SkyWest Airlines 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

Delta Connection agreement expires in 2010; however, Delta can terminate the agreement at any time without cause upon 180

days notice.

Maintenance costs will likely increase as the age of the Company’s regional jet fleet increases

Because the average age of SkyWest’s CRJ700s and CRJ200s is approximately 0.4 and 2.8 years, respectively, SkyWest’s CRJ

fleet requires less maintenance now than it will in the future. The Company has incurred relatively low maintenance expenses on

its regional jet fleet because most of the parts on SkyWest’s regional jet aircraft are under multi-year warranties and a limited

number of heavy airframe checks and engine overhauls have occurred. The Company’s maintenance costs will increase

significantly, both on an absolute basis and as a percentage of its operating expenses, as SkyWest’s fleet ages and these warranties

expire. Under the Company’s United Express Agreement, specific amounts are included in the rates for future maintenance on

CRJ200 engines. The actual cost of maintenance on CRJ200 engines may vary from the estimated rates (See Management’s

Discussion and Analysis).

The Company has a significant amount of contractual obligations which could have a material adverse effect on the

Company’s operations and financial condition.

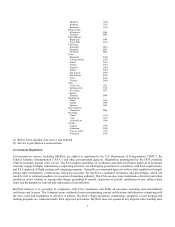

As of December 31, 2004, the Company had $495.8 million in total long-term debt obligations. Substantially all of this long-term

debt was incurred in connection with the acquisition of EMB120 and CRJ200 aircraft. The Company also has significant long-

term lease obligations primarily relating to its aircraft fleet. These leases are classified as operating leases and therefore are not

reflected as liabilities in the Company’s condensed consolidated balance sheets. At December 31, 2004, the Company had 153

aircraft under lease with remaining terms ranging from one to 18 years. Future minimum lease payments due under all long-term

operating leases were approximately $2.10 billion at December 31, 2004. At a 7% discount factor, the present value of these

lease obligations was equal to approximately $1.40 billion at December 31, 2004.

As of December 31, 2004, the Company had commitments of approximately $500 million to purchase 20, CRJ700 aircraft and

related flight equipment. The Company currently anticipates that it will take delivery of these aircraft from January 2005 through

May 2005. Additionally, during the quarter ended March 31, 2004, Delta awarded to the Company seven additional CRJ200s that

are scheduled for delivery during the first half of 2005. The Company anticipates subleasing these seven aircraft from Delta. The

Company’s high level of fixed obligations could impact its ability to obtain additional financing to support additional expansion

plans or divert cash flows from operations and expansion plans to service the fixed obligations.

Terrorist activities or warnings have dramatically impacted, and will likely continue to impact, the Company

The terrorist attacks of September 11, 2001 and their aftermath have negatively impacted the airline industry in general and the

Company’s operations in particular. The primary effects experienced by the airline industry include a substantial loss of passenger

traffic and revenue, increased security and insurance costs, increased concerns about future terrorist attacks, airport delays due to

heightened security and significantly reduced yields due to the drop in demand for air travel.

Additional terrorist attacks, the fear of such attacks, the war in Iraq, other hostilities in the Middle East or other regions, as well as

other factors, could negatively impact the airline industry, and result in further decreased passenger traffic and yields, increased

flight delays or cancellations associated with new government mandates, as well as increased security, fuel and other costs. The

Company cannot provide any assurance that these events will not harm the airline industry generally or the Company’s operations

or financial condition in particular.

The Company’s reliance on only three aircraft types exposes the Company to a number of potentially significant risks

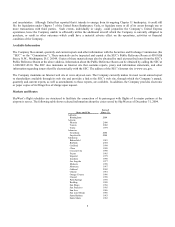

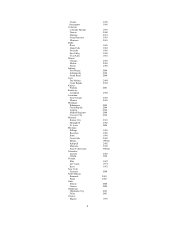

As of December 31, 2004, the Company had a fleet of 73 EMB120s, 125 CRJ200s and 12 CRJ700s. As of December 31, 2004,

75.5% of the Company’s ASMs were flown using CRJ200s, 12.7% of the Company’s ASMs were flown using EMB120s and

11.8% of the Company’s ASMs were flown using CRJ700s. Additionally, as of December 31, 2004, the Company had

agreements to acquire 20 CRJ700s and had obtained options to acquire another 80 CRJ700s that can be delivered in either 70 or

90 seat configurations. The Company presently anticipates that delivery dates for the 80 optioned CRJ700s could start in June

2005 and continue through September 2008; however, actual delivery dates remain subject to final determination as agreed upon

by the Company and its major partners. The Company is subject to numerous risks related to the concentration of aircraft types in