SkyWest Airlines 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

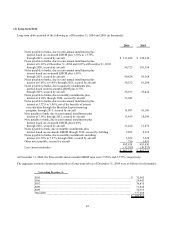

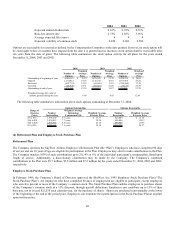

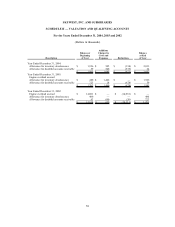

The following table summarizes purchases made under the Employee Stock Purchase Plan:

Year Ended December 31,

2004 2003 2002

Number of share purchased 343,136 324,680 214,131

Average price of shares purchased $ 14.57 $ 13.24 $ 20.76

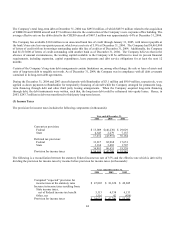

(7) Related-Party Transactions

The Company’s President, Chairman and Chief Executive Officer, serves on the Board of Directors for Zion’s Bancorporation

(“Zion’s”) and the Utah State Board of Regents. The Company maintains a line of credit (see Note 2) and certain bank accounts

with Zion’s, Zion’s is an equity participant in leveraged leases on two CRJ200 and four EMB120 aircraft operated by the

Company and Zion’s provides investment administrative services to the Company for which the Company paid approximately

$241,000 during the year ended December 31, 2004. Zion’s also serves as the Company’s transfer agent. The balance in the

Zion’s accounts as of December 31, 2004, was $92,381,000.

One of the Company’s board members is a shareholder in Soltis Investment Advisors. Soltis Investment Advisors provides cash

management advisory services for a portion of the Company’s cash programs, advisory services to the Company’s 401k

retirement plan and deferred compensation plan. With respect to the Company’s cash programs, the Company invests in name

brand funds such as PIMCO and Wells Fargo/Strong and Fidelity Money Market funds. The Company makes no direct

investment in Soltis. All funds are in a custodian account with Fidelity Investments and in SkyWest’s name. Fidelity

Investments provides insurance that covers the total value of the accounts in the event that Fidelity fails financially or in the event

of loss other than those through normal market declines. Soltis receives no money directly from SkyWest for its services, rather

Soltis is compensated by Fidelity Investments. Soltis received approximately $196,126 in 2004 for fees from Fidelity relating to

the Company’s cash programs. With respect to the Company’s 401k retirement plan, the plans assets are invested in name brand

funds such as Fidelity, Vanguard, Marsico, Turner etc. The Plan’s assets are in a custodian account with Fidelity Investments in

the name of SkyWest. Monies are wired directly to Fidelity Investments. Fidelity provides insurance that covers the total value

of the accounts in the event that Fidelity fails financially or in the event of loss other than those through normal market declines.

Soltis receives no money directly from the Company for its services, rather the individual plan participants pay Soltis directly for

advisory fees which are deducted from plan participant’s individual account balances on a quarterly basis. The deduction for

quarterly fees is reviewed by the Company’s management and the record keeper. Soltis received approximately $195,000 in 2004

for fees for these services. With respect to the deferred compensation plan for the officer group, Soltis provides consulting

services in conjunction with the Newport Group. Since the Newport Group is the advisor and recordkeeper for the plan, no

money is exchanged between the Company and Soltis. Soltis is paid directly by the Newport Group for its advisory services.

Soltis received $20,000 during 2004 from the Newport Group.

(8) Subsequent Events

Subsequent to year-end, on January 24, 2005 the Company announced in conjunction with Continental Airlines to end its

contractual relationship for flying turboprop aircraft as a Continental Connection carrier. The decision was reached in part due to

Continental’s desire for a different aircraft due to certain operational constraints and in part due to SkyWest not achieving certain

internal financial objectives. The Company currently intends to phase out of its Continental Connection turbo-prop flying from

March to June 2005. This flying consisted of approximately 1.5% of SkyWest’s annual ASM production for 2004 and accounted

for less than 1.0% of SkyWest’s annual operating income for 2004. No impairment charge was deemed necessary based on the

evaluation of assets relating to the Continental operations.

ITEM 9. CHANGES IN AND DISAGREEMENTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

On March 31, 2003, the Company dismissed its independent auditors, KPMG LLP ("KPMG"), and, effective April 7, 2003,

selected Ernst & Young LLP (“E&Y”) to be its new independent auditors. The Company’s actions were approved by the Audit

Committee of its Board of Directors.