SkyWest Airlines 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

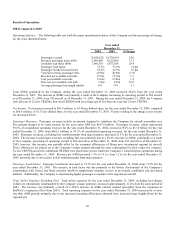

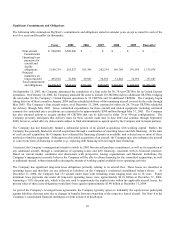

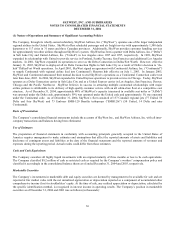

Significant Commitments and Obligations

The following table summarizes SkyWest’s commitments and obligations stated in calendar years except as noted for each of the

next five years and thereafter (in thousands):

Total 2005 2006 2007 2008 2009 Thereafter

Firm aircraft $ 500,000 $500,000 $ - $

-

$ - $ - $ -

Commitments

Operating lease

payments for

aircraft and

facility

obligations 2,100,719 201,527 183,398 202,234 186,789 191,693 1,135,078

Principal

maturities on

long-term debt 495,818 32,586 29,943 30,835 31,848 32,919 337,687

Total commitments

and obligations $3,096,537 $734,113 $213,341 $233,069 $ 218,637 $ 224,612 $ 1,472,765

On September 15, 2003, the Company announced the completion of a firm order for 30, 70-seat CRJ700s for its United Express

operations. On February 10, 2004, the Company amended the order to include 10 CRJ200s and two additional CRJ700s, bringing

the total order for the Company’s United Express operations to 32 CRJ700s and 10 additional CRJ200s. The Company began

taking delivery of these aircraft in January 2004 and has scheduled delivery of the remaining aircraft covered by the order through

May 2005. The Company’s firm aircraft orders, as of December 31, 2004, consisted of orders for 20, 70-seat CRJ700s scheduled

for delivery through May 2005. Gross committed expenditures for these aircraft and related equipment, including estimated

amounts for contractual price escalations are estimated to be approximately $500 million through May 31, 2005. The Company

has also obtained options to acquire another 80 CRJ700s that can be delivered in either 70 or 90-seat configurations. The

Company presently anticipates that delivery dates for these aircraft could start in June 2005 and continue through September

2008; however, actual delivery dates remain subject to final determination as agreed upon by the Company and its major partners.

The Company has not historically funded a substantial portion of its aircraft acquisitions with working capital. Rather, the

Company has generally funded its aircraft acquisitions through a combination of operating leases and debt financing. At the time

of each aircraft acquisition, the Company has evaluated the financing alternatives available, and selected one or more of these

methods to fund the acquisition. Subsequent to this initial acquisition of an aircraft, the Company may also refinance the aircraft

or convert one form of financing to another (e.g., replacing debt financing with leveraged lease financing).

At present, the Company’s management intends to satisfy its 2005 firm aircraft purchase commitment, as well as its acquisition of

any additional aircraft, through a combination of operating leases and debt financing, consistent with its historical practices.

Based on current market conditions and discussions with prospective leasing organizations and financial institutions, the

Company’s management currently believes the Company will be able to obtain financing for the committed acquisitions, as well

as additional aircraft, without materially reducing the amount of working capital available for its operating activities.

The Company has significant long-term lease obligations primarily relating to its aircraft fleet. These leases are classified as

operating leases and therefore are not reflected as liabilities on the Company’s condensed consolidated balance sheets. At

December 31, 2004, the Company had 153 aircraft under lease with remaining terms ranging from one to 18 years. Future

minimum lease payments due under all long-term operating leases were approximately $2.10 billion at December 31, 2004.

Assuming a 7.0% discount rate, which is the rate used to approximate the implicit rates within the applicable aircraft leases, the

present value of these lease obligations would have been equal to approximately $1.40 billion at December 31, 2004.

As part of the Company’s leveraged lease agreements, the Company typically agrees to indemnify the equity/owner participant

against liabilities that may arise due to changes in benefits from tax ownership of the respective leased aircraft. See Note 4 to the

Company’s consolidated financial statements set forth in Item 8 of this Report.