SkyWest Airlines 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

The Company’s total long-term debt at December 31, 2004 was $495.8 million, of which $487.9 million related to the acquisition

of EMB120 and CRJ200 aircraft and $7.9 million related to the Company’s corporate office building. During the year ended

December 31, 2004, the Company acquired two new CRJ200s from proceeds from the issuance of long-term debt of $34.5

million. The average effective rate on the debt related to the EMB120 and CRJ 200 aircraft was approximately 4.4% at December

31, 2004.

Seasonality

As is common in the airline industry, the Company’s pro-rate operations are favorably affected by increased travel, historically

occurring in the summer months, and are unfavorably affected by decreased business travel during the months from November

through January and by inclement weather which occasionally results in cancelled flights, principally during the winter months.

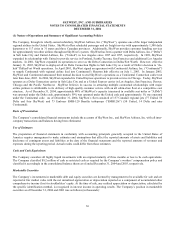

New Accounting Standard

As contemplated by SFAS Statement 123, Accounting for Stock-Based Compensation, the Company currently accounts for share-

based payments to employees using intrinsic value method set forth in Opinion 25, Accounting for Stock Issued to Employees and,

as such, generally recognizes no compensation cost for employee stock options. Accordingly, the adoption of the fair value

method set forth in Statement 123(R) is likely to have a significant impact on the Company’s results of operations, although it is

not anticipated to have a significant impact on the Company’s overall financial position. The impact of adoption of Statement

123(R) cannot be predicted at this time because it will depend on levels of share-based payments granted in the future. However,

had the Company adopted Statement 123(R) in prior periods, the impact of that standard would have approximated the impact of

Statement 123 as described in the disclosure of pro forma net income and earnings per share in Note 1 to the Company’s

consolidated financial statements set forth in item 8 of this Report. Statement 123(R) also requires the benefits of tax deductions

in excess of recognized compensation cost to be reported as a financing cash flow, rather than as an operating cash flow as

required under current literature. This requirement will reduce net operating cash flows and increase net financing cash flows in

periods after adoption. While the Company cannot estimate what those amounts will be in the future (primarily because they

depend on, among other things, when employees exercise stock options), the amount of operating cash flows recognized in prior

periods for such excess tax deductions were $442,000, $129,000 and $1,525,000 in 2004, 2003, and 2002, respectively.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Aircraft Fuel

In the past, the Company has not experienced difficulties with fuel availability and currently expects to be able to obtain fuel at

prevailing prices in quantities sufficient to meet its future needs. Pursuant to the Company’s contract flying arrangements, United

will bear the economic risk of fuel price fluctuations on the Company’s United Express flights. On the Company’s Delta

Connection regional jet flights, Delta will bear the economic risk of fuel price fluctuations. On the majority of the Company’s

Delta Connection routes flown by EMB120s, as well as all existing Continental Connection routes, the Company will bear the

economic risk of fuel fluctuations. At present, the Company believes that its results from operations will not be materially and

adversely affected by fuel price volatility.

Interest Rates

The Company’s earnings are affected by changes in interest rates due to the amounts of variable rate long-term debt and the

amount of cash and securities held. The interest rates applicable to variable rate notes may rise and increase the amount of

interest expense. The Company would also receive higher amounts of interest income on cash and securities held at the time;

however, the market value of the Company’s available-for-sale securities would likely decline. At December 31, 2004, the

Company had variable rate notes representing 73.1% of its total long-term debt compared to 77.4% of its long-term debt at

December 31, 2003. For illustrative purposes only, the Company has estimated the impact of market risk using a hypothetical

increase in interest rates of one percentage point for both variable rate long-term debt and cash and securities. Based on this

hypothetical assumption, the Company would have incurred an additional $3,746,000 in interest expense and received $4,868,000

in additional interest income for the year ended December 31, 2004 and the Company would have incurred an additional

$2,500,000 in interest expense and received $4,410,000 in additional interest income for the year ended December 31, 2003.