisition

of fractional shares constituting less than one trading unit.

The decrease of 0 thousand shares of treasury stock was due to the sale of

fractional shares constituting less than one trading unit.

40