SkyWest Airlines 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

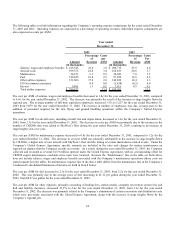

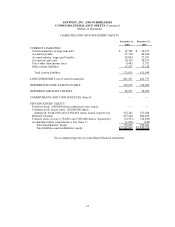

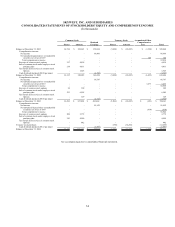

SKYWEST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME

(In thousands)

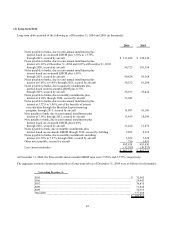

Common Stock Treasury Stock Accumulated Other

Retained Comprehensive

Shares Amount Earnings Shares Amount Loss Total

Balance at December 31, 2001 62,724 $ 309,691 $ 258,024 (5,898) $ (20,285) $ (1,590) $ 545,840

Comprehensive income:

Net income - - 86,866 - - - 86,866

Net unrealized appreciation on marketable

securities net of tax of $107 - - - - - 168 168

Total comprehensive income - - - - - - 87,034

Exercise of common stock options 397 4,438 - - - - 4,438

Sale of common stock under employee stock

purchase plan 214 4,431 - - - - 4,431

Tax benefit from exercise of common stock

Options - 1,525 - - - - 1,525

Cash dividends declared ($0.08 per share) - - (4,582) - - - (4,582)

Balance at December 31, 2002 63,335 320,085 340,308 (5,898) (20,285) (1,422) 638,686

Comprehensive income:

Net income - - 66,787 - - - 66,787

Net unrealized appreciation on marketable

securities net of tax of $813 - - - - - 1,273 1,273

Total comprehensive income - - - - - - 68,060

Exercise of common stock options 24 309 - - - - 309

Sale of common stock under employee stock

purchase plan 533 6,505 - - - - 6,505

Tax benefit from exercise of common stock

Options - 129 - - - - 129

Cash dividends declared ($0.08 per share) - - (4,626) - - - (4,626)

Balance at December 31, 2003 63,892 $ 327,028 $ 402,469 (5,898) $ (20,285) $ (149) $ 709,063

Comprehensive income:

Net income - - 81,952 - - - 81,952

Net unrealized depreciation on marketable

securities net of tax of $607 - - - - - (910) (910)

Total comprehensive income - - - - - - 81,042

Exercise of common stock options 208 2,772 - - - - 2,772

Sale of common stock under employee stock

purchase plan 343 4,999 - - - - 4,999

Tax benefit from exercise of common stock

Options - 442 - - - - 442

Treasury stock purchases - - - (896) (12,266) - (12,266)

Cash dividends declared ($0.12 per share) - - (6,997) - - - (6,997)

Balance at December 31, 2004 64,443 $ 335,241 $ 477,424 (6,794) $ (32,551) $ (1,059) $ 779,055

See accompanying notes to consolidated financial statements.