SkyWest Airlines 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

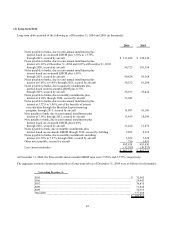

to consolidate any of these trusts or any other entities in applying FIN 46. Management believes that the Company’s maximum

exposure under these leases is the remaining lease payments.

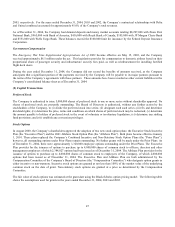

Total rental expense for non-cancelable aircraft operating leases was approximately $145.9 million, $124.9 million and $103.3

million for the years ended December 31, 2004, 2003 and 2002, respectively.

The above minimum rental payments do not include landing fees, which amounted to approximately $32.7 million $26.5 million

and $19.7 million for the years ended December 31, 2004, 2003 and 2002, respectively.

The Company’s leveraged lease agreements, typically agree to indemnify the equity/owner participant against liabilities that may

arise due to changes in benefits from tax ownership of the respective leased aircraft to the Company’s consolidated financial

statements set forth in Item 8 of this Report. The terms of these contracts range up to 18 years. The Company did not accrue any

liability relating to the indemnification to the equity/owner participant because the probability of this occurring is remote.

Self-insurance

The Company self-insures a portion of its losses from claims related to workers' compensation, environmental issues, property

damage, medical insurance for employees and general liability. Losses are accrued based on an estimate of the ultimate aggregate

liability for claims incurred, using standard industry practices and the Company’s actual experience.

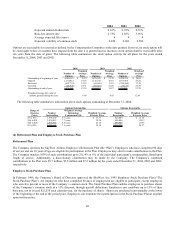

Purchase Commitments and Options

On September 15, 2003, the Company announced the completion of a firm order for 30, 70-seat CRJ700s for its United Express

operations. The Company began taking delivery of these aircraft in January 2004 and has scheduled delivery of the remaining

aircraft covered by the order through May 2005. The Company’s firm aircraft orders, as of December 31, 2004, consisted of

orders for 20, 70-seat CRJ700s scheduled for delivery through May 2005. Gross committed expenditures for these aircraft and

related equipment, including estimated amounts for contractual price escalations will be approximately $500 million in 2005. The

contract also includes options for another 80 aircraft that can be delivered in either 70 or 90-seat configurations. The Company

presently anticipates that delivery dates for these aircraft could start in June 2005 and continue through September 2008; however,

actual delivery dates remain subject to final determination as agreed upon by the Company and United.

Legal Matters

The Company is subject to certain legal actions which it considers routine to its business activities. As of December 31, 2004,

management believes, after consultation with legal counsel, that the ultimate outcome of such legal matters is not likely to have a

material adverse effect on the Company’s financial position, liquidity or results of operations. The most significant of these

matters is as follows:

Michaelena Fitz-Gerald, Romead Neilson, et al., v. SkyWest Airlines, Inc.

In July 2003, two former employees of SkyWest commenced litigation in the Superior Court of Santa Barbara, California,

alleging violations of minimum wage, meal and rest break, and overtime regulations, as well as violations of the California Labor

Code and Business and California Professions Code. In addition to their own claims, the plaintiffs have pled the case as a class

action on behalf of all current and former flight attendants based in California since July 1999 but had not obtained class

certification as of March 10, 2005. The plaintiffs are seeking monetary damages as compensation for their grievances. The

Company and the plaintiffs have engaged in discovery and unsuccessfully attempted to mediate a settlement without reaching a

mutually acceptable result. The Company is vigorously opposing the plaintiffs’ claims. Because the amount of a potential loss, if

any, resulting from the outcome of the forgoing case is neither probable nor reasonably estimable, no amounts related to such

have been recorded in the Company’s condensed consolidated financial statements.

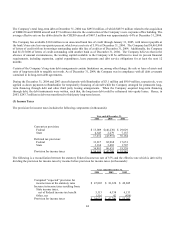

Concentration Risk and Significant Customers

The Company monitors the financial condition of its major partners and requires no collateral from its major partners or

customers. The Company maintains an allowance for doubtful accounts receivable based upon expected collectability of all

accounts receivable. The Company’s allowance for doubtful accounts totaled $24,000 and $59,000 as of December 31, 2004 and