SkyWest Airlines 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

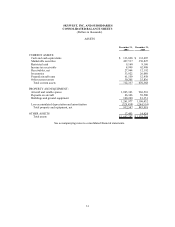

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2004

(1) Nature of Operations and Summary of Significant Accounting Policies

The Company, through its wholly-owned subsidiary, SkyWest Airlines, Inc. (“SkyWest”), operates one of the larger independent

regional airlines in the United States. SkyWest offers scheduled passenger and air freight service with approximately 1,500 daily

departures to 117 cities in 31 states and three Canadian provinces. Additionally, SkyWest provides customer handling services

for approximately ten other airlines throughout SkyWest’s system. SkyWest has been a partner with Delta Airlines, Inc. (“Delta”)

in Salt Lake City and United Airlines, Inc. (“United”) in Los Angeles since 1987 and 1997, respectively. In 1998, SkyWest

expanded its relationship with United to provide service in Portland, Seattle/Tacoma, San Francisco and additional Los Angeles

markets. In 2001, SkyWest expanded its operations to serve as the Delta Connection in Dallas/Fort Worth. However, effective

January 31, 2005, SkyWest re-deployed all its Delta Connection flights to Salt Lake City as a result of Delta’s decision to “de-

hub” Dallas/Fort Worth operations. In April 2003, SkyWest signed an agreement with Continental Airlines, Inc. (“Continental”)

to supply Continental with regional airline feed into Continental’s Houston hub effective on July 1, 2003. In January 2005,

SkyWest and Continental announced their mutual decision to end SkyWest’s operations as a Continental Connection carrier not

later than June, 2005. In 2004, SkyWest expanded its United Express operations to provide service in Chicago. Today, SkyWest

operates as a Delta Connection carrier in Salt Lake City and as a United Express carrier in Los Angeles, San Francisco, Denver,

Chicago and the Pacific Northwest. SkyWest believes its success in attracting multiple contractual relationships with major

airline partners is attributable to its delivery of high-quality customer service with an all cabin-class fleet at a competitive cost

structure. As of December 31, 2004, approximately 40% of SkyWest’s capacity (measured in available seat miles or “ASMs”)

was operated under the Delta code, approximately 59% was operated under the United code and approximately 1% was operated

under the Continental code. As of December 31, 2004, SkyWest’s fleet consisted of 137 Canadair regional jets (77 United, 56

Delta and four SkyWest) and 73 Embraer EMB-120 Brasilia turboprops (“EMB120s”) (50 United, 14 Delta and nine

Continental).

Basis of Presentation

The Company’s consolidated financial statements include the accounts of SkyWest Inc., and SkyWest Airlines, Inc. with all inter-

company transactions and balances having been eliminated.

Use of Estimates

The preparation of financial statements in conformity with accounting principals generally accepted in the United States of

America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents.

The Company classified $9.2 million of cash as restricted cash as required by the Company’s workers’ compensation policy and

classified it accordingly in the consolidated balance sheets as of ended December 31, 2004 and 2003, respectively.

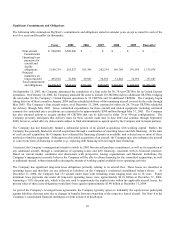

Marketable Securities

The Company’s investments in marketable debt and equity securities are deemed by management to be available for sale and are

reported at fair market value with the net unrealized appreciation or depreciation reported as a component of accumulated other

comprehensive income (loss) in stockholders’ equity. At the time of sale, any realized appreciation or depreciation, calculated by

the specific identification method, is recognized in interest income in operating results. The Company’s position in marketable

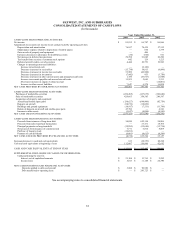

securities as of December 31, 2004 and 2003 was as follows (in thousands):