SkyWest Airlines 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

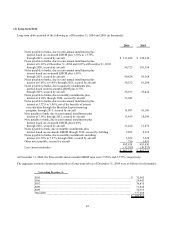

At December 31, 2004, the Company had $639,000 of federal alternative minimum tax credit carryforward, which do not expire.

The Company also had federal and state net operating loss carryforwards of $2,054,000, which will not begin to expire until 2023.

However, the Company anticipates that this benefit will be used in the tax year ending December 31, 2005.

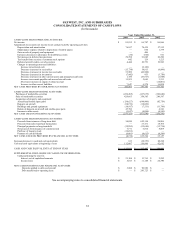

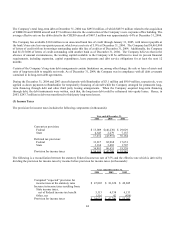

The significant components of the net deferred tax assets and liabilities are as follows (in thousands):

As of December 31,

2004 2003

Deferred tax assets:

Accrued benefits $ 7,303 $ 6,365

Net operating loss carryforward 1,335 -

AMT credit carryforward 639 -

Accrued reserves and other 2,592 889

Total deferred tax assets 11,869 7,254

Deferred tax liabilities:

Accelerated depreciation (189,766) (155,475)

Other 551 569

Total deferred tax liabilities (189,215) (154,906)

Net deferred tax liability $ (177,346) $ (147,652)

The Company’s income tax receivables were $8,999 and $62,908 million at December 31, 2004 and 2003, respectively. The

Company’s deferred tax liabilities were $189,215 and $154,906 million at December 31, 2004 and 2003, respectively. The

Company’s income tax receivable and deferred tax liabilities were primarily generated through accelerated bonus depreciation on

newly purchased aircraft and support equipment in accordance with the Job Creation and Worker Assistance Act of 2002.

(4) Commitments and Contingencies

Lease Obligations

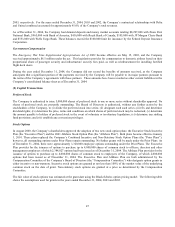

The Company leases 153 aircraft, as well as airport facilities, office space, and various other property and equipment under non-

cancelable operating leases which are generally on a long-term net rent basis where the Company pays taxes, maintenance,

insurance and certain other operating expenses applicable to the leased property. Management expects that, in the normal course

of business, leases that expire will be renewed or replaced by other leases. The following table summarizes future minimum

rental payments required under operating leases that have initial or remaining non-cancelable lease terms in excess of one year as

of December 31, 2004 (in thousands):

Year ending December 31,

2005 $ 201,527

2006 183,398

2007 202,234

2008 186,789

2009 191,693

Thereafter 1,135,078

$ 2,100,719

In January 2003, the FASB issued Interpretation No. 46, or (FIN 46), Consolidation of Variable Interest Entities, which requires

the consolidation of variable interest entities. The majority of the Company’s leased aircraft are owned and leased through trusts

whose sole purpose is to purchase, finance and lease these aircraft to the Company; therefore, they meet the criteria of a variable

interest entity. However, since these are single owner trusts in which the Company does not participate, the Company is not at

risk for losses and is not considered the primary beneficiary. As a result, based on the current rules, the Company is not required